4 trends we’re watching in the artificial intelligence investing space

How have markets reacted one week after the Federal Reserve cut rates?

One week after the Federal Reserve (Fed) resumed its cutting cycle, market momentum cooled – but the economy didn’t. Across the week, the S&P 500, S&P 500 equal-weight and S&P 400 declined; U.S. Treasury yields were a bit higher across the curve and the U.S. dollar strengthened – a mild cool-off in animal spirits.

Then came stronger-than-expected data. Two prints stood out:

- Growth revisions surprised to the upside: Q2 2025 gross domestic product (GDP) came in at 3.8% in the third estimate, versus 3.3% expected. Although trade swings can nudge the headline around, this upgrade was mostly about stronger consumer spending (+2.5% vs 1.7%) – in short, the consumer remains solid.

- The jobs market is holding up: Initial and continuing claims came in below forecasts – evidence of a labor market that has slowed, not cracked.

The bottom line: A bit of “good news is bad news.” Firmer growth risks stickier inflation and a shallower, slower pace of cuts. That said, investors are still pricing one to two more cuts this year – and we agree. The Fed remains driven by incoming data, with risks on both sides.

Against this backdrop – and with defensive sectors outperforming growth sectors this week – the market’s shifting tone makes it timely to address an ongoing concern: Are we in an artificial intelligence (AI) bubble?

Ready to take the next step in investing?

We offer $0 commission online trades, intuitive investing tools and a range of advisor services, so you can take control of your financial future.

What we’re watching for in a potential artificial intelligence market bubble

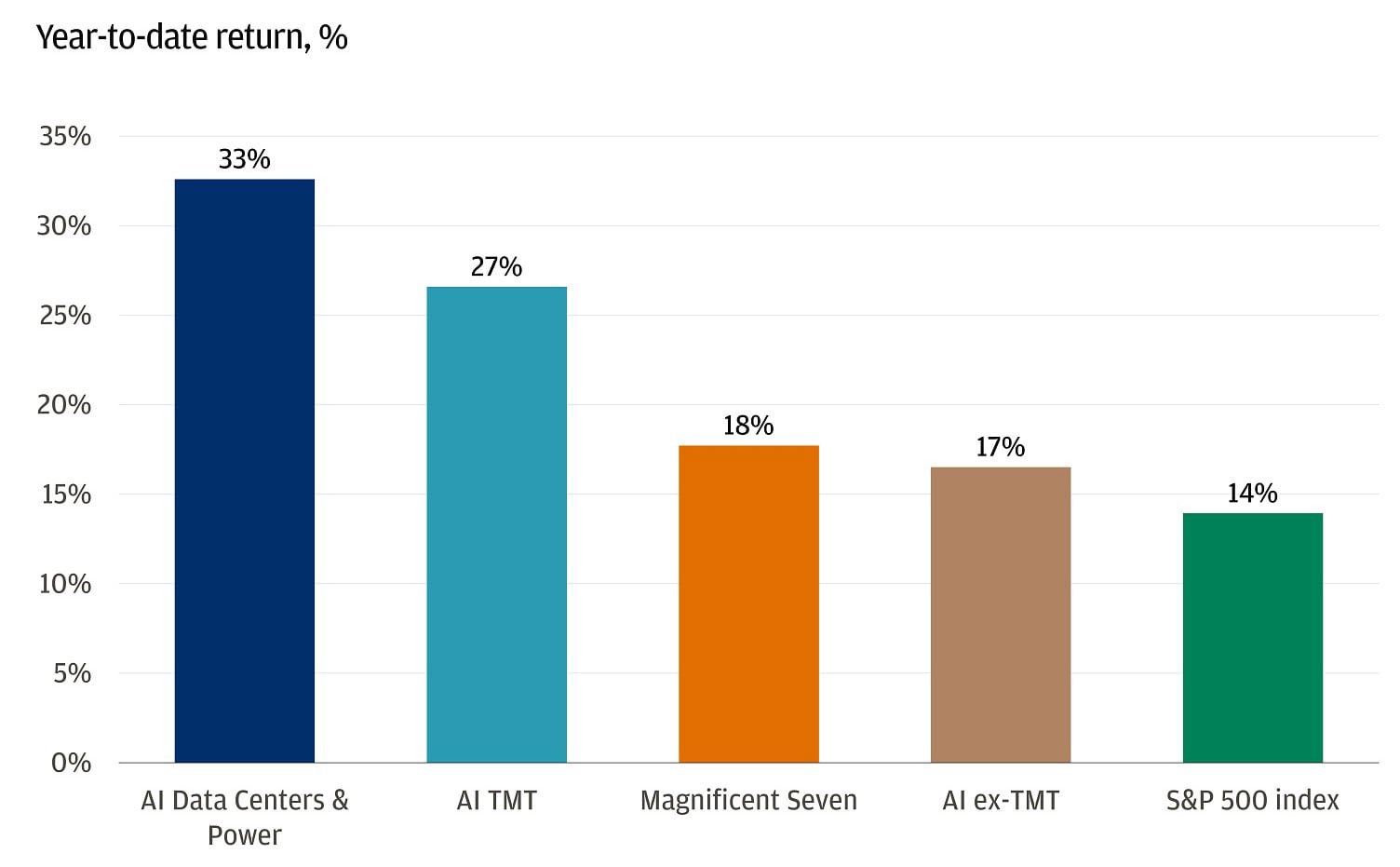

In the equity space, we continue to embrace the AI theme. All signs still point to robust capital expenditure (capex) and profit generation. U.S. hyperscalers, data centers and power providers have returned more than double the S&P 500 year-to-date and we continue to highlight tech and utilities as two of our preferred sectors.

The market is continuing to reward the builders of AI

Given how central AI has become to the equity rally – technology companies including Amazon, Google, Tesla and Meta now make up roughly 50% of the S&P 500 – and its growing impact on the broader economy, it’s fair to wonder: Is this for real or are we in another bubble? It’s a question we hear often from clients and one we ask ourselves regularly. Here are four signs we’re watching to make sure the AI story is built on solid ground.

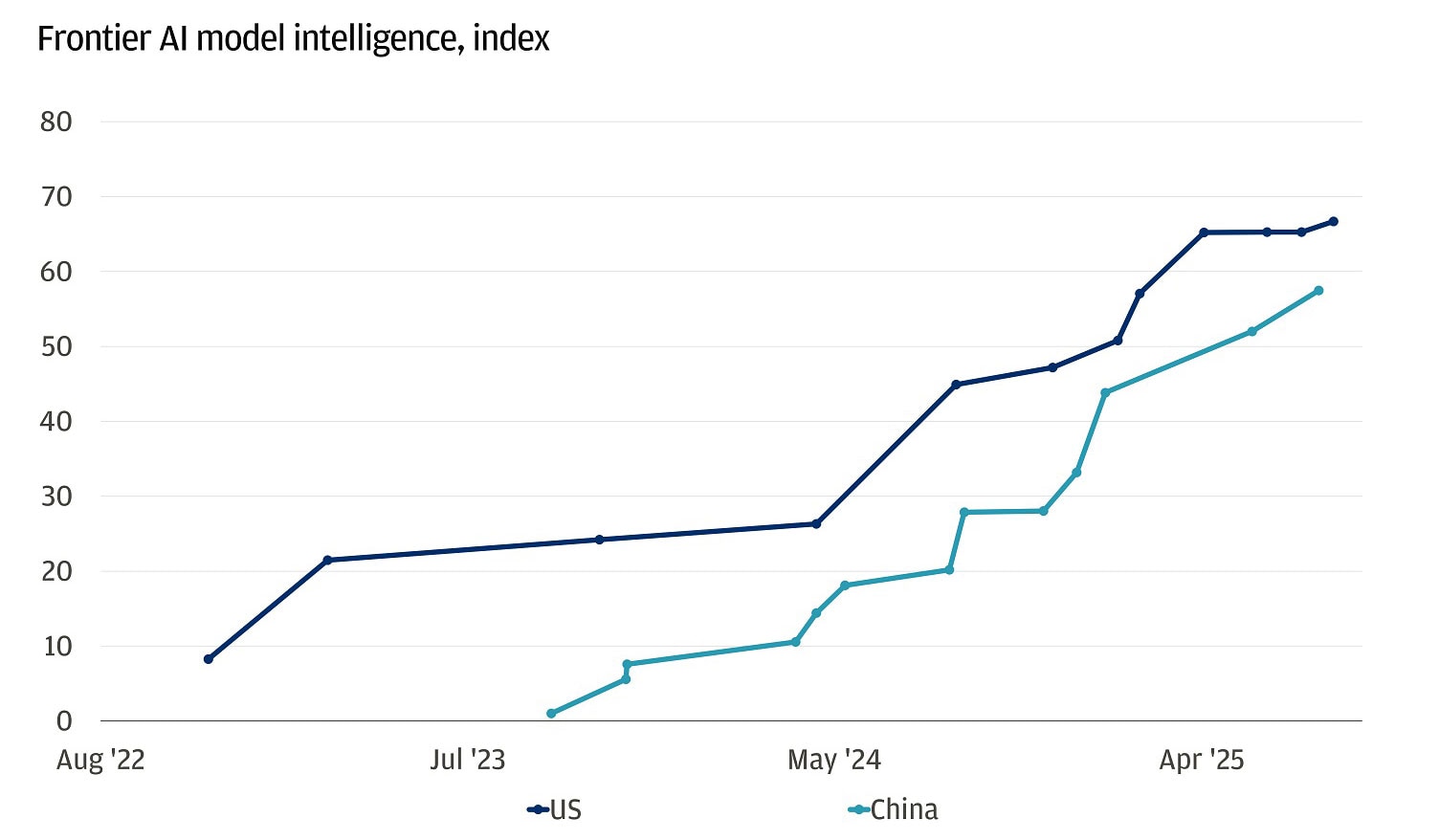

The models keep getting better and require more computing power

It would be worrisome if the newest AI models weren’t performing any better than their predecessors, or if they required less power for only small improvements – suggesting hyperscalers might be overspending. Instead, we’re seeing promising signs: Leading models from both the U.S. and China continue to improve and the computing power needed to train them keeps rising.

AI model performance for frontier models

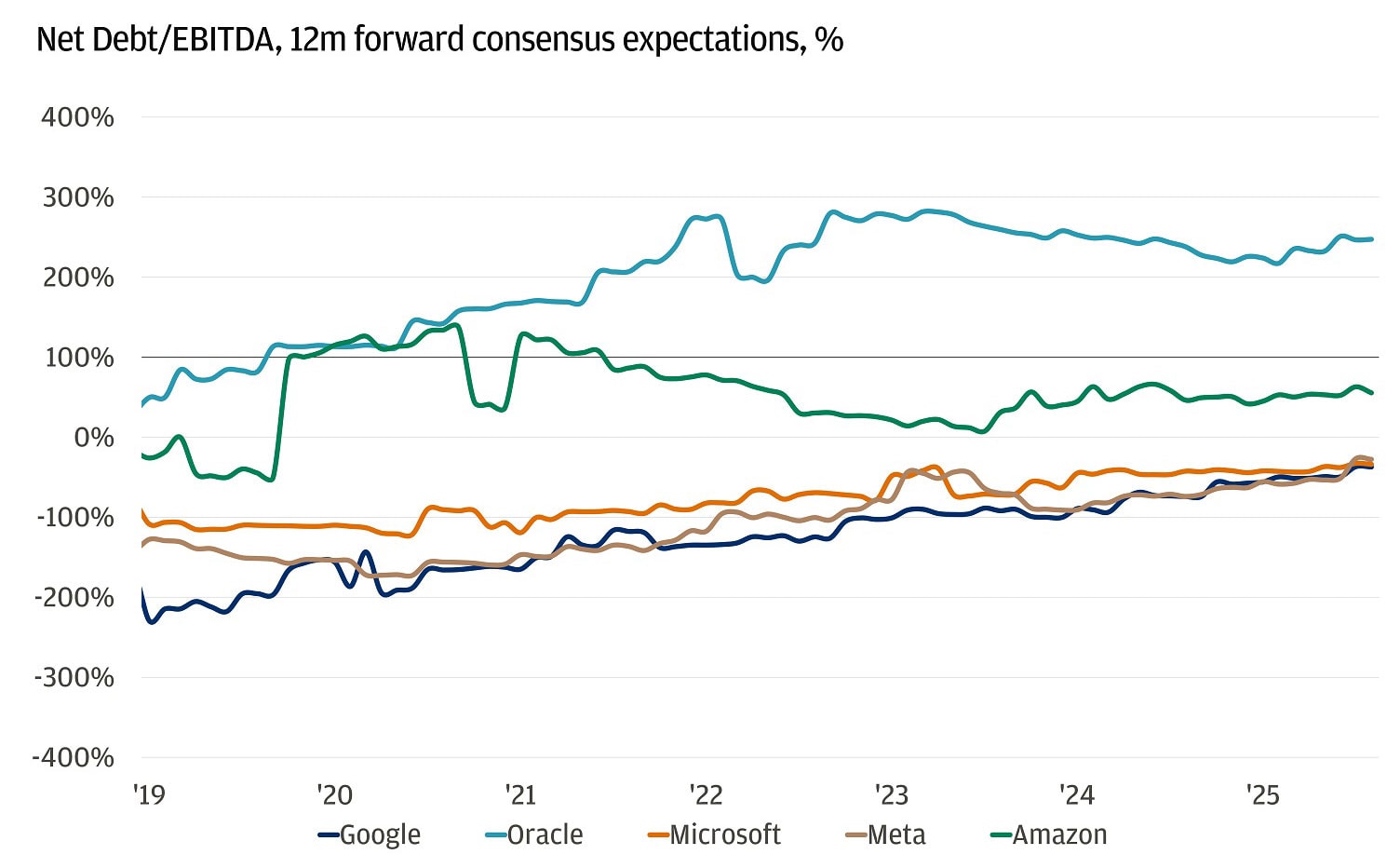

Strong financials and measured capex show no signs of an AI investment bubble

Ongoing investment in AI is only sustainable if there’s enough capital and no signs of overinvestment. With the exception of Oracle, the major hyperscalers building AI data infrastructure have less debt on their balance sheets than they generate in profit and three out of five have surplus cash.

Balance sheet health of hyperscalers

The amount of capex being deployed in AI remains low compared to previous periods of heavy investment, like telecoms before the dot-com crash and energy during the shale and fracking boom. At its peak, telecoms capex reached 2.67% of GDP, while energy peaked at 4.75%. By contrast, the current AI cycle is at just 1.05%.

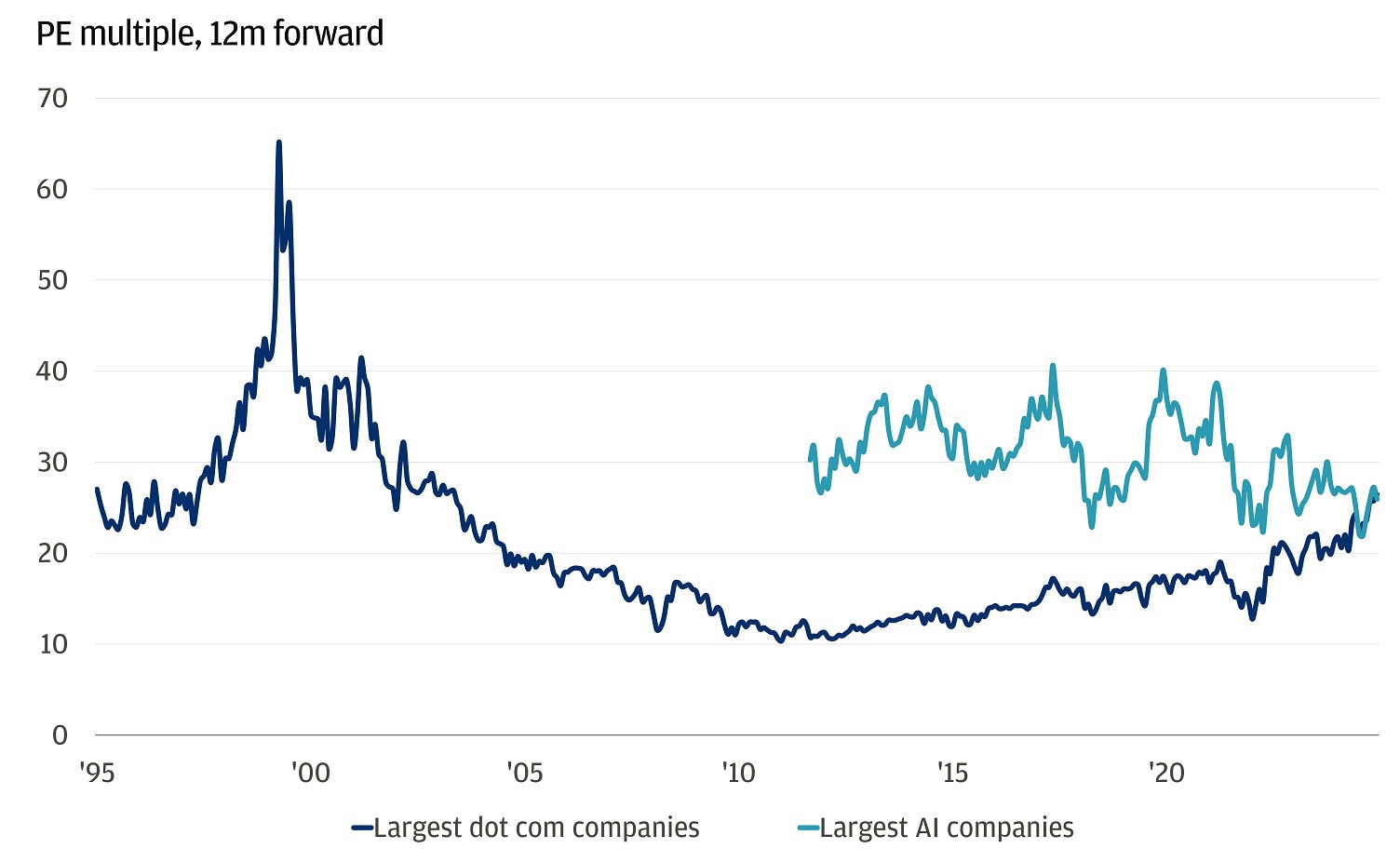

Valuations and initial public offering returns are staying contained

As earnings have come in, the price multiples on the largest AI companies have actually fallen relative to both the broader market and previous bubbles. In fact, the largest AI companies’ Price-to-Earnings (PE) multiples are now lower than their average over the last 10 years. Even returns from recent IPOs – which have historically coincided with periods of peak enthusiasm – have yet to see a meaningful pick-up. The 12-month return currently sits at 3.8%, compared to a 5-year average of 10%.

AI multiples relative to dot com

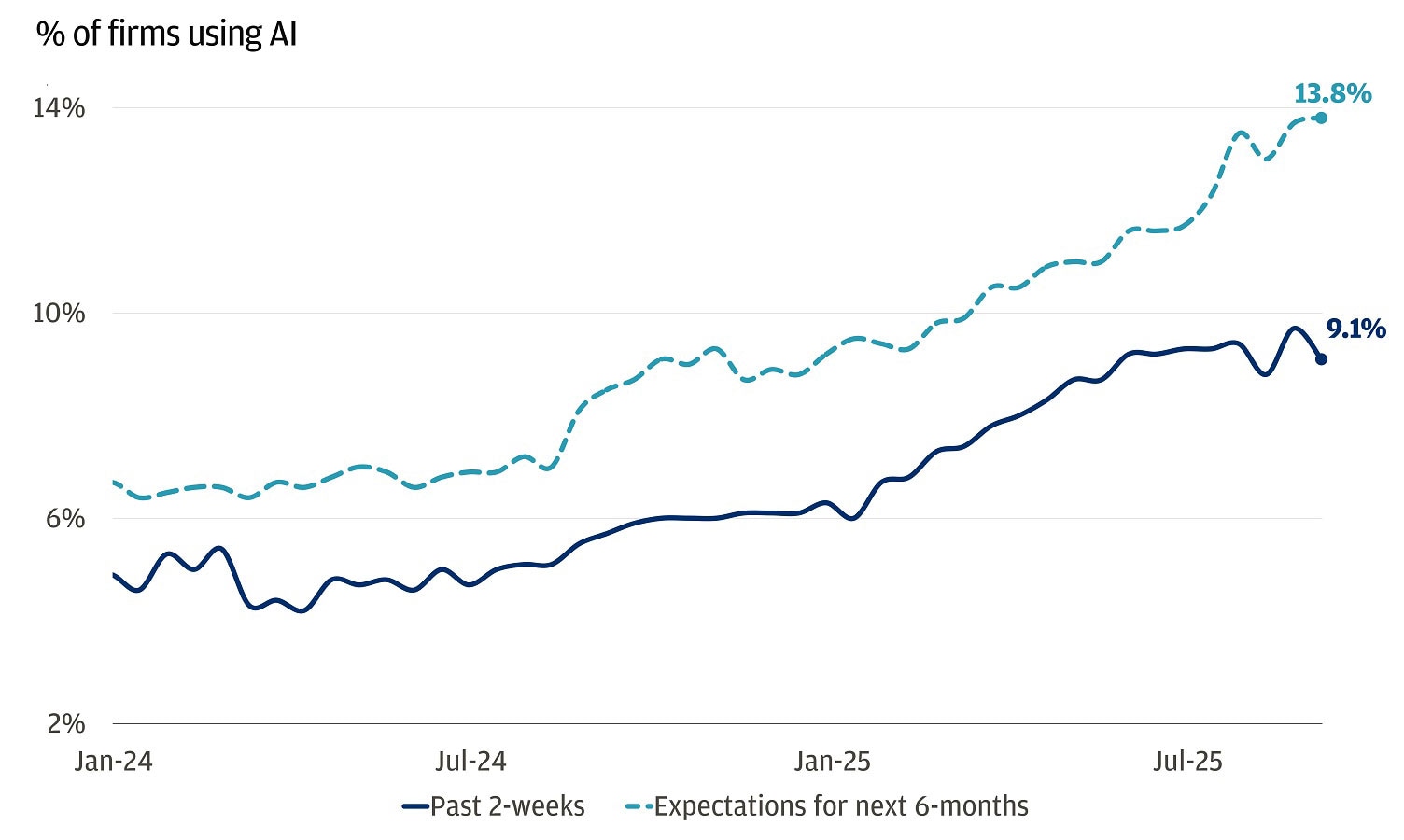

There’s plenty of runway left for AI adoption

According to a recent Census Bureau survey, AI adoption in the U.S. has jumped 60% over the past year, but only 9.1% of companies report actively using the technology to produce goods or services – leaving plenty of room for further growth. It’s worth noting that the survey asks, “Have you used Artificial Intelligence to produce a good or service?” That phrasing is designed to capture companies using AI productively and will be lower than other measures of AI adoption based on spending on AI. For instance, the Ramp AI index measures the number of companies paying for AI subscriptions and has adoption rates as high as 44.5%. While spending is important, we believe it will ultimately be the goods and services produced from AI which will unlock the productivity gains for the economy.

AI adoption in the U.S.

All in all, AI remains a secular theme we recommend clients pursue. With the Fed’s recent rate cut, lower borrowing costs and higher equity valuations are making capital-intensive projects more attractive, fueling further investment and adoption across the AI landscape. As AI infrastructure and usage continue to expand, we see a reinforcing cycle of growth and opportunity.

Reach out to your J.P. Morgan advisor to have a conversation about suitable opportunities.

All market and economic data as of 09/26/25 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

You're invited to subscribe to our newsletters

We'll send you the latest market news, investing insights and more when you subscribe to our newsletters.

Global Investment Strategist, J.P. Morgan Wealth Management

Global Investment Strategist