How to choose a checking account

Checking accounts are more than just a place to keep your money in an accessible account — they typically offer other services as a part of having an account with that institution. Learning more about checking account options may help you reap its full benefits.

What is a checking account?

A checking account is used for day-to-day cash deposits and withdrawals. With a checking account, you can access your money through in-person withdrawals, a debit card, bank wire transfers or by writing checks. There are different types of checking accounts, including a student checking account.

Most traditional checking accounts have a monthly service fee. There are typically ways to waive the monthly service fee on a checking account if you meet certain requirements. There may be other fees for things like out-of-network ATMs, checks and overdrafts.

Checking account pros and cons

When choosing whether you want to open a checking account, weigh out the pros and cons first.

Some pros include:

- Not all accounts require a minimum balance to open or maintain the account. Most traditional checking accounts have a monthly service fee. There may be ways to waive the monthly service fee on a checking account if you meet certain requirements.

- Some accounts allow you to use any ATM convenient to you with little to no fees.

- Some checking accounts offer perks and benefits, like checks.

- With checking accounts, you can set up direct deposit with your employer. You don’t have to wait for a paper check and instead can have your paycheck automatically deposited into your account each pay period.

Some cons include:

- Some banks require you to keep a minimum balance in your checking account at all times.

- While there can be ways to waive them, most checking accounts charge a monthly service fee.

Different types of checking accounts

Banks and credit unions oftentimes offer multiple types of checking accounts to choose from. Below you'll find the most common types of checking accounts. Not all checking accounts are the same, so do your research before picking one.

Traditional checking account

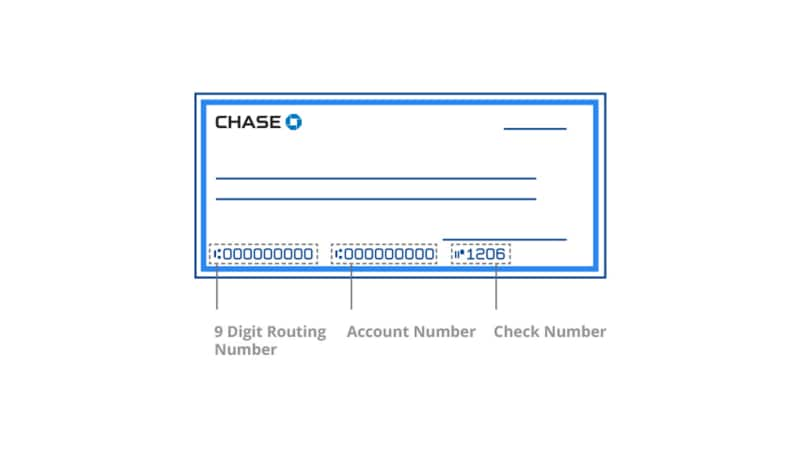

This is a type of checking account in which you use checks and a debit or ATM card to withdraw money or make transactions, and they sometimes offer online bill pay services. You can open a traditional checking account at most banks and credit unions.

Premium checking account

Premium checking accounts earn or offer you perks that you’d normally have to pay for with a traditional checking account. Examples could include no-fee personal checks, no-fee official checks, no-fee money orders or waived out-of-network ATM fees. Some banks offer additional perks, such as lower mortgage interest rates.

Student checking accounts

Banks create checking accounts tailored specifically for students. Students don’t always have a lot of income or savings, so a student checking account can come in handy. Student checking accounts can offer basic check-writing and debit card services, which sometimes includes a zero monthly service fee. You also may have the ability to utilize payment apps like Zelle®.

Now that you know some of the checking account options available, you can move forward and confidently choose the right type of account for your lifestyle.