What this government shutdown may mean for the stock market and investors

Editorial staff, J.P. Morgan Wealth Management

- The latest U.S. federal government shutdown started at 12:01 a.m. on Wednesday, October 1.

- Historically, government shutdowns haven’t had much of a material impact on the U.S. stock market or the broader economy.

- There are risks to the economy, however, which increase as the shutdown goes on.

- President Donald Trump has stated cuts resulting from the shutdown could be made permanent, a variable which could impact markets.

The shutdown of the U.S. federal government that has been looming over Washington for weeks officially went into effect at 12:01 a.m. on Wednesday, October 1. The shutdown is the result of Congress’ failure to agree on the funding bills necessary to keep the federal government open; it does not mean the federal government is in default.

Until funding is restored, the shutdown’s broad impact will translate into pauses for nonessential services. In addition, some federal employees who have been deemed nonessential may be furloughed or have to work without pay.

It’s important to note that, while government shutdowns haven’t historically had much of a material impact on the stock and bond markets, there are certain risks to be aware of – particularly the longer the shutdown drags on. In this article, we’ll cover who and what the shutdown could affect, as well as its potential impact on the U.S. economy and stock market.

What does a U.S. federal government shutdown mean, and who and what will it affect?

A shutdown of the U.S. federal government occurs when Congress fails to pass legislation to fund government operations and agencies, often because of disagreements over budget priorities or specific policy issues. In the case of this shutdown – the first in seven years – it is the result of a partisan standoff on health care and spending.

Without approved funding, federal law prohibits government activities paid for with “discretionary spending” from continuing, resulting in the closure of nonessential services and the furlough of many federal employees.

Discretionary spending – the piece of government spending impacted by the shutdown – refers to the portion of the federal budget that is decided by Congress through annual appropriations bills. Unlike mandatory spending (which is required by law for programs like Social Security, Medicare, and Medicaid), discretionary spending is not automatic and must be approved each year. During fiscal year 2024, discretionary spending was around 25% of total government spending.

Despite discretionary spending only representing a quarter of total government spending, all parts of the federal government will be impacted by the shutdown in some way, including the work of agencies like Environmental Protection Agency, the Labor Department and parts of the IRS.

From a services perspective, national parks and museums will be shuttered, and some public services – such as call centers for federal agencies – may be unavailable. Regulatory and oversight activities such as inspections, audits and regulatory reviews may be postponed. Delays or suspensions could affect the processing of passports, visas, federal permits and other applications.

Government programs that are funded outside of the congressional appropriations process are called “mandatory” and operate as normal during government shutdowns. Essential activities funded by the “mandatory” budget – including those focused on national security, safety and medical care – will continue. For instance, programs such as Social Security, Medicare and Medicaid will remain uninterrupted, and tax collection and debt repayment will also be unaffected. All told, mandatory programs account for close to 75% of annual federal spending.

While many employees in discretionary programs will be furloughed (told not to report to work), those employees whose roles involve the “safety of human life or the protection of property” are exempt from furlough and are required to report to work.

Some individuals may find themselves more directly affected than others. Federal workers, for example, will face some of the most obvious hardships, particularly if the shutdown is prolonged. During a shutdown, all federal workers do not receive pay regardless of any discretionary/mandatory designation of their program but would be paid retroactively once funding is appropriated and the shutdown ends. Families and workers who depend on certain government services could also face financial difficulties.

Ready to take the next step in investing?

We offer $0 commission online trades, intuitive investing tools and a range of advisor services, so you can take control of your financial future.

What’s the history of U.S government shutdowns, and how long do they typically last?

Government shutdowns as we know them today are a relatively new part of American political life. They came about in the 1980s alongside stricter interpretation of the Antideficiency Act, a law that prohibits government agencies from spending money that Congress has not yet appropriated.

Per the U.S. House of Representatives website, at that time, “The Attorney General believed government agencies had no legal means to operate during a funding gap. Beginning with the appropriations process for fiscal year 1982, many subsequent funding gaps have resulted in a shutdown of affected agencies, in which day-to-day operations halt and employees are furloughed without pay. Eventually, federal officials carved out exemptions for government employees deemed ‘essential,’ like military and law enforcement personnel involved in the protection of life and property.”

Since 1980, the U.S. federal government has seen 14 shutdowns lasting one day or more. The longest – and the most recent – lasted from December 21, 2018, to January 25, 2019.

What’s been the historical impact of government shutdowns on the economy?

In a 2015 report, the Congressional Research Service (CRS) outlined that shutdowns have historically cost the economy at least 0.1 percentage points of growth per week, and sometimes more. And the longer federal funding remains blocked, the greater the consequences – and the more difficult it is for the economy to make up for lost ground in future months.

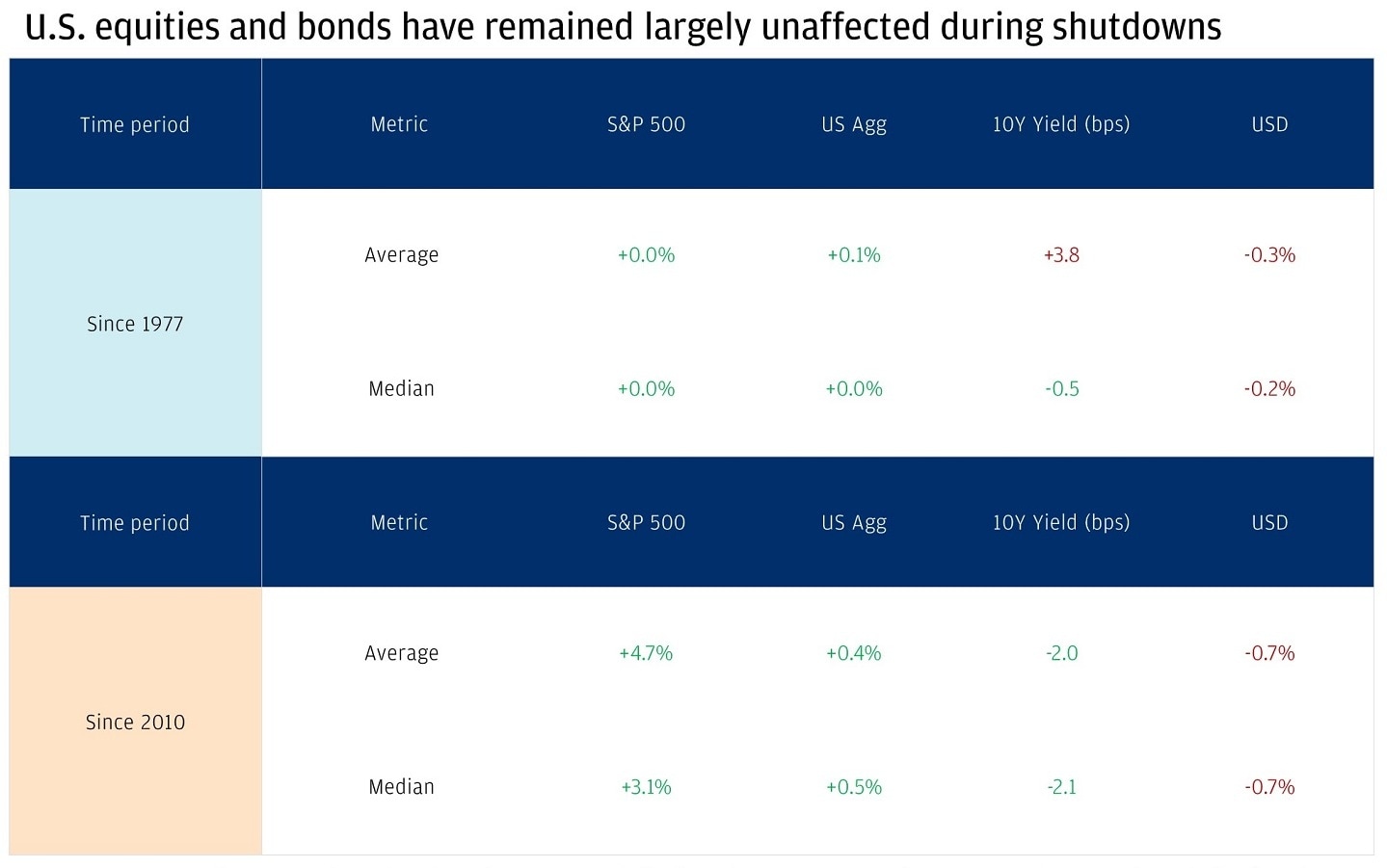

When it comes to the markets, however, the impact of government shutdowns has been minimal. Dana Harlap, Global Investment Strategist for J.P. Morgan Wealth Management, said, “Historically, markets have treated shutdowns as a nonevent with no clear impact. Since 1980, the S&P 500 has been about flat on average during shutdowns, and U.S. Treasury yields and the U.S. dollar have followed a similar pattern. A government shutdown has no bearing on Treasury debt or principal repayment at maturity. That said, a prolonged shutdown could briefly weigh on economic activity; for example, a month-long shutdown is typically estimated to reduce quarterly gross domestic product (GDP) growth by about 0.1 to 0.2 percentage points, with most losses recouped once the government reopens.”

Government shutdowns have had limited impact on markets

What should investors be mindful of during this particular government shutdown?

An immediate impact of this government shutdown could be a disruption in federal agencies’ collection of data for the publication of key economic indicators. Among the first affected items could be the Bureau of Labor Statistics’ jobs report, due October 3, 2025.

This is a report that many investors are closely watching to gauge current labor market dynamics and determine whether the Federal Reserve can continue on its rate-cutting path or if the economy is already showing signs of stabilizing and reaccelerating.

That said, the Department of Labor should still be able to provide weekly initial and continuing jobless claims, as these measures are aggregated from state-level reports, which should not be affected by the federal government shutdown. These weekly reports could provide the Fed with helpful labor market data to better inform its monetary policy decision toward the end of October should the shutdown draw out.

Beyond that, there’s the chance that the government shutdown could have unforeseen ripple effects through the economy, which is already being tested by tariffs and a slowing labor market.

According to a 2023 CRS report, “Depending on its length, a shutdown could ... harm consumer and investor sentiment, reducing private consumption and investment.”

Another variable to this shutdown is that President Trump has publicly floated that cuts – including cuts to benefit programs and the federal workforce – could be made permanent.

Jeff Kreisler, Head of Behavioral Science at J.P. Morgan Private Bank, said, "For those who have a continuously eroding trust in the institution of government, the shutdown may exacerbate their feelings since many services and provisions they may need will halt, and could make it increasingly difficult to repair that trust in the future… Generally, as services decrease, people might begin to look to other ways to meet their needs."

Still, Harlap reiterates that headwinds remain limited: “We think the potential for a government shutdown is low on the list of market drivers right now, with investors more focused on the potential impacts of the Federal Reserve’s rate-cutting cycle, trade and immigration policy, economic data developments and corporate earnings.”

The bottom line

Although the effect of government shutdowns on financial markets has historically been minimal, the likelihood and magnitude of direct impacts increases as the shutdown lingers on.

You're invited to subscribe to our newsletters

We'll send you the latest market news, investing insights and more when you subscribe to our newsletters.

Editorial staff, J.P. Morgan Wealth Management