What is a bank account number?

A bank account number is a unique set of digits assigned to the account when you open a bank account. Financial institutions will assign such numbers to each account you hold. Businesses and banks use these numbers to identify your account. A bank account number is not to be confused with the routing number, which identifies the financial institution. For this article, we’ll focus on the bank account number.

How many digits is a bank account number?

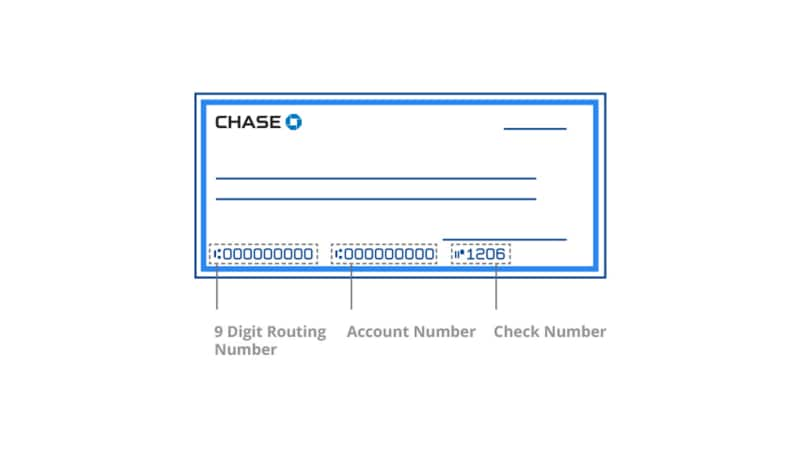

Bank account numbers typically consist of eight to 12 digits, but some account numbers could even contain up to 17 digits. You can find your account number on your checks or by accessing your account on your financial institution’s website or by contacting the bank directly.

Is your debit card number the same as your bank account number?

While they’re sometimes confused with one another, a debit card number is distinct from a bank account number. Depending on the debit card issuer, a debit card number is comprised of 16 digits usually found on the front of the card.

What is a bank account number used for?

A bank account number is used to help manage transactions to and from your account. It tells the bank from which account to withdraw or to which account to deposit a sum of money. This number is commonly used for transactions such as payment reconciliation by checks, account transfers, direct deposits and direct payments.

Ways to help protect your bank account number

Protecting your account is a key part of being a responsible bank account holder. Here are some ways to help protect your bank account:

- Don't give your account numbers or any personal or financial information on the phone, unless you initiate the conversation and you know the person or organization.

- Report lost or stolen checks immediately and your financial institution will stop payment on the check numbers you report. When you get new checks, look through them to make sure none of them were stolen in the mail.

- Destroy or store financial information securely (including bank statements, invoices, ATM and credit card receipts).

- Store all checks, including canceled checks, in a safe place.

Find more ways to help protect your bank account number.