Finding opportunity in increasing deficits

J.P. Morgan Wealth Management

Market update

U.S. equity markets are declining this week after a downgrade of the U.S. sovereign debt rating and the narrow passage of President Donald Trump’s tax bill in the House. Details are covered below.

Weekly moves:

- In equities, the S&P 500 is down -2.0% heading into the holiday weekend. The tech-heavy Nasdaq 100 (-1.5%) is outperforming but remains negative. Internationally, European equities (-0.1%) are nearly flat, while offshore Chinese equities have gained about +1.1%.

- In fixed income, bonds are selling off. The debt downgrade, increased fiscal deficit projections, and a weak 20-year Treasury auction have pushed yields higher at the long end of the curve. The 20-year yield is up eight basis points, and the 30-year has reached its highest levels since 2023, climbing nine basis points, reflecting increased term premium.

- Gold is serving as a hedge against geopolitical and deficit risks, rising +3.9% this week. Oil (-1.5%) is declining as OPEC+ members discuss a potential third consecutive oil production increase in July, considering an additional 411,000 barrels per day.

Below, we explore how investors can add resilience to their portfolios amid the prospect of higher fiscal deficits.

Spotlight

President Trump’s tax bill narrowly passed the House with a 215 to 214 vote, advancing a multi-trillion dollar package aimed at preventing a year-end tax increase while significantly increasing the U.S. debt burden.

Work with an advisor

Our advisors can provide ongoing financial advice on how your portfolio can adapt to the changes in the market, your life and your goals.

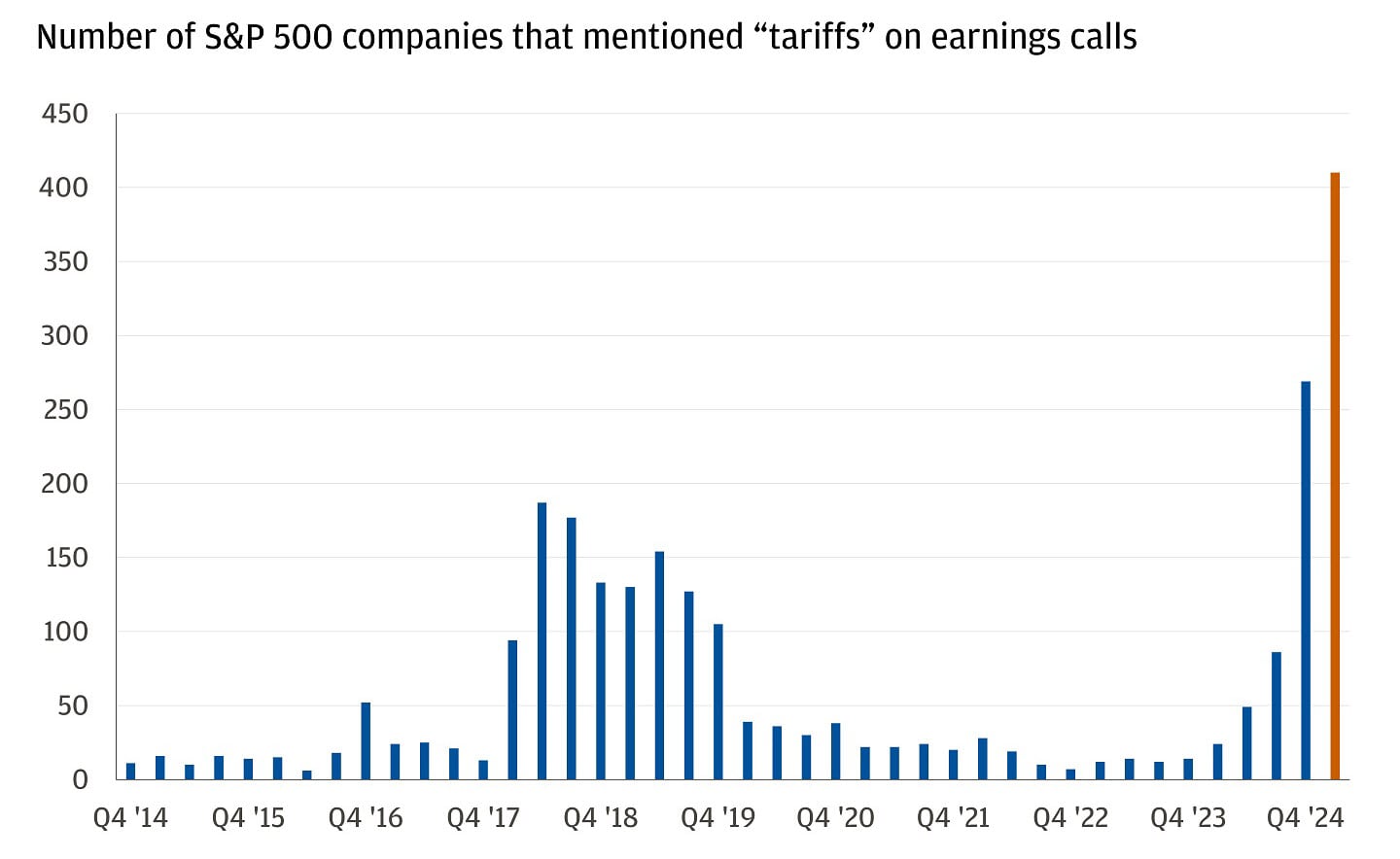

The reconciliation bill has shifted focus away from tariff policy over the past month, though this morning President Trump made two new tariff threats over social media. The first is a threat to place “at least” a 25% duty on iPhones unless Apple makes them in America. In the second, the President said he was “recommending” a 50% tariff on goods imported from the European Union starting on June 1. First-quarter earnings reports from about 95% of S&P 500 companies show that over 85% mentioned “tariffs” on their calls. An empirical research analysis found that only about 11% of companies reported an explicit tariff impact, suggesting a 7% decline in gross profit margins.

86% of S&P 500 companies mentioned “tariffs”

Nonetheless, earnings growth for the year now stands at 12.4%, relatively in line with the 12.6% prior to the earnings season kick off.

With a delay until July 9 for reciprocal tariffs to take effect and more clarity from companies on tariff impacts, investor focus has largely shifted from tariffs to deficits and the tax bill.

The bill faces Senate opposition, with Republicans divided over permanent tax cuts and spending cuts. Currently, the bill aims to make many of the tax cuts in the 2017 Tax Cuts and Jobs Act (TCJA) permanent, estimated to cost $3.8 trillion over 10 years, with net spending cuts reducing the estimated net cost to $3.2 trillion over 10 years.

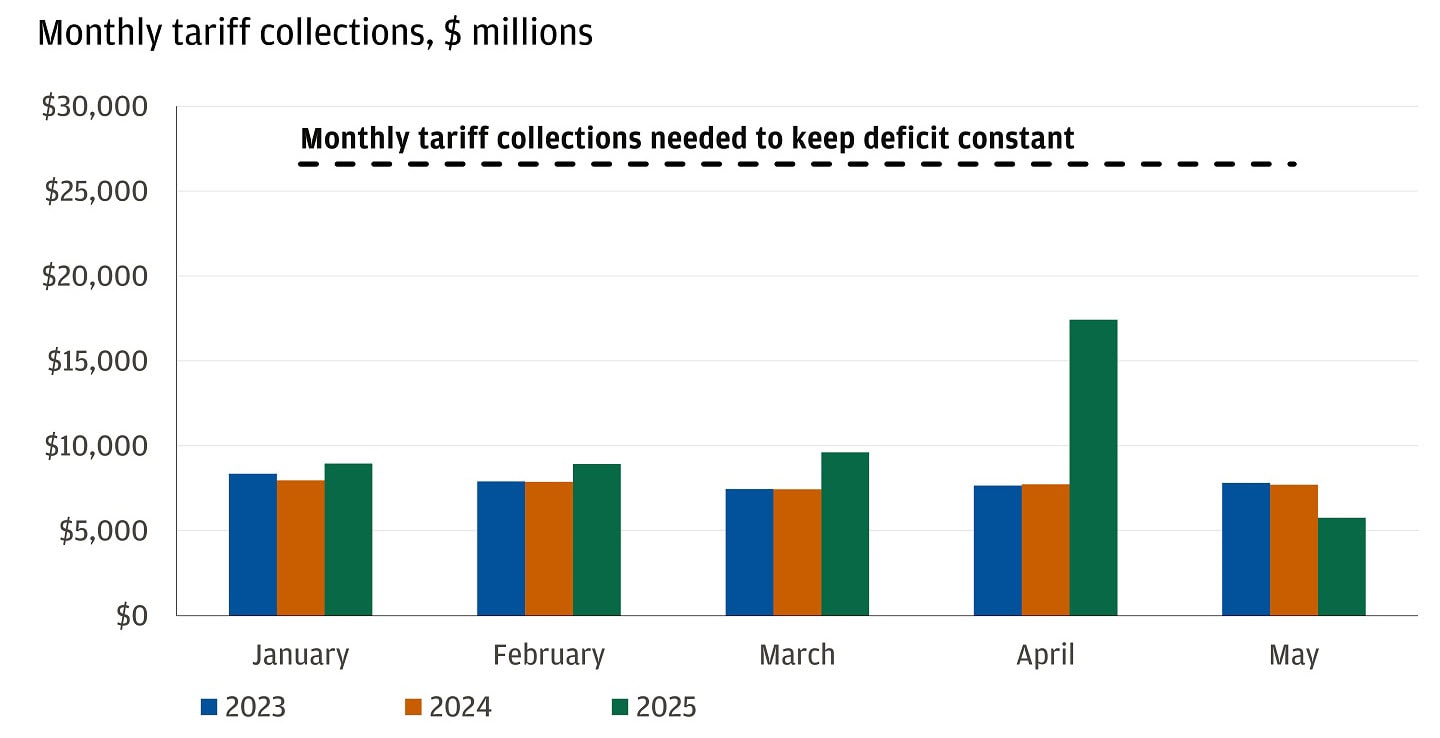

This increase amounts to $320 billion annually, requiring $26.6 billion in monthly tariff revenue to maintain a constant deficit.

Tariff collections aren’t enough to cover deficit shortfall

Increasing deficits are not a new phenomenon in the United States. Just last week, Moody’s became the latest nationally recognized statistical ratings organization (NSRO) to downgrade the United States sovereign credit rating (following S&P in 2011 and Fitch in 2023), citing increasing fiscal deficits as the reason for the downgrade.

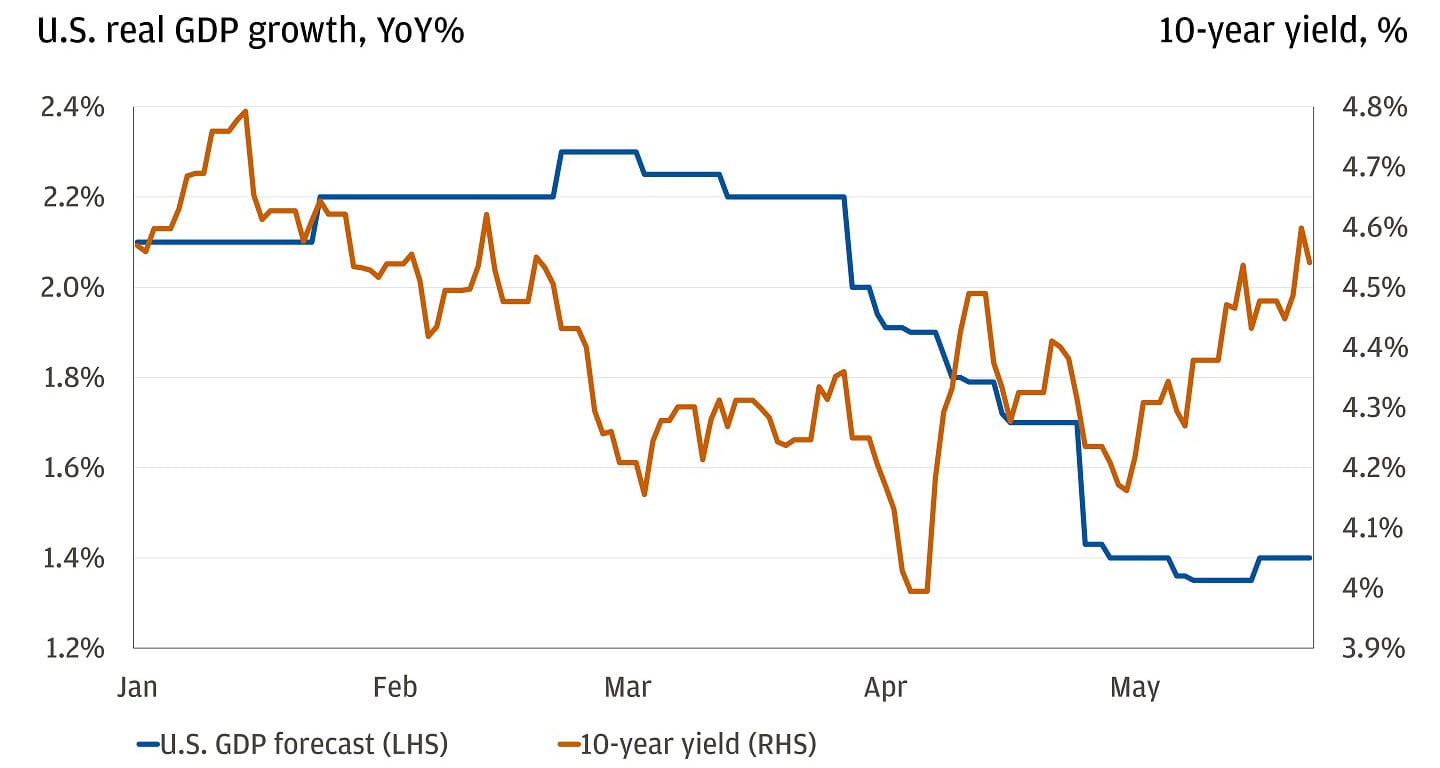

Bond markets have been selling off, not just due to the downgrade, but also due to the prospect of increasing deficits as global investors diversify away from U.S. dollars. Unlike before, U.S. growth estimates are declining. Earlier this year, Wall Street expected deregulation and continued U.S. exceptionalism, supporting higher 10-year rates. Now, rates are rising due to deficit fears, not growth expectations.

Yields have risen while growth estimates are declining

Currently, the deficit as a share of gross domestic product (GDP) is higher than nominal GDP growth, indicating a rising debt stock. However, if the government’s borrowing rate exceeds GDP growth, the debt stock will increase rapidly. For now, the borrowing rate is below GDP growth, providing some reassurance despite the path toward a higher debt ratio.

To protect portfolios from increasing deficits, we suggest adding resilience, defined as assets, that could increase income and / or provide uncorrelated returns to both bonds and equities. Collectively, the assets offer the potential to mitigate the severity of portfolio-level drawdowns.

Here are three ways to achieve this:

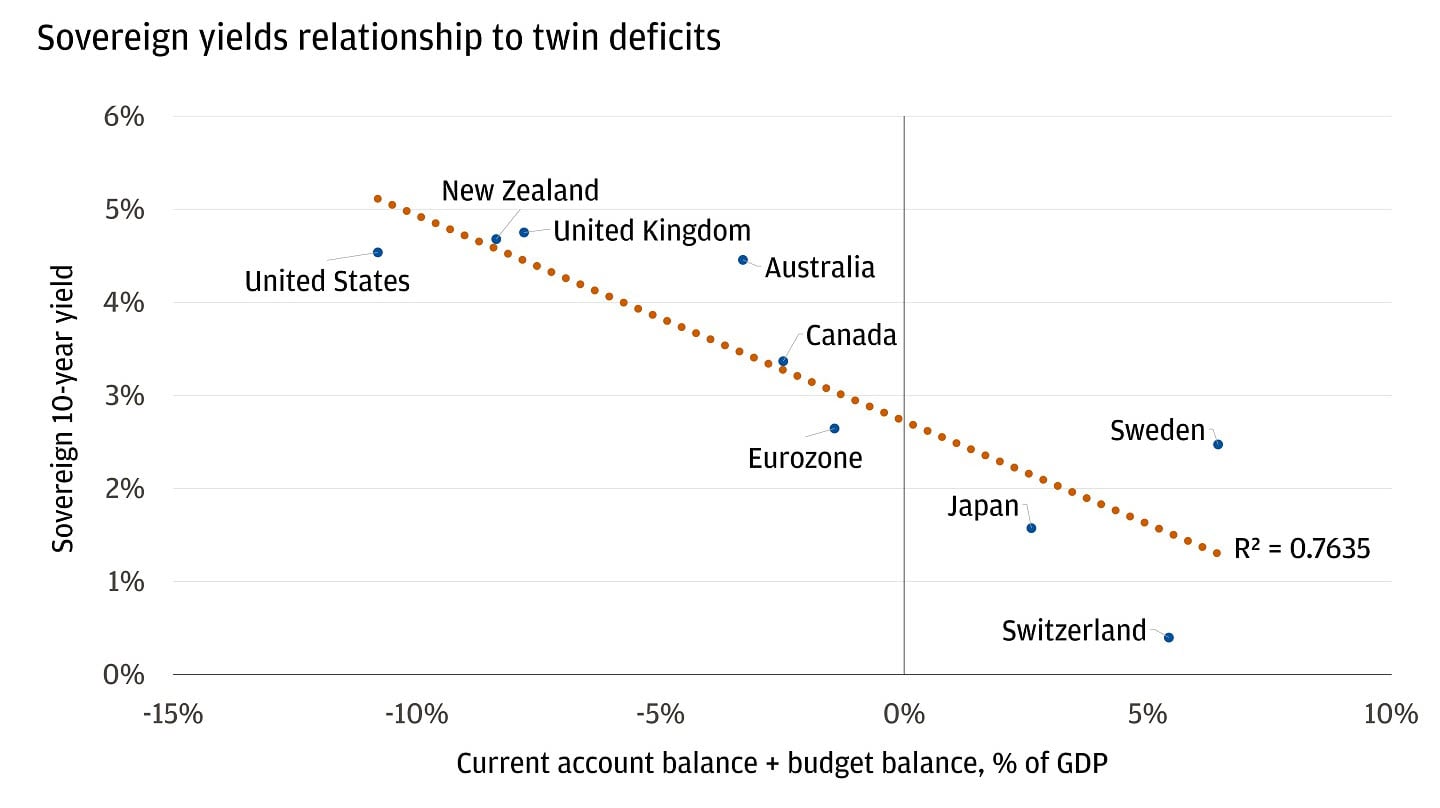

1. Dollar diversification: Investors are distinguishing between countries based on their reliance on external financing for trade and budget deficits. The U.S. is viewed less favorably, potentially keeping the U.S. dollar under pressure as global investors adjust portfolios. This is evident in higher U.S. government funding needs relative to G-10 peers and a current account deficit, which implies the need to fund it externally.

The U.S. relies heavily on external financing relative to G-10 peers

U.S. equities have outperformed globally by +2x since 2010, leading to portfolios heavily weighted in U.S. assets. Whether due to lack of rebalancing or capturing U.S. tech growth, it was a sound strategy. However, we see tides changing and recommend adding international diversification to underweight portfolios. The U.S. dollar is seen as structurally overvalued due to historical foreign investment inflows and shifting investor confidence amid diminishing U.S. economic advantages and rising political risks.

To mitigate risks from a potentially overvalued dollar, consider diversifying investments into international markets not denominated in U.S. dollars, such as Europe and Japan. Diversification, rather than concentration, means that you likely won’t have the highest return (won’t be holding 100% of the highest performing asset) in a given year. However, it creates a smoother ride for investor portfolios. Using MSCI World as a benchmark, we believe about 30% of your equity allocation should be in non-U.S., with two-thirds of that in Europe. This can help reduce currency risk and further diversify sources of return in your portfolio.

2. Gold: Gold is up about 25% year-to-date amid increased central bank buying and heightened uncertainty.

As we wrote in our Mid-Year Outlook, many central banks (e.g., Saudi Arabia, Taiwan, Japan, China, Singapore, Brazil and Korea) have less than 7% of their foreign reserves in gold. In comparison, Germany and the United States each hold over 75% of their reserves in gold, meaning that central banks have room to expand gold holdings. And just this week, it was reported that China imported the most gold in nearly a year last month, despite record prices after heightened demand for the precious metal prompted the central bank to ease restrictions on bullion inflows. Total gold imports to the country reached 127.5 metric tons, a 73% jump from a month earlier.

We believe the precious metal can continue to act as a diversifier to geopolitical risk and higher deficits.

3. Infrastructure: Infrastructure investment offers a compelling opportunity with long-term contracts often embedding inflation hedging for portfolio resilience. Over 40% of historical infrastructure returns are driven by income. Generating income through infrastructure may be attractive (for suitable investors) amid elevated bond market volatility. Since Q2 2008, infrastructure has generated low double-digit annual returns.

Questions on how to add resilience to your portfolio? Reach out to your J.P. Morgan advisor.

All market and economic data as of 05/23/25 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Explore ways to invest

Take control of your finances with $0 commission online trades, intuitive investing tools and a range of advisor services.

J.P. Morgan Wealth Management