Copper prices have reached an all-time high: What's behind the surge?

Global Investment Strategist

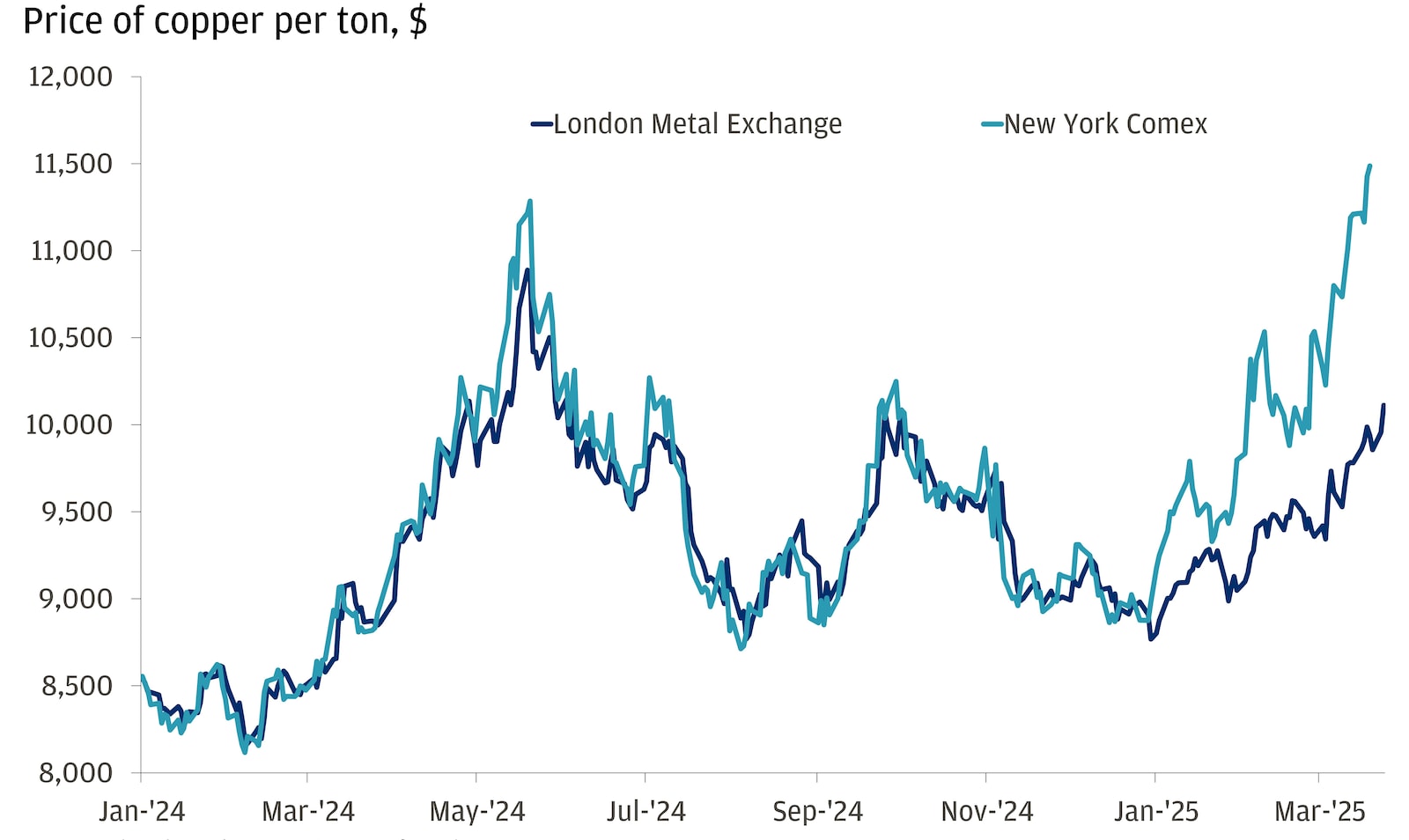

Recently, copper prices have reached a new all-time high on New York’s Commodity Exchange (Comex). This price surge is driven by reports that the U.S. may introduce significant tariffs on copper imports sooner than the 270-day deadline the Trump administration set for the Commerce Department to investigate copper tariffs on national security grounds. This move is part of a broader initiative to enhance domestic production of essential minerals and reduce dependency on foreign sources.

This policy shift follows numerous trade policy announcements that have unsettled global equity markets, particularly in the U.S., and comes just before a new wave of tariffs is expected to take effect on April 2. While the long-term goal is to boost local production capabilities, the immediate consequence is increased costs for American manufacturers reliant on imported copper. The surge, marking a 29% increase this year, has created a notable disparity between U.S. copper prices and the global benchmark set by the London Metal Exchange (LME). Potential tariffs have prompted traders to expedite copper shipments to the U.S., anticipating a shortage that could push prices even higher. The disparity between domestic and international copper prices may grow further due to the industrial usage of copper in the power build-out for artificial intelligence.

Work with an advisor

Our advisors can provide ongoing financial advice on how your portfolio can adapt to the changes in the market, your life and your goals.

While the tariffs aim to encourage domestic production, they also pose challenges. The U.S. currently does not mine enough copper to meet demand, and environmental objections make increasing the supply a significant challenge. As these dynamics unfold, we expect continued volatility and emphasize the importance of a resilient portfolio that can weather potential volatility.

U.S. tariff concerns spur bigger gains on the Comex than on the LME, reaching a new all-time high

All market and economic data as of 03/26/25 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Explore ways to invest

Take control of your finances with $0 commission online trades, intuitive investing tools and a range of advisor services.

Global Investment Strategist