Navigate retirement with J.P. Morgan by your side

Plan for the retirement you deserve. We’re here to help you with every step of your retirement planning and living with trusted insights, tools and resources.

Open a retirement account or speak with our retirement specialists to learn more. Call us Monday through Friday, from 8 AM to 9 PM ET and Saturday from 8:30 AM to 5 PM ET.

Retiring with confidence begins with a retirement plan

Explore which type of retirement account fits you and your goals

Traditional IRA

Tax-deferred growth

Traditional IRA contributions may be tax-deductible. Your earnings, if any, are tax-deferred and will be included in your taxable income at the time of withdrawal.

Roth IRA

Tax-free growth

Roth IRA contributions are not tax-deductible. Your earnings, if any, are tax-deferred and may be withdrawn tax-free if certain conditions are met.

Annuities

Steady income stream

Annuities are a long-term, tax-deferred insurance contract that can provide a steady income stream, typically for retirement purposes and provided by a J.P. Morgan advisor.

Put your plan into action

Open a Self-Directed IRA account

- Enjoy $0 commission online trades on stocks, ETFs and more

- Invest with fractional shares starting from $5

- Manage everything through the Chase Mobile® app or chase.com

Open a Self-Directed IRA account

- Enjoy $0 commission online trades on stocks, ETFs and more

- Invest with fractional shares starting from $5

- Manage everything through the Chase Mobile® app or chase.com

Talk to our Retirement Specialists

- Learn about available investment products

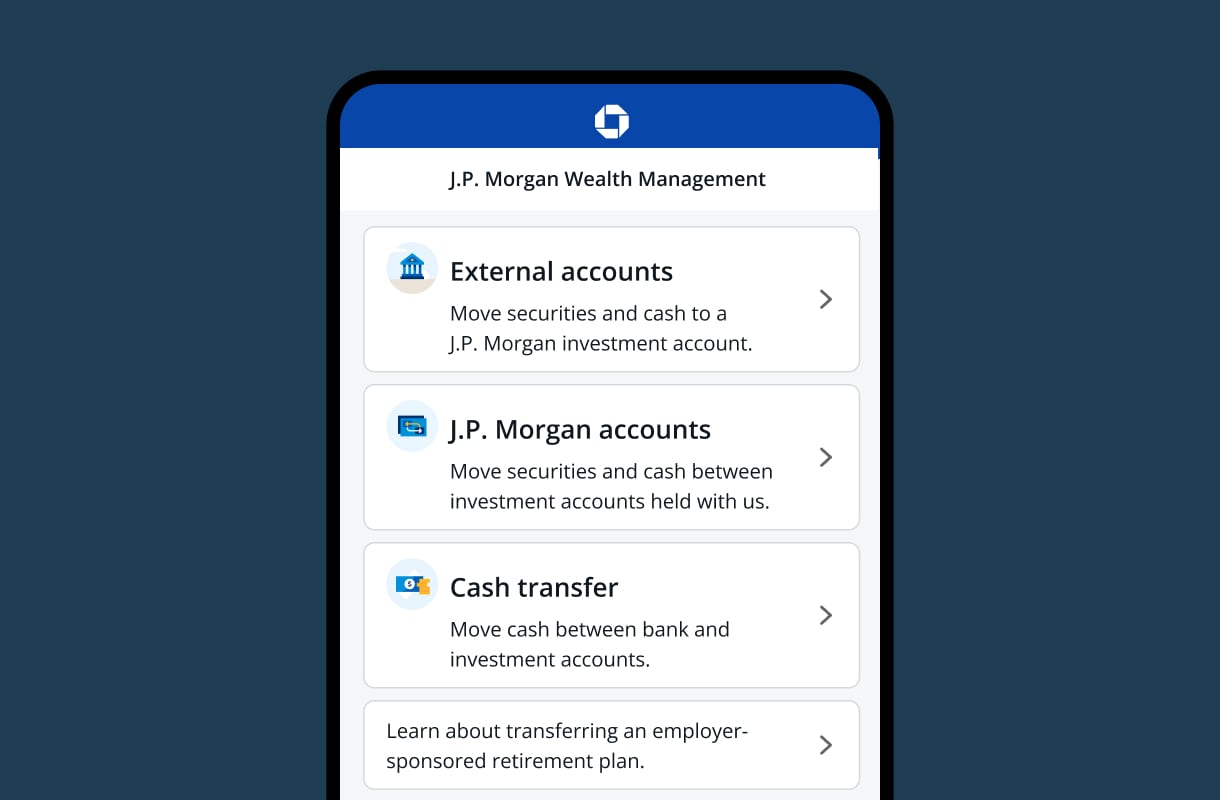

- Get guidance on 401(k) rollovers and transfers

- Connect with a J.P.Morgan advisor

Call us Monday through Friday, from 8 AM to 9 PM ET and Saturday from 8:30 AM to 5 PM ET. You can also let us call you by filling out a short form.

Talk to our Retirement Specialists

- Learn about available investment products

- Get guidance on 401(k) rollovers and transfers

- Connect with a J.P.Morgan advisor

Call us Monday through Friday, from 8 AM to 9 PM ET and Saturday from 8:30 AM to 5 PM ET. You can also let us call you by filling out a short form.

We can help you build your legacy

Connect with a J.P. Morgan retirement specialist

Our retirement specialists can help answer questions about retirement and retirement accounts, provide guidance on 401(k) rollovers, help connect you with a J.P. Morgan advisor and more.

Submit this form or call us Monday through Friday, from 8 AM to 9 PM ET and Saturday from 8:30 AM to 5 PM ET at 1-877-888-4797.

By providing your mobile number, you are giving permission to be contacted at that number about your investment contact form. Your consent allows the use of text messages, artificial or prerecorded voice messages, and automatic dialing technology for informational and account service, but not for sales or telemarketing. Message and data rates may apply, message frequency varies. You can opt out of receiving messages at any time by texting STOP or you can text HELP for more info. Terms and Conditions & Privacy Policy.

*All form fields required

Click below once to have a J.P. Morgan team member contact you.

Helpful resources

Retirement Calculators

Frequently asked questions

Determining how much money is needed to retire can be a complex process. It is different for everyone, however, there are some general guidelines that can be used as a starting point. One common guideline is 4%, which suggests withdrawing 4% of your savings annually for a 30-year retirement. For a $50,000 yearly income, you'd need $1.25 million saved. For more assistance, speak with a financial advisor who can help tailor a plan to your specific needs.

Learn more about how much you may need to retire and tips on retiring early.

Yes. You can open a Roth or Traditional IRA on your own with J.P. Morgan Self-Directed Investing. Learn more about opening a retirement account.

We offer multiple retirement planning tools, including J.P. Morgan Wealth Plan® and our retirement calculators.

With J.P. Morgan Wealth Plan®, you can set and track your retirement goals and get personalized insights to guide you on your journey.

Run your numbers with our retirement calculators to see how your current plan is working toward your goals.

Use J.P. Morgan Wealth Plan® to set and track your retirement goals and get personalized insights to guide you on your retirement journey on your own or with a J.P. Morgan advisor. An advisor can provide ongoing updates on your progress.

You can open a Roth IRA or Traditional IRA on your own or with a J.P. Morgan advisor. You can also open an annuity contract, which can provide a steady income stream during retirement, with the help of a J.P. Morgan advisor.

Our Retirement Desk is available Monday–Friday from 8 AM to 9 PM ET or Saturday from 8:30 AM to 5 PM ET, at 1-877-888-4797. You can also contact your J.P. Morgan advisor if you have one, or your tax or legal professional.