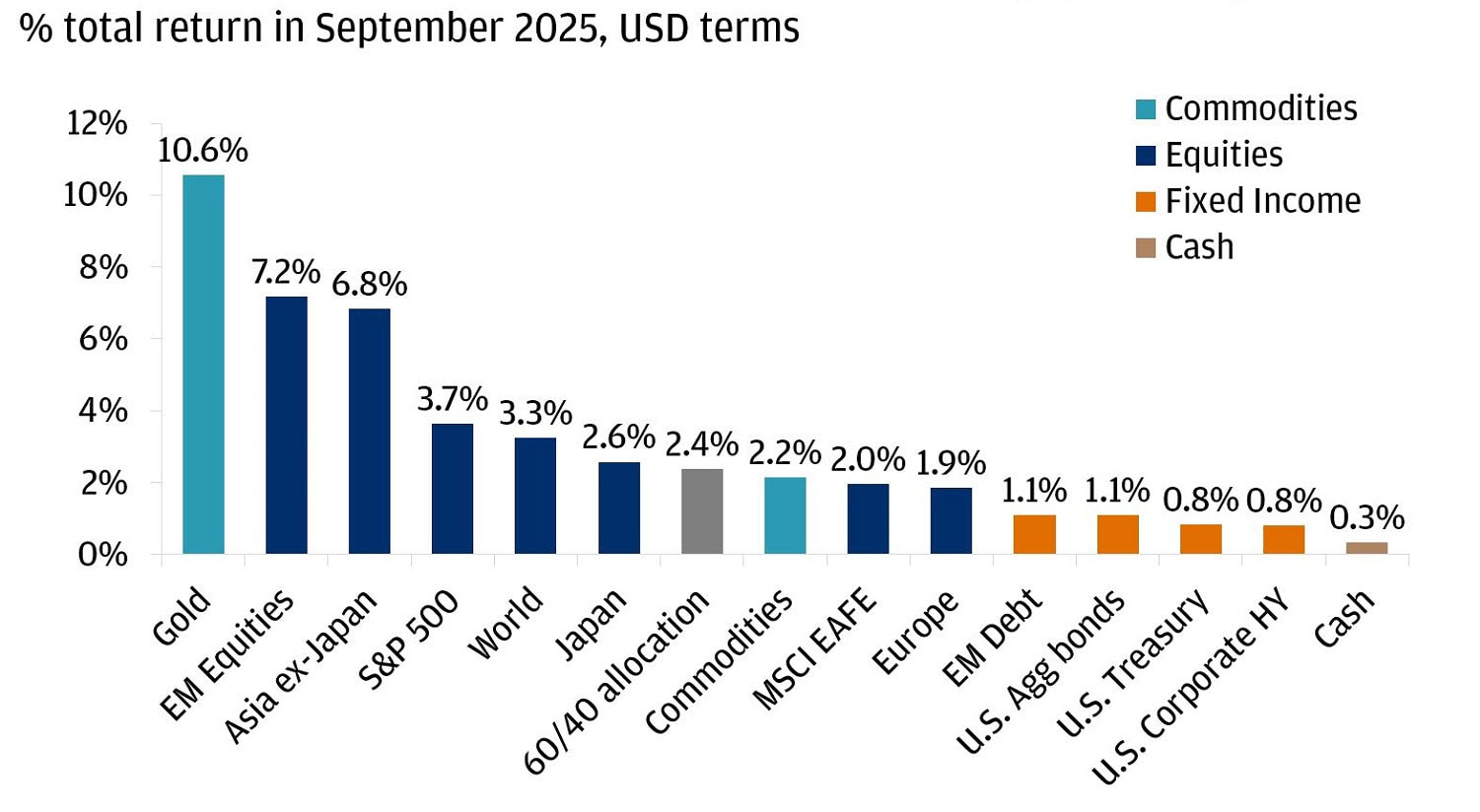

S&P 500 rallies in September as AI innovation and Fed rate cuts drive U.S. market growth

The S&P 500 saw an impressive +3.7% gain last month, delivering its best performance in the month of September since 2010. This rally was largely fueled by a combination of the continued momentum in artificial intelligence (AI) and the delivery of a rate cut by the Federal Reserve (Fed), defying September’s earned reputation as a challenging month for markets.

Below, we explore how these two themes shaped market performance last month, why the U.S. economy may be faring better than feared and what this could mean for your portfolio as the final quarter of the year kicks off.

Risk assets rise as the Federal Reserve resumes cutting cycle in September

AI-driven stock market rally shows sustainable growth, not a bubble

September’s U.S. equity rally was powered by tech innovation, with the “Magnificent Seven” stocks once again outperforming the index (i.e., +6.8%). The enduring strength of these companies has led some investors to question whether they are in a bubble.

We don’t believe that’s the case.

Some question the massive amount of capital expenditures being funneled into the AI theme, but we’re of the mind that the ongoing investment is sustainable given these companies’ ample capital and no signs of over-investment. Moreover, note that most tech sector behemoths – like Microsoft and Google – are expected to generate more profit over the next 12 months than any net debt they hold on their balance sheets.

Ready to take the next step in investing?

We offer $0 commission online trades, intuitive investing tools and a range of advisor services, so you can take control of your financial future.

However, skeptics may point to a company like Oracle, which has entered the game but is relying on debt to play it. The company issued $18 billion of debt in September, but the auction was met with robust demand at tight credit spreads. In our view, this move signals that investors still have plenty of appetite to support the theme.

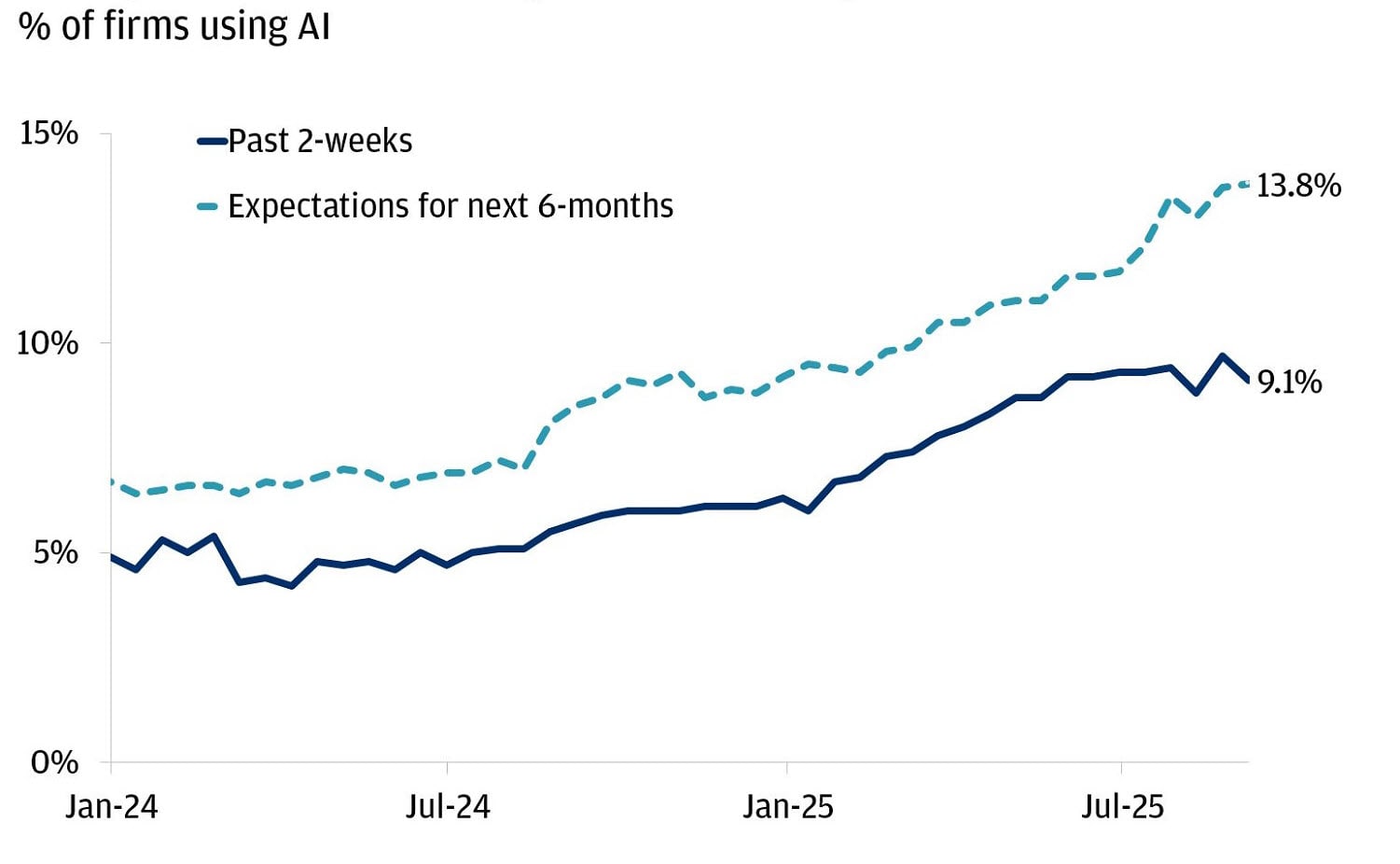

Indeed, the proliferation of AI appears to be accelerating: Adoption has jumped 60% over the last year according to a recent Census Bureau survey. Still, only approximately 9% of U.S. companies reported using AI to produce a good or service in the past two weeks, indicating significant room for future growth.

We believe the AI story still has substantial runway, and future Fed cuts could offer further support by reducing borrowing costs to finance continued investment in the technology.

AI adoption in the U.S. has significant room to grow

Fed rate cuts support economic growth and ease inflation risks

In a widely anticipated move, the Federal Reserve lowered its policy rate by 25 basis points to 4%–4.25% at its September meeting. We believe the action is intended to deliver incremental support to the economy and stave off risks to the labor market.

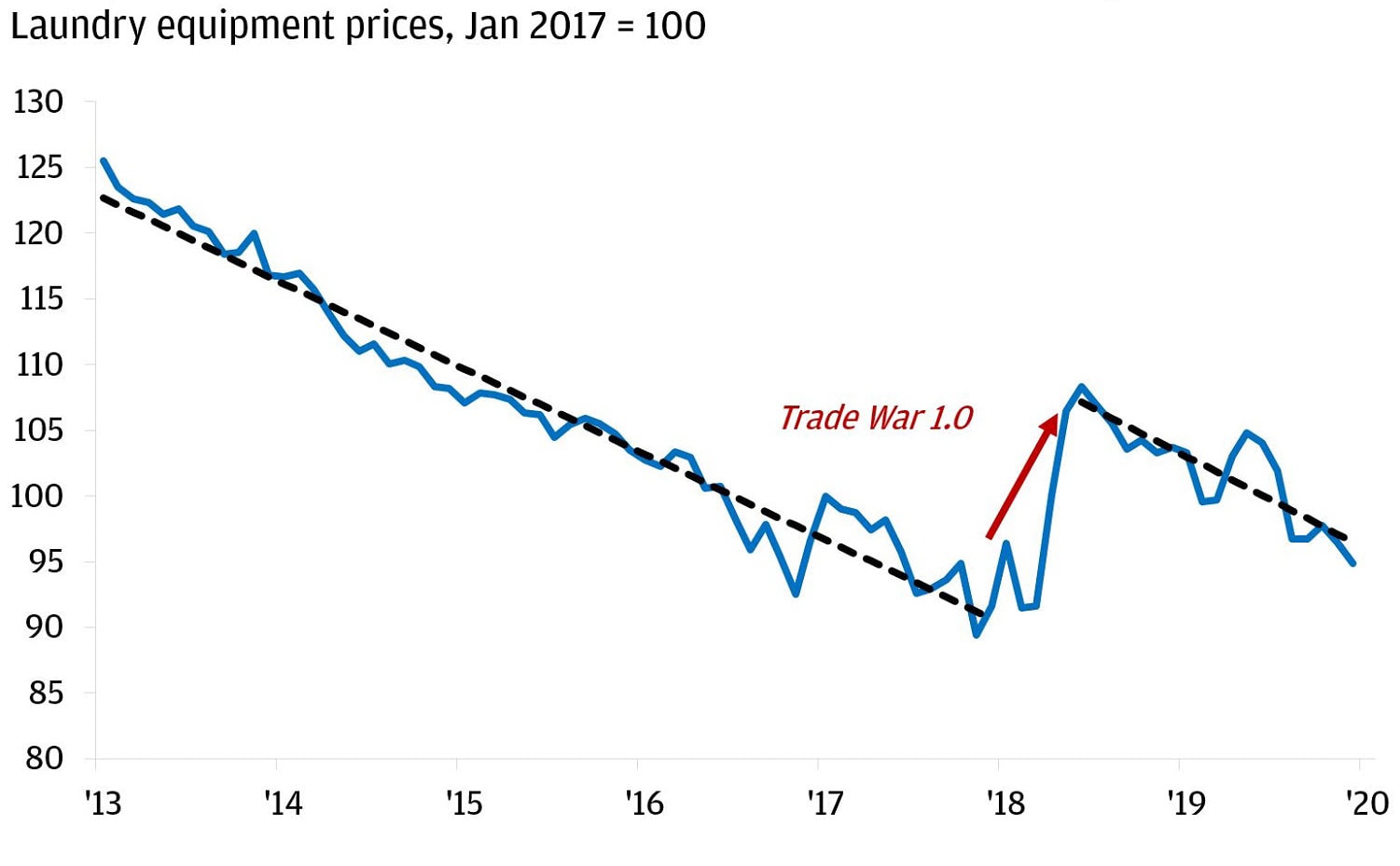

The decision wasn’t made in a silo, and inflation risks remain important to monitor. That said, the Fed signaled that it is not overly concerned about price pressures at the moment, even as new tariff announcements surfaced late in the month. We too think the tariff-induced inflation pressures will be temporary, and one of our favorite ways to illustrate why is to look back at the impact of tariffs imposed in 2018 and 2019. The chart below uses laundry equipment prices as an example – they spiked when tariffs were implemented but then resumed their original downward trajectory.

2018-19 trade war showed tariffs result in one-time price increases

As we monitor current inflation data, we’re seeing inflationary pressure staying mostly isolated in goods along with little risk of spillover into the more heavily weighted services sector.

Services sector inflation is impacted significantly by labor market dynamics. For inflation to become “sticky” – and create a dynamic the Fed may need to divert its focus to – we would likely need to see wage-driven services inflation pick up, which is unlikely to occur amid a softening labor market. The unemployment rate, for example, ticked up to 4.3% in August.

We maintain our base-case view that the Fed will deliver an additional 75 basis points of rate cuts by the middle of 2026 against a no-recession macro backdrop. Lower policy rates can boost economic activity (e.g., lending from regional banks to small businesses, supporting risk assets like equities, etc.).

Reduced rates also present reinvestment risk – yields on cash and short-term liquidity vehicles (e.g., high-yield savings accounts, Treasury bills, etc.) tend to closely track the Fed’s policy rate and are likely to decline along the way. For investors looking to explore portfolio considerations amid the evolving policy backdrop, check out our rate-cutting play book.

U.S. economic growth exceeds expectations: What could be next for investors after strong GDP and labor market data?

One week after the Fed’s decision, investors received further confirmation that the U.S. economy may be performing better than initially feared, as the Bureau of Economy Analysis released the final revision of second-quarter gross domestic product (GDP), showing growth of 3.8% (vs. 3.3% expected). From our perspective, the stronger growth is a net positive and demonstrates the prudence of the Fed’s meeting-by-meeting approach moving forward.

Indeed, the macro backdrop in September showed a mix of resilience and risks. Retail sales growth came in solid at 0.6% (vs. 0.2% expected), suggesting that consumer spending is holding up. U.S. weekly jobless claims fell by 33,000 to 231,000 late in the month, which supports our view that the labor market may be bending but not breaking.

Investors are still pricing in one to two more cuts this year – as mentioned above, we are inclined to agree.

Potential investment strategies for October 2025: Navigating inflation and rate cuts

September was indeed an exceptional month with global equities rising, and many investors were glad for the gains. As we enter the final quarter of 2025, we expect the positive momentum to continue despite ongoing questions about a potential AI bubble, the path for the Fed and the influence of politics. Of course, investors should still ensure that their portfolios are prepared for alternate outcomes.

If growth remains faster than we expect – and boosts inflation along with it – we could see a slower pace of rate cuts. For investors looking to take a defensive stance in such a scenario, assets like gold may be a good option. As an asset, gold has a track record of performing well in high-inflation environments. To illustrate, the one-year average for gold performance is 13% when headline Core Price Index (CPI) is between 3% and 4% year-over-year (YoY); compare this to a one-year average performance of 5% in environments when inflation is between 2% and 3%.

But if the economy slows down instead, we would look to core bonds. With yields at 4.4% on the U.S. Aggregate Bond Index, we continue to see an attractive entry point. A recessionary-type backdrop would likely prompt the Fed to deliver faster, deeper rate cuts, supporting core fixed-income positions and helping offset a potential equity drawdown.

The bottom line

Building a diversified portfolio with a mix of assets can help you navigate many different economic scenarios and stay on track toward your goals, regardless of our base case for a continuation of the rally, an unexpected recession or an unforeseen rise in inflation. Following this, now is as good of a time as any to review your plan and consider whether you need to rebalance your allocations or add new ones.

As the leaves change and the air cools, we will continue to monitor the investments landscape as its drivers evolve. Between now and our next market review to be published in early November, you can find our latest insights at The Know.

You're invited to subscribe to our newsletters

We'll send you the latest market news, investing insights and more when you subscribe to our newsletters.

Head of Investment Strategy, J.P. Morgan Wealth Management

Global Investment Strategist