Strong support. Goals achieved. Builders and developers, we're here for your clients.

A range of products and programs to benefit new construction sales

Welcome to where you can work with a mortgage lender who understands the business, from appraisal support to sales to closing. Hear from Chase team members and customers on the condo/builder program with Chase.

New construction programs

Mortgage products

Extended-term rate lock

Both the homebuyer and you are protected from interest rate increases for up to 12 months. Fees may apply.

Rate cap option

Buyers can secure their interest rate for up to one year with an option to float down the rate if market conditions become favorable. Fees may apply.

Escrow holdback

Your buyers can complete the purchase of their home while building is still in the final stages of construction.

Portfolio lender benefits

Flexible underwriting allows us to offer closings at lower pre-sale occupancy than industry standards (as low as 25%). We also lend on condo project units with a high commercial space percentage.

New construction appraisal support

Take advantage of our batch appraisals for multiple units, automated appraisal suppression and manual AMC notification, when necessary.

In-house condo project approval group

Our specialized project underwriters focus on condo approvals and ensure that all lending opportunities are pursued, including jumbo, Fannie Mae, Freddie Mac and more.

Rate types

To make the process smoother for your homebuyers, our fixed-rate and adjustable-rate mortgages are available for a variety of terms to meet their needs.

Loan choices

Your clients can choose from a variety of mortgages, from low-downpayment to conventional to jumbo Chase DreaMaker℠ to conventional to jumbo (portfolio), Federal Housing Administration (FHA) or Veterans Affairs (VA) loans.

So many ways to help make homeownership possible

Chase Homebuyer Grant℠

In select areas across the country, our Chase Homebuyer Grant provides qualified customers $2,500 or $5,000 that’s first applied to help lower interest rates for the homebuyer. Then it can be applied to Chase fees, other fees or the down payment on applicable loans.

$5,000 Chase Closing Guarantee

We promise an on-time closing for eligible products in as soon as three weeks or you'll get $5,000, if you qualify.

Homebuying tools and calculators

Homebuyers can enter criteria to help find the loan that meets their needs, and even start their application right away.

Relationship Pricing Program

Your buyers may be eligible for a rate discount based on new and existing balances when buying a new home., Max rate discounts apply. Their Chase Home Lending Advisor (HLA) can provide more information.

Talk with a Regional Builder Manager today

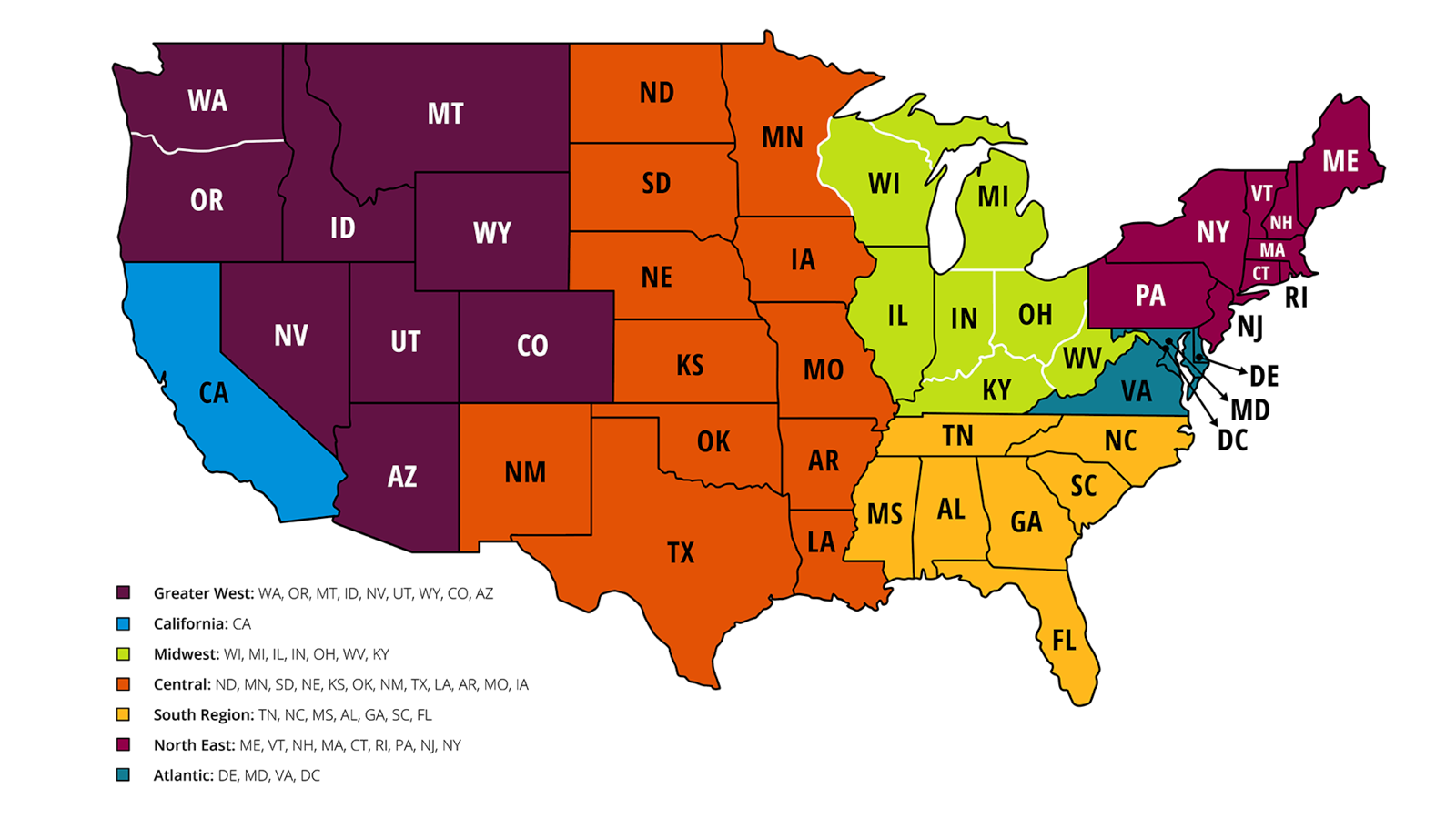

Find a Regional Condo or Builder Sales Manager ready to help your clients reach your sales goals.

Meg Hamlin

- meg.hamlin@chase.com

- 720-839-7004

Marla Murray

- marla.murray@chase.com

- 602-570-8506

John Perger

- john.perger@chase.com

- 714-595-3661

Jason Chapin

- jason.chapin@chase.com

- 415-420-1143

Richard Torres

- richard.torres@jpmchase.com

- 760-662-1153

Benny Lee

- benny.x.lee@chase.com

- 718-902-8305

Dionne Younger

- dionne.younger@chase.com

- 713-240-1805

Benny Lee

- benny.x.lee@chase.com

- 718-902-8305

Benny Lee

- benny.x.lee@chase.com

- 718-902-8305

Benny Lee

- benny.x.lee@chase.com

- 718-902-8305