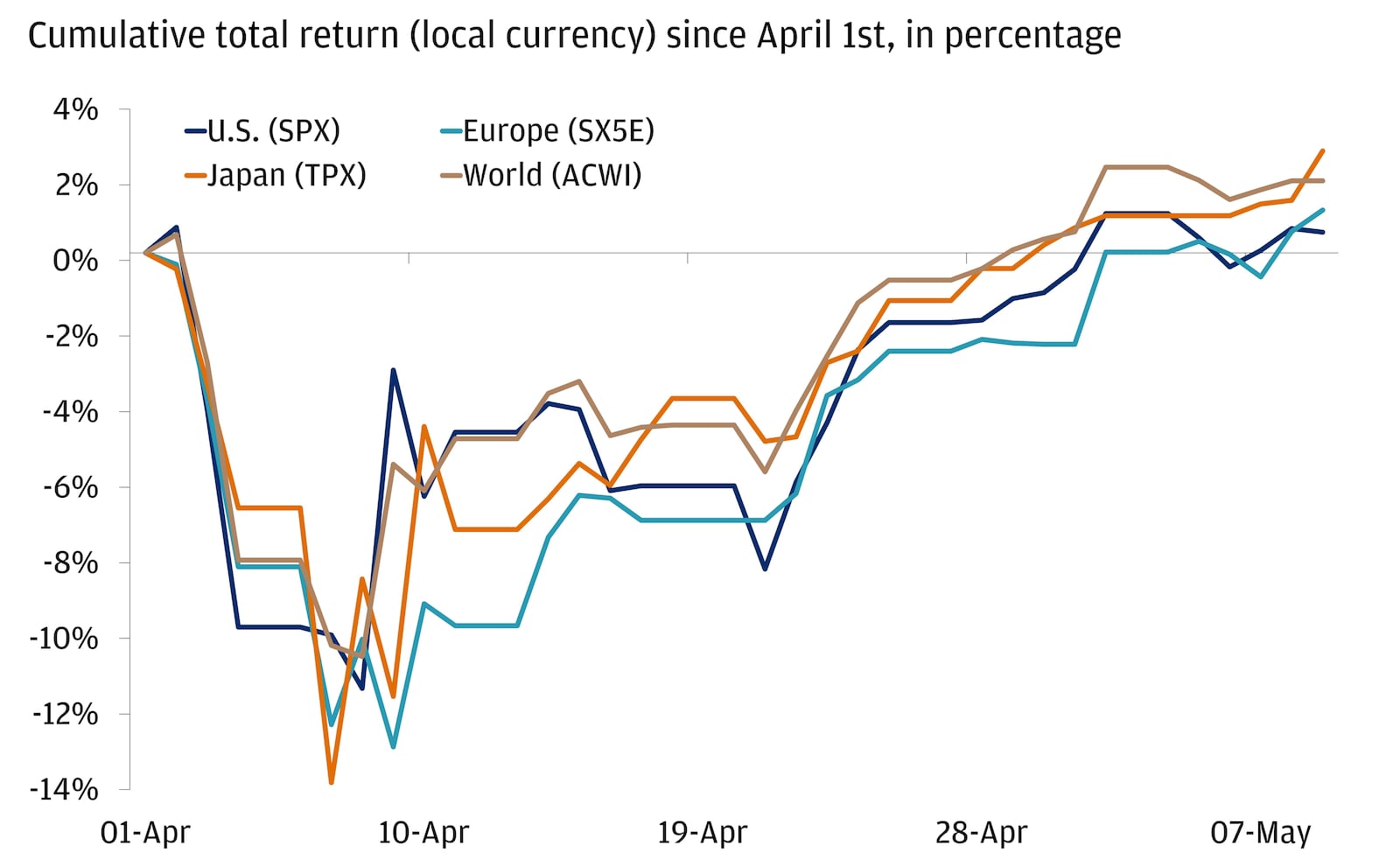

How global markets have recovered from tariff shocks

J.P. Morgan Wealth Management

Global equity markets have staged an impressive recovery from the ‘Liberation Day’ shock in early April. This synchronized recovery underscores how sensitive equity markets are to evolving trade policy, yet the shadow of tariffs still looms over the economic landscape. As trade negotiations unfold, we anticipate ongoing volatility and the summer could bring further complexity as the tariff postponement is scheduled to end amidst U.S. budget reconciliation and debt ceiling discussions.

Over the past month, trade dynamics have been highly volatile. It mostly started on ‘Liberation Day’ when President Donald Trump announced a minimum 10% tariff on all U.S. imports and additional reciprocal duties on 60 nations. This decision increased the average effective tariff rate in the U.S. to about 25%, up from approximately 2% at the beginning of the year, surprising many investors. On April 9, the Trump administration announced a 90-day pause on elevated ‘reciprocal’ tariffs, instead setting a baseline 10% tariff rate for most countries.

Work with an advisor

Our advisors can provide ongoing financial advice on how your portfolio can adapt to the changes in the market, your life and your goals.

However, trade tensions with China escalated and levies ultimately reached 145%. Yesterday’s equity market rally followed a de-escalation between the U.S. and China, with both nations agreeing to temporarily lower tariffs for 90 days. This adjustment leaves the average statutory tariff rate on U.S. imports from China at approximately 50% (beginning of the year baseline of roughly 20% plus the additional announced 30% tariff rate).

This recent progress marks a step towards answering the question of what President Trump ultimately seeks – decoupling or a deal – with indications leaning towards a deal. While the recent progress is promising, a comprehensive agreement that addresses structural imbalances comes with challenges that require time and trust-building. As such, geographic and asset class diversification remain key to navigating these uncertainties.

The synchronized equity market rebound

All market and economic data as of 05/12/25 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Explore ways to invest

Take control of your finances with $0 commission online trades, intuitive investing tools and a range of advisor services.

J.P. Morgan Wealth Management