Your mortgage tax statement is now online

Sign in to your account or enroll in chase.com to download and print your mortgage tax statement.

Here's how to access your tax statement online, stay informed and get support during tax time

Enroll in chase.com

You can see all your Chase accounts side by side, view statements, pay bills and more.

Receive digital tax statements

See how your statement works

Watch our video to get your questions answered and check out the FAQs below for more details.

Chase MyHome®, helps you put your future goals within reach

Access tools and info on one digital dashboard to help you discover new possibilities, take the next step and work toward your financial goals. Sign in to your Chase account to start exploring.

Keep track of your progress

See your current mortgage balance and how many payments you have left to ensure you have the right payment strategy to meet your goals.

Try our savings calculators

Find out how you could pay off your mortgage sooner. Small changes like additional principal payments could help you pay less interest and save next tax season.

Make payments your way

Set up flexible mortgage payments and choose the option that works best for you and your budget.

Compare interest rates

Explore rate options and see what refinancing can do for you, whether that s lowering your payments or tapping into your home equity to meet other goals.

Frequently Asked Questions

Get the tax related answers you need.

IRS Form 1098 (Mortgage Interest Statement)

IRS Forms 1099-A, 1099-C and 1099-MISC

Online tax forms

IRS Form 1098 (Mortgage Interest Statement)

Chase is not required to file a Form 1098 Mortgage Interest Statement for interest received from a corporation, partnership, irrevocable trust, estate, association or company, or if no interest payments were made during the year. Also, if you are a coborrower or additional borrower on the loan, you will not receive a Form 1098.

The IRS requires us to report the outstanding principal balance as of January 1, 2025 in Box 2 or when Chase originated or acquired the loan in 2025.

For HELOC accounts originated in 2025, the amount reported in Box 2 will be the amount of the first draw you take.

Some customers have special circumstances with their Chase loan. For example, COVID deferrals and/or loan modifications. To properly report principal and interest for these special circumstances, the standard 1098 needs to be adjusted. Some of these circumstances will remain in place for the life of the loan, meaning that those customers will receive two 1098 statements every year (one standard and one corrected). When you receive two 1098s, look for the statement with the “Corrected” box checked. Information from this 1098 is what is being reported to the IRS.

Box 2 on IRS Form 1098 displays the principal balance of your loan as of January 1, 2025 or when Chase acquired or originated the loan in 2025.

Box 1 shows the mortgage interest received during the tax year being reported (2025). The amount may include mortgage interest, late fees, capitalized interest and deferred interest you paid during the year.

The amount of interest you pay may change from year to year, usually because of a change in your interest rate or in the number of payments we received from you during the calendar year. For instance, you may have paid less interest if you modified your loan or received payment assistance through the Homeowners Assistance Fund. This may result in a lower amount of interest showing on your Form 1098.

There are several reasons for the difference between the amounts shown on your Form 1098 and billing statement. The interest reported on your Form 1098 may include fees or exclude interest that wasn't due yet or wasn’t paid by you. The principal amount on your Form 1098 may include capitalized amounts from a modification.

Box 5 (Mortgage insurance premiums) applies only to loans closed after December 31, 2006. Also, Box 5 may not be reported on Form 1098 if the deduction for mortgage insurance premiums paid is not extended for the current tax year. For more information about the deductibility of mortgage insurance, see the Schedule A (Form 1040) instructions at IRS.govOpens overlay.

The IRS doesn't require us to report real estate taxes paid by you on Form 1098. We do, however, provide that information to you on the Annual Tax and Interest Statement for informational purposes only. Any real estate taxes paid will be reflected in the “Escrow Activity” or “Additional Amount” section of the statement. To determine if the real estate taxes you paid are deductible, we suggest you contact your own tax advisor or the IRS at 1-800-829-1040 or go to IRS.govOpens overlay.

We can't provide tax advice. We suggest you contact your own tax advisor or the IRS at 1-800-829-1040 or go to IRS.govOpens overlay.

We can’t provide tax advice. Please refer to the IRS "Instructions for Payer/Borrower" included with your Form 1098, contact your own tax advisor or the IRS at 1-800-829-1040 or go to IRS.govOpens overlay.

You should receive Form 1098 from each company to which you paid reportable mortgage interest or discount points. You could receive more than one Form 1098 if you refinanced the property during the year and/or if servicing on the loan was transferred.

According to the IRS, not all discount points are reportable, such as points paid to improve a residence, purchase a second home or refinance a loan. We suggest you contact your own tax advisor or the IRS at 1-800-829-1040 or go to IRS.govOpens overlay.

IRS Forms 1099-A, 1099-C and 1099-MISC

The IRS requires a lender to send you this form if it acquires an interest in your property through a foreclosure, you release your property to the lender in full or partial satisfaction of the debt (also known as a deed-in-lieu of foreclosure) or it determines you abandoned the property.

The form includes the date the property was acquired, the outstanding principal balance at the time and the property’s fair market value. For more information, please contact your own tax advisor, call the IRS at 1-800-829-1040 or go to IRS.govOpens overlay.

When we have evidence that a property has been abandoned, the IRS requires us to file a Form 1099-A. We don’t consider a property abandoned if you’ve made a payment, promised to make a payment, are actively pursuing a loan modification, selling the property or releasing the property. Also, we won’t file a Form 1099-A if a foreclosure starts within three months of the date we deem the property abandoned.

Not necessarily. It only means that the lender acquired an interest in the property through foreclosure, you released it to the lender or they determined you abandoned it.

The IRS requires us to send you this form when we cancel $600 or more of your principal balance in a calendar year. It can be all or a part of your principal balance. We can cancel debt—in certain circumstances also called waiving a deficiency—through a loan modification, a settlement for less than the amount you owed, or a business or investment debt discharged through bankruptcy.

We could also cancel your debt after a foreclosure, a sale of your home for less than the balance of your mortgage loan (also called a short sale) or a deed-in-lieu of foreclosure. This form includes the debt description, the cancellation date and the amount of debt canceled. For more information, we suggest contact your own tax advisor or the IRS at 1-800-829-1040 or go to IRS.govOpens overlay.

Chase will mail your tax forms to you as the forms become available. While we mail tax forms by January 31st, it isn’t always possible to combine them into a single mailing.

The IRS only requires us to send you this form when we cancel $600 or more of your principal balance debt in a calendar year.

We cannot provide tax advice. We suggest you contact your own tax advisor or the IRS at 1-800-829-1040 or go to IRS.govOpens overlay.

Chase sends Form 1099-MISC to customers and vendors by January 31 for miscellaneous payments totaling $600 or more made during a tax year. The federal government doesn’t require Chase to send tax information if you received payments of less than $600.

The IRS requires us to send you this form when we pay you certain types of income such as incentives to sell your home for less than the balance of your mortgage loan, to release your property to us or to relocate. We may also send you Form 1099-MISC if we send you a check or apply credits to your mortgage loan related to a correction. Please refer to the letter you received for details as to why a correction was performed.

We cannot provide tax advice. We suggest that you contact your own tax advisor, or the IRS at 1-800-829-1040 or go to IRS.govOpens overlay.

We’ll send you Form 1099-MISC (Miscellaneous Information), if required by the IRS. While checks may include co-borrowers, Form 1099-MISC is sent only to the primary borrower on the account. If you receive Form 1099-MISC, and you’re not tax responsible for the full amount on that form, please consult the Form 1099-MISC instructions for more information about how to file Form 1099-MISC in these situations. Please see the Who Must File section of the IRS General Instructions for Certain Information Returns at IRS.govOpens overlay. If you have questions about how this affects your tax return, you can call the IRS at 1-800-829-1040 or contact your own tax advisor.

To change the Social Security number or TIN on your account, we must receive a completed and signed Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding) or Form W-9 (Request for Taxpayer Identification Number and Certification) from any customer on the account who is requesting the change. These forms are available at IRS.govOpens overlay.

Submit your written request and any supporting documents to:

Online tax forms

Tax forms are available for the primary borrower and co-borrower to see, download and print by signing in to your account from the sign-in box above.

Certain 1099 forms are not available online and will be mailed to you by January 31st.

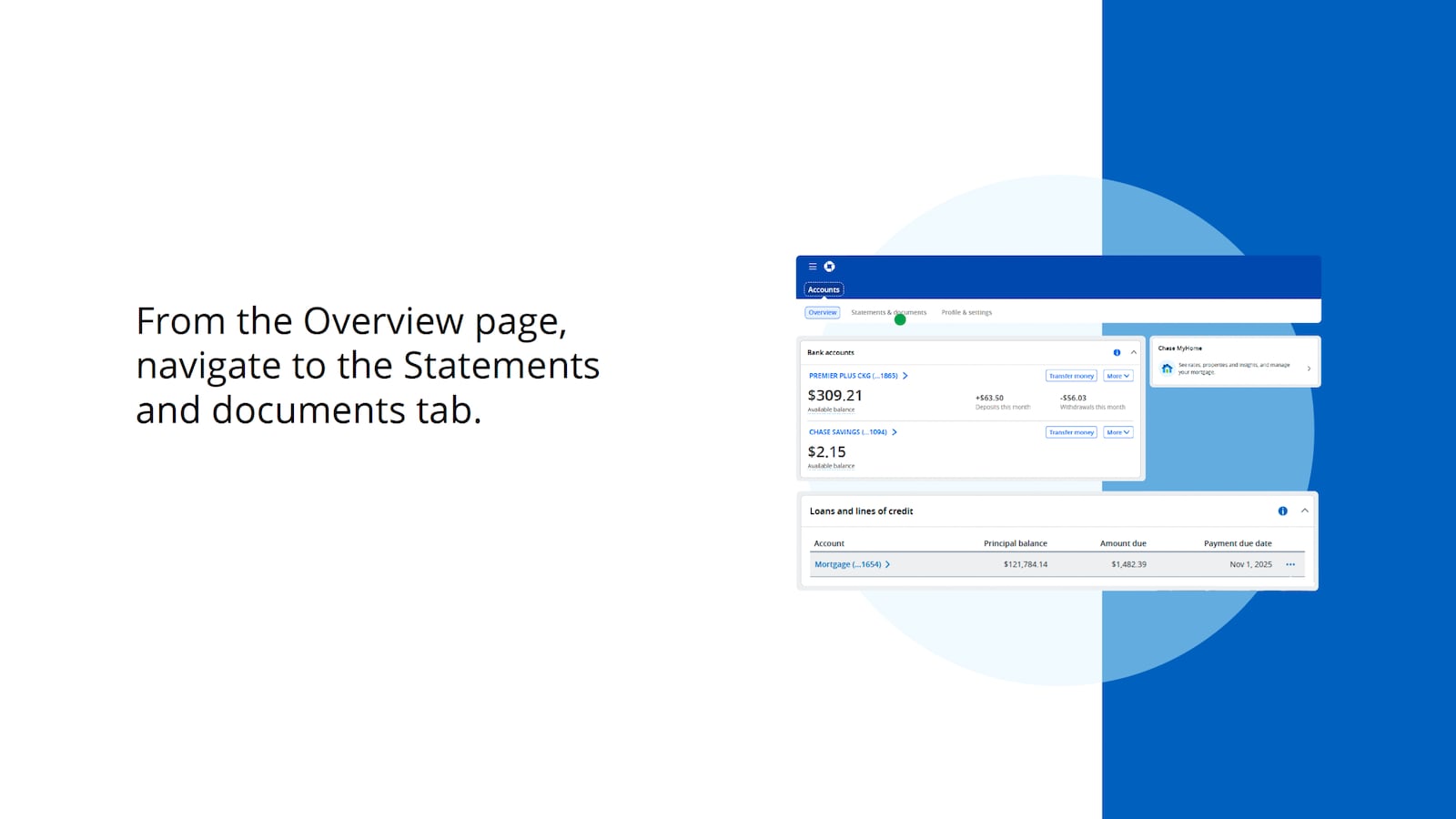

Depending on the tax form, you can go to the paperless options under Accounts Settings on the Profile & Settings page at chase.com/paperless to change the tax forms you receive to paperless.

You can securely access up to seven years of tax forms online depending on the form type. In your Chase account, choose "Tax documents" from the drop down in the mortgage account summary. Choose the tax year to view and choose "Open or save" to download or see the tax form.

We'll send you an email at your primary email address when your tax forms are available online. Please sign in to your account to confirm we have your correct contact information on file.

Try downloading the latest version of Adobe Reader or using a different browser.

For other questions or inquiries, please call the telephone number printed on your tax statement.