What is Chase Credit Journey®?

Quick insights

- Chase Credit Journey is a free online tool for anyone—not only Chase cardmembers—to see their credit score, credit balances, limits and credit history—all without impacting your score.

- With Credit Journey®, not only will you receive a free credit score, you’ll also get information about what that score means and how to improve it.

- Credit Journey provides important insights into credit and offers an array of services for you to keep track of your credit.

Understanding credit can be daunting at first. Where do you begin? There are credit cards, credit scores, credit history and so much more terminology related to all of these. With Chase Credit Journey, you can break down these concepts and gain the foundational knowledge to help jumpstart your financial wellness.

Let’s take a look at some of the services that come with using Chase Credit Journey.

Free credit score

When you enroll in Chase Credit Journey, you can get access to an Experian™ credit report and receive your free credit score, whether you have a Chase account or not. Knowing this three-digit number is the first step towards understanding how your credit works and ways to boost it.

You may be wondering: What is considered a good credit score? What's a bad one? Receive answers you need about what your score means and how to improve it with insights, credit reports and tools. Keep in mind that you can get updates on your credit score at no cost or impact to your score.

A free credit score provided through Chase Credit Journey is generally accurate and typically updates on a regular basis. It utilizes the VantageScore3.0® model powered by Experian, one of the three major U.S. credit bureaus. Your Credit Journey score is typically eligible for a refresh once every 7 days, and we strive to refresh your score at least once a month. In many cases, you may also receive an immediate score refresh when a credit monitoring alert is triggered.

Credit reports

In addition to your free credit score, you’ll gain access to a credit report provided by Experian. In this report, you’ll get access to information regarding:

- Open accounts

- Closed accounts

- Credit checks (should the lender use Experian)

- Derogatory marks

- Collections

- Public records

- Consumer statements

- Personal information

- And more

A credit report is essential for understanding the factors that go into determining your credit score. It helps give you an overarching view of your creditworthiness, which can help guide you on your credit journey.

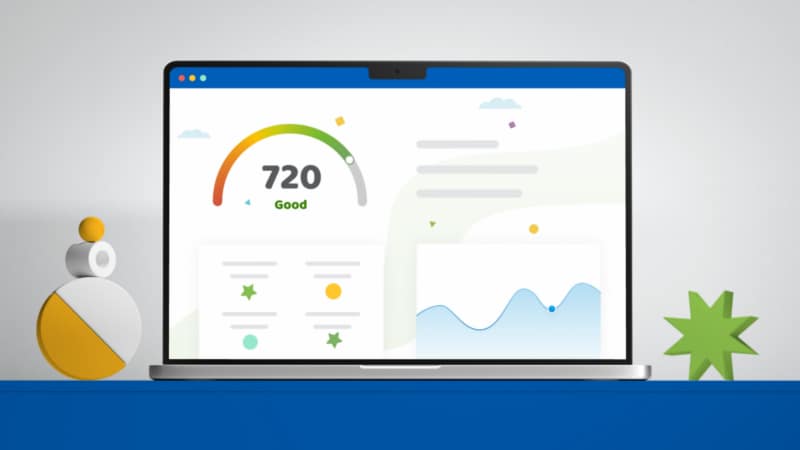

Your personal credit dashboard

When you enroll in Chase Credit Journey, you’ll have access to your own customized credit dashboard. This dashboard serves as your “home base” as you navigate your credit journey. Here, you’ll see your Experian credit score, where you fall in the VantageScore 3.0 range, find insights on credit usage, score history and so much more. You’ll be able to look at all of Credit Journey’s features at a glance.

Access to this information—in addition to credit usage, limits and balances—in one easy-to-use visually enhanced tool can help bolster your knowledge and confidence around credit.

Round-the-clock customer support

Your credit information is important. That‘s why with Chase Credit Journey, you can feel secure knowing you can check the timeline of any credit activity or identity monitoring alerts within the last two years. Get details regarding each alert to stay aware of suspicious activity.

Our support services includes a dispute guide for helping you dispute inaccurate information should you find any on your credit report. You can also access the platform’s FAQs anytime with our “Help and Support” tool.

In addition, there are two major support services that come with Chase Credit Journey, including identity monitoring and credit monitoring. Let’s explore them in greater detail below.

Identity monitoring services

When you enroll in Chase Credit Journey, you’ll have the option to opt-in to identity monitoring services. You can opt-in any time after you’ve enrolled as well. Identity monitoring is a way to help protect your identity and keep your information safe.

ID monitoring includes:

- Dark web surveillance: Find out if your info is on suspicious websites.

- Data breach monitoring: Be notified if your data is exposed in a company’s security lapse.

- Social Security number (SSN) activity tracking: Keep track of name or address changes linked to your SSN.

- Identity verification alerts: Know when a lender verifies your identity, such as when you apply for a loan.

Additionally, if you encounter an instance of identity theft due to a lost card, stolen wallet or other financial fraud-related issues, you could be eligible to begin a claims process through ID Restoration services, which cover a maximum of $1M per customer for expenses accrued while restoring your credit.

Credit monitoring services

When you enroll in Chase Credit Journey, you will be notified of new items or actions when they occur. We help you monitor changes to your credit usage, credit limits and balances to assist you with tracking your spending—across all your accounts, not just the ones you have with Chase.

This service is a two-part benefit; it helps you to keep track of changes happening on your credit report and identifies items/actions on your report that you do not recognize, potentially uncovering suspicious or even fraudulent activity.

You'll receive a credit report alert when we spot:

- New activity: Some examples of a new activity include opening a new account or having a lender check your credit.

- Positive activity: This includes activities like paying down a past due balance or paying off an account.

- Negative activity: You’ll see this if you miss a payment, any of your accounts are sent to collections or a bankruptcy shows up on your credit report.

You’ll also be notified if:

- Your credit limit changes

- Your credit usage changes

- Your credit balance changes

Monitoring your credit is an important aspect of building your credit awareness and knowledge. It helps you look out for potential issues or fraud, allowing you to take action and better navigate your financial journey.

Keep in mind that credit monitoring alerts do not include score changes or score goal updates.

Gather insights to make empowering decisions

With all this information available to you at your fingertips, it can be confusing knowing what to do with it. Don’t worry—Chase Credit Journey will offer you insights to help you make proactive choices about your credit.

When you get your free credit score, you'll also get a breakdown of the major components of your score as well as insights and quick tips.

As a Chase Credit Journey user, you can also explore our credit score improvement tool. This is a free tool where you may receive a personalized action plan provided by Experian. This plan gives you actionable steps you can take to help improve your credit score after you set a goal and timeframe for yourself.

Finally, with Credit Insider, you’ll have access to a suite of educational materials and articles tailored to your needs. These include topics on credit essentials, building your credit health, protecting against risks and guides for your future.

Benefits to using Chase Credit Journey

You’ve enrolled in Chase Credit Journey and got your free credit score and report. Now what?

By keeping track of your credit through Chase Credit Journey, you will know where you stand with regard to credit usage, new activity and, of course, your credit score. These insights can help you build the necessary savvy and knowledge to make better financial decisions.

Let‘s explore these benefits in detail.

Enhanced financial savvy

If you’re new to banking and credit cards, Chase Credit Journey will guide you through the process of understanding credit. Want to learn more about your score and how it affects your chances of getting approved for a loan? Want to prepare for a future where you are debt-free? You can get answers to these questions and more by utilizing Chase Credit Journey.

Safety and security

Both credit monitoring and identity monitoring services will help keep your credit card information and identity safe. You’ll get notified of suspicious activity as soon as possible so you can act fast on potential fraud. In fact, Chase Credit Journey will keep a look out for any of your information that could be vulnerable to theft, including any information that could be found on the dark web.

Free and simple

We know that financial knowledge can be overwhelming. So, how can you learn everything you need to know to get started in one convenient and cost-effective way? Chase Credit Journey is a safe, user-friendly tool where you can increase your financial IQ for free. Stay updated on your credit score and make goals for yourself without having to invest money into educational courses or a financial planner. The personalized credit dashboard gives you a visual glance into your credit journey, making your financial goals more accessible and more actionable.

In conclusion

Whether you’re new to credit or want to understand your credit better, Chase Credit Journey is an essential tool to help you improve your financial wellness. Understanding your free credit score is just the beginning. With Chase Credit Journey, you can achieve your financial goals using multiple services in one free, easy-to-use platform.