Quick shot: January inflation numbers are in; here’s how they’re impacting the markets

J.P. Morgan Wealth Management

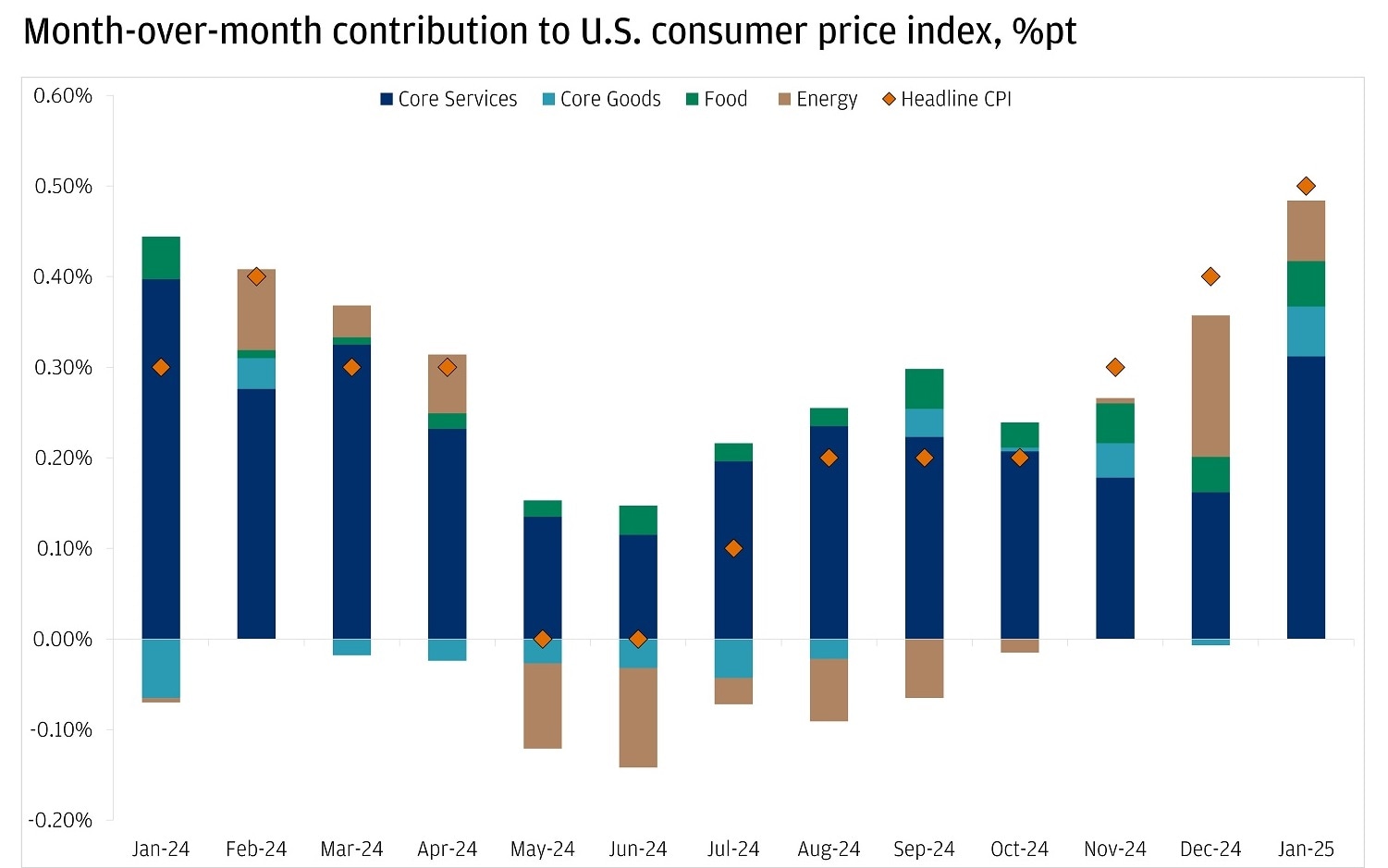

While a little spice can be welcome, unexpected heat can catch you off guard. That’s essentially what happened on Wednesday after the U.S. released the January Consumer Price Index (CPI) report, which gives an indication how the prices of a basket of goods and services changed over the preceding month. The headline measure (which includes food and energy) came in above expectations at 0.5% month-over-month (versus expectations of 0.3%) and the core measure (which excludes food and energy) was 0.4% month-over-month (versus expectations of 0.3%). Both measures showed an acceleration in inflation, which brought the year-over-year numbers to 3.0% and 3.3% respectively – still above the 2% target set by the Federal Reserve.

The main contributor to this inflation increase was core services. While shelter inflation was relatively steady (a positive development), services prices jumped in several categories including motor vehicle insurance, communication services and recreation services. Notably, on the consumer goods front, used vehicle prices rose after showing some signs of cooling last year. Additionally, both food and energy prices increased, with the latter notably impacted by a 15% surge in egg prices. This marked the largest monthly increase since 2015, primarily driven by the ongoing avian flu.

Work with an advisor

Our advisors can provide ongoing financial advice on how your portfolio can adapt to the changes in the market, your life and your goals.

Following the report, U.S. equity markets declined and U.S. treasury yields rose as investors reduced their expectations for the number of interest rate cuts by the Federal Reserve in 2025. We still expect that the inflation data will moderate enough for the Federal Reserve to cut interest rates this year, but the recent strength of the labor market and higher-than-expected inflation may delay these cuts to the latter half of the year.

Importantly, we still believe the economic expansion can continue, albeit with increased volatility. Ensuring that portfolios are well-prepared to handle potential market fluctuations remains crucial.

Services inflation drives consumer prices higher

All market and economic data as of 02/12/25 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Explore ways to invest

Take control of your finances with $0 commission online trades, intuitive investing tools and a range of advisor services.

J.P. Morgan Wealth Management