What’s been the tariff impact on U.S. businesses since “Liberation Day”?

Global Investment Strategist

Author’s note: We are closely monitoring the ongoing conflict in the Middle East and its potential impact on oil, markets and the economy. For insights on how to potentially protect portfolios amid the widening conflict, read our recent Top Market Takeaways.

The most common question that I get is: "Will tariffs trigger a U.S. recession this year?" Our perspective is that tariffs alone won't lead to a recession in 2025. While tariffs do present a cost shock, the U.S. economy is equipped with various shock absorbers to mitigate severe downturns. However, we do anticipate a slowdown in economic growth, from the approximately 2% year-over-year growth we projected at the end of 2024 to closer to 1% in 2025.

Our outlook considers the fact that parts of the Administration's current tariff policy are being adjudicated in the courts. Even if the courts eventually deem certain aspects of the tariff policy unconstitutional, we believe that the current administration has different levers at its disposal to keep tariffs in place. Below, we discuss what we are seeing so far when it comes to tracking the impact of tariffs on the U.S. economy, from how import prices are changing, the rise in tariff collections and the potential impact on profits margins and the labor market.

Work with an advisor

Our advisors can provide ongoing financial advice on how your portfolio can adapt to the changes in the market, your life and your goals.

U.S. importers, rather than foreign exporters, are absorbing initial tariff costs

Before diving into the details, let's clarify what tariffs are. Essentially, a tariff is a tax on imports. An often-cited potential mitigating factor to the impact of tariffs is that foreign suppliers might lower their prices to retain large U.S. customers, effectively absorbing the tariff costs themselves. We can test this theory by examining U.S. import price data. If foreign suppliers were indeed bearing the tariff costs, we would expect a significant drop in import prices. However, this hasn't been the case, even when we focus on imports from China where import prices are down only around 1.5% since January. If exporters in China were baring the cost of the tariffs, we would expect import prices to be down closer to between 25% to 30% (the percentage point change in tariff rates since the beginning of the year).

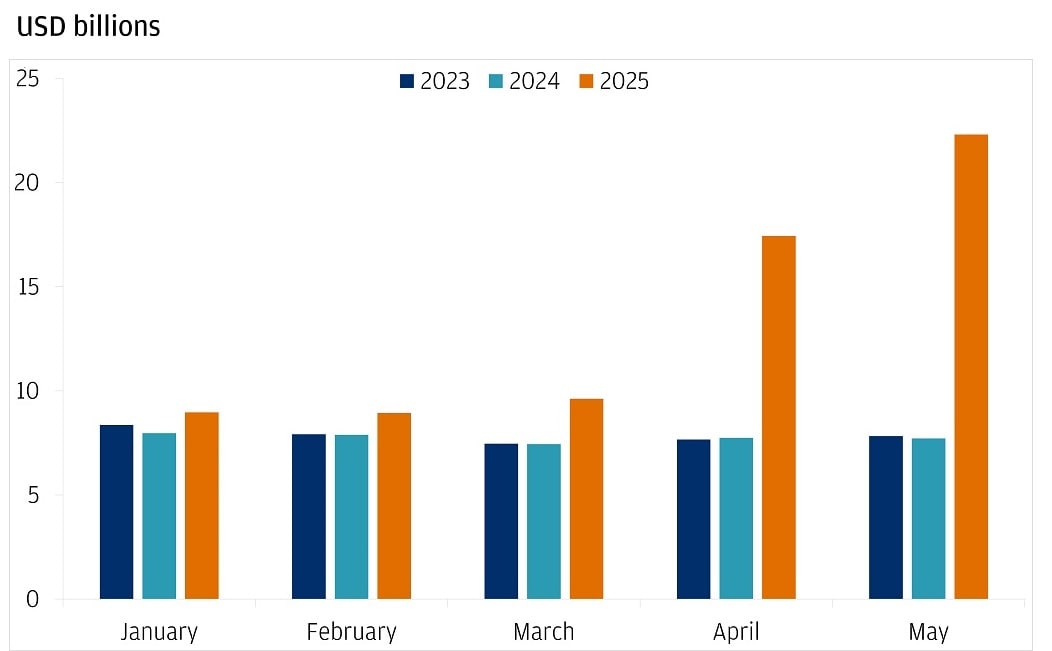

For now, U.S. businesses are shouldering the lion’s share of the initial tariff costs, and that has been reflected in the increasing U.S. tariff collection data more recently. The latest data would imply an effective tariff rate that is moderately below our expectation for a 10% to 15% rate by year-end. So, the tariff impact is starting, but not yet at full force.

Tariff collections continued to increase in May

The role of shock absorbers

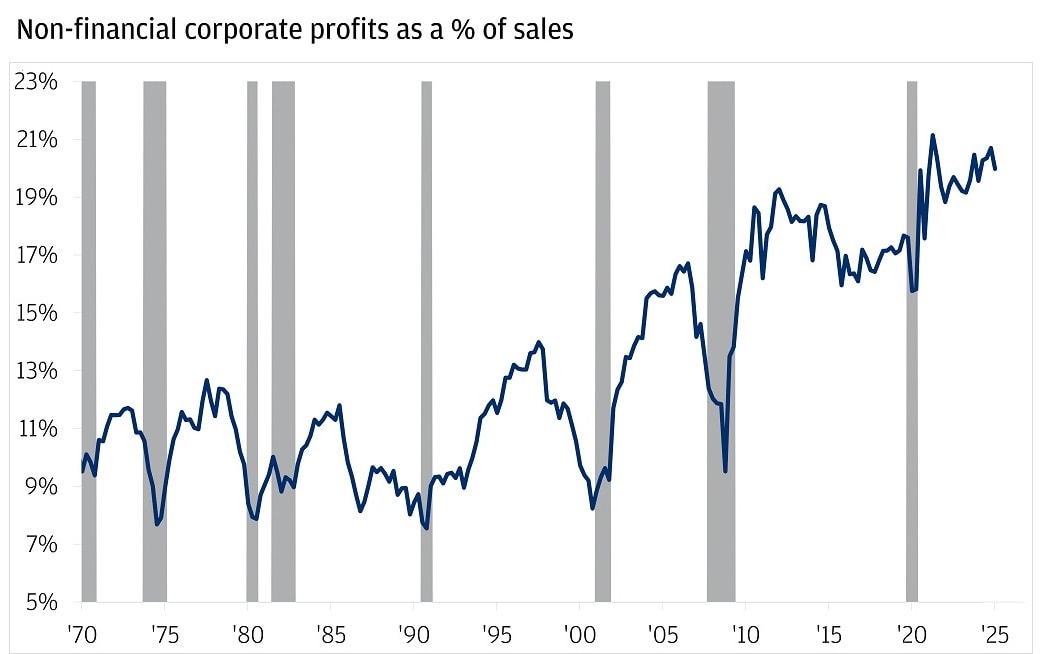

In any economic shock, the capacity of shock absorbers is crucial. In other words, the starting point matters significantly. When faced with higher costs due to tariffs, U.S. businesses have a few options: Absorb the costs into their profit margins, pass them on to consumers or a combination of both. The good news is that profit margins across the economy remain elevated relative to history, despite a slight decline during the first quarter, providing room for corporations to absorb some of the additional costs. Of course, this isn't true for every company in every sector, but the U.S. economy is starting from a position of strength. Remember, this was an economy growing at nearly 3% last year, well above the trend growth rate of 1.5% to 2% and was expected to grow around 2% this year before tariffs were announced.

U.S. corporate profit margins remain elevated

Corporate profit margins and the labor market are linked

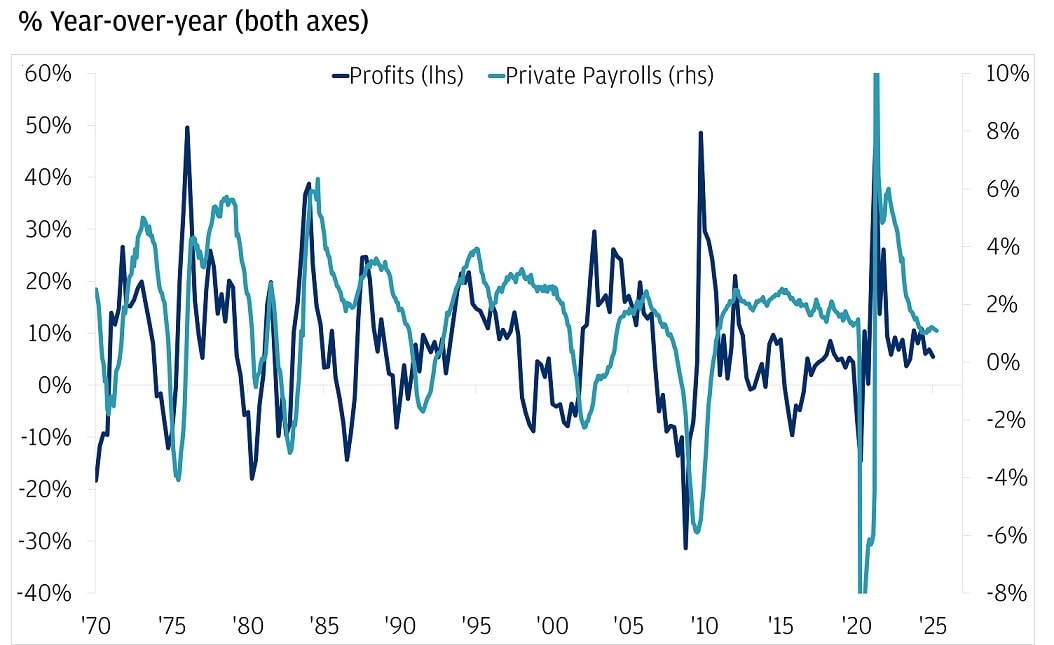

The health of corporate profit margins is linked to the labor market's strength, which is crucial given that household consumption is a dominant driver of U.S. economic growth. If profit margins compress significantly (or turn negative), businesses may need to cut costs, potentially by reducing headcount. Historically, periods of weakening profit margins often precede labor market weakness. While we're not at that point yet, we'll closely monitor this connection to assess how businesses are responding to higher tariff costs and whether there's cause for meaningful labor market concern.

Downturns in profit margins often precede weakness in the labor market

All market and economic data as of 06/25/2025 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Explore ways to invest

Take control of your finances with $0 commission online trades, intuitive investing tools and a range of advisor services.

Global Investment Strategist