Q2 2025 earnings: Here's what we are watching

Global Investment Strategist

If Rod Tidwell were an equity analyst, he’d likely be shouting, “Show me the earnings!” as we navigate through the Q2 2025 earnings season. Just like in the classic movie "Jerry Maguire," where success hinges on tangible results, investors are eager to see what the numbers reveal about corporate health and market direction.

The earnings landscape ahead

Approximately 12% of S&P 500 companies have reported their Q2 2025 results, revealing a mixed performance, particularly in the banking sector. Some institutions faced lower earnings due to fewer deposits and rising costs but offset these challenges with increased income from fees and services. A bright spot in the data is the stability in credit quality – indicating fewer loans are going bad – which bodes well for the financial sector and the overall economy. Analysts expect a 5% growth in earnings for Q2, a notable slowdown from over 18% growth in Q4 2024 and more than 13% in Q1 2025. This revision reflects concerns about tariffs, product availability and profit margins. However, with many tariffs yet to be enacted, there is optimism that investors could see strong upside surprises this quarter.

We believe street estimates calling for 5% EPS growth in Q2 is too low

Work with an advisor

Our advisors can provide ongoing financial advice on how your portfolio can adapt to the changes in the market, your life and your goals.

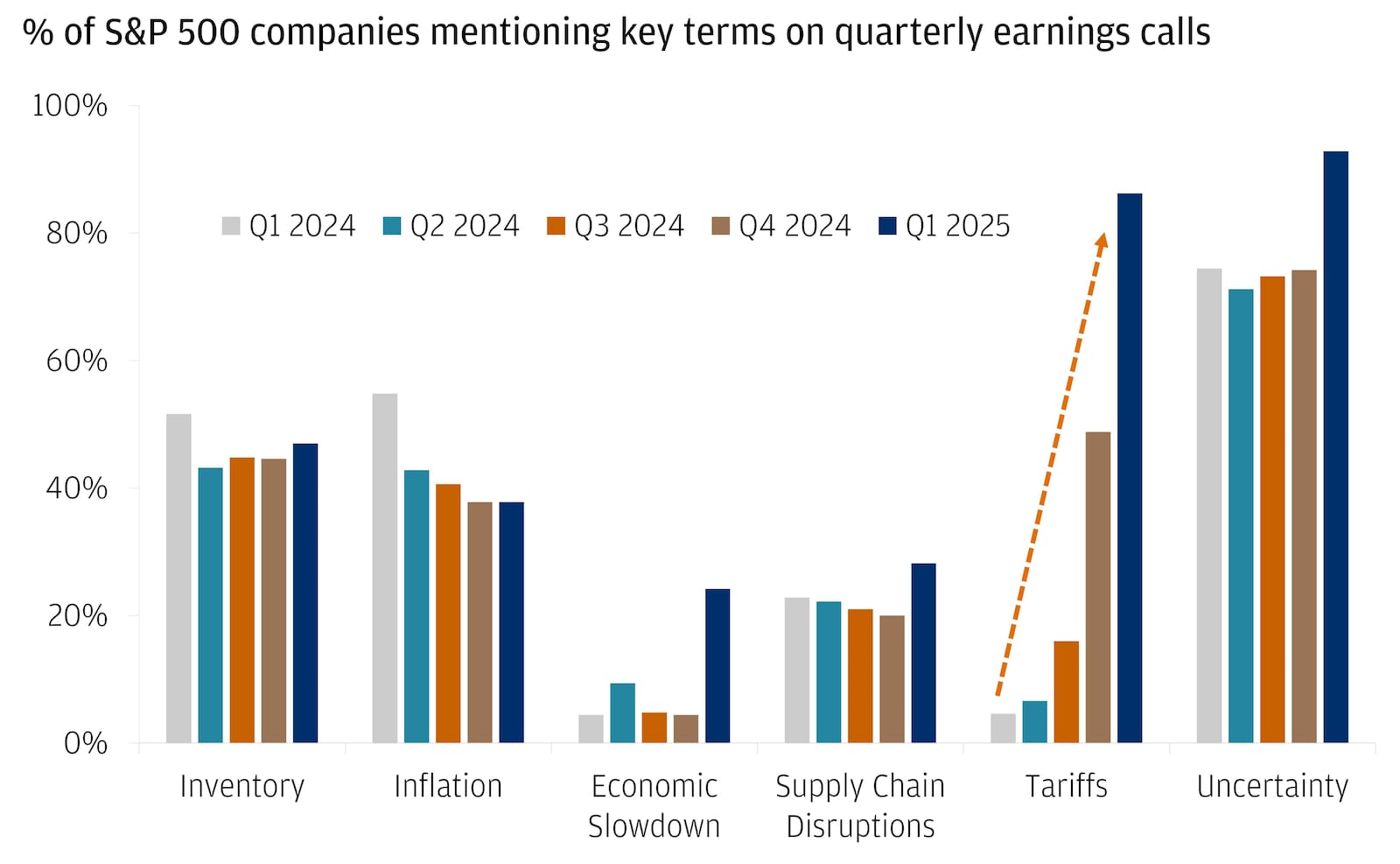

Margins matter: Tariffs and the bottom line

Uncertainties and tariffs have become significant concerns for many companies, and management teams are likely to address these issues in their earnings calls. The estimated net profit margin for the S&P 500 in Q2 2025 is 12.3%. While this represents a slight dip from the previous quarter, it is an improvement over last year and indicates that companies may be successfully maintaining healthier profit margins compared to recent years, even if they haven't reached the peak levels seen in 2021. We expect margin improvements to drive better-than-expected earnings growth this quarter. Companies that navigate these challenges effectively and report solid earnings are likely to be rewarded by the market, even if their valuations seem stretched. Conversely, firms that miss their Q2 targets could face some downward pressure, especially given high valuations and the belief that policy initiatives have not yet broadly impacted earnings.

Tariff talk top of mind for C-Suite

You had me at Capex: AI's winning strategy

The buzz around artificial intelligence (AI) continues to capture investor attention and its implications for earnings are substantial. The Hyperscalers are projected to spend over $300 billion on Capex this year to build AI infrastructure, with expectations to exceed that amount by 2026. This aggressive spending is opening new avenues for growth across industries such as software and utilities.

Despite advancements in efficiency, such as the development of models like DeepSeek’s R1, the demand for computing power to train leading AI systems is doubling every five and a half months. This rapid increase highlights a significant challenge: the power supply is becoming a bottleneck that the U.S. is eager to address. Consequently, hyperscaler companies are ramping up their capital expenditures to support these growing demands. With tech stocks rebounding and markets rallying toward new highs, we believe investors should focus on opportunities that capitalize on this AI momentum.

Our view: What this means for investors

Looking ahead, expectations for earnings growth are tempered by the realities of a changing economic landscape. While the U.S. economy remains resilient, the guidance provided by companies regarding consumer spending will be critical. Signs of slowing demand and how firms respond will shape the market's direction. Our view remains cautiously optimistic, but favorable on sectors like technology, financials and utilities. In the end, it’s about getting invested, staying invested and keeping your financial goals in sight – because the true winners are those who play the long game!

All market and economic data as of 07/23/2025 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Explore ways to invest

Take control of your finances with $0 commission online trades, intuitive investing tools and a range of advisor services.

Global Investment Strategist