June 2025 CPI report: Tariffs are having an impact on consumer prices

Global Investment Strategist

The tortoise and the tariff

In today's fast-paced market, it's tempting to sprint toward quick gains, but history suggests time in the market rather than timing the market has rewarded investors, embodying the spirit of the tortoise. The June Consumer Price Index (CPI) report, with its subtle shifts, reveals how tariffs are quietly reshaping consumer prices, particularly in sectors heavily reliant on imports.

As we delve into the complexities of the CPI report and the shifting tariff landscape, remember: the race isn't won by those who start fast, but by those who understand the long-term impact of these economic forces, focus on their goals and finish strong.

CPI insights: The slow and steady increase

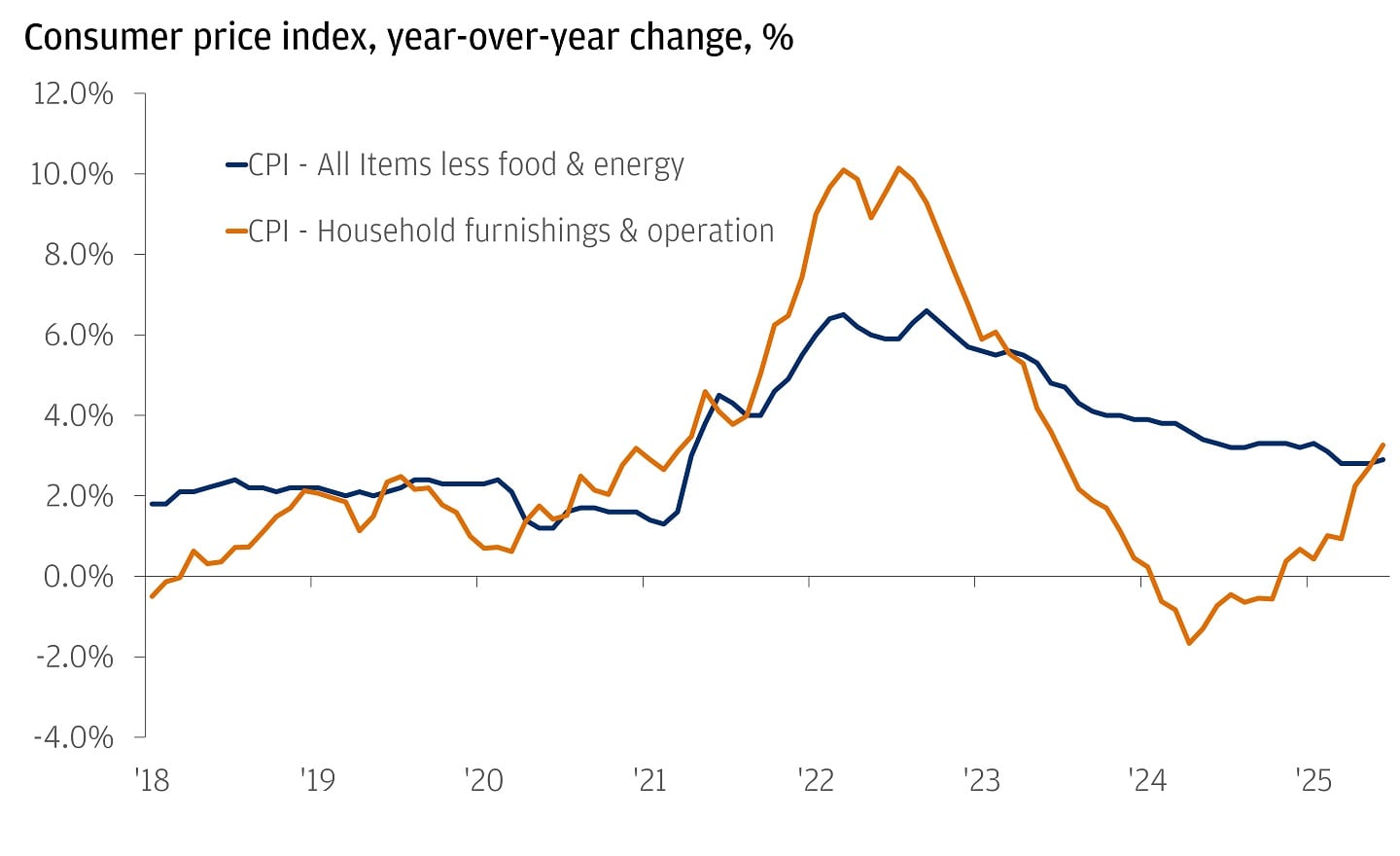

The June CPI report revealed a rise of 0.3% from the previous month, aligning with expectations. However, the core CPI, which excludes volatile items such as food and energy, came in slightly below expectations at 0.2%. Beneath these seemingly stable numbers, there were subtle shifts influenced by tariffs. For instance, household furnishings and operations have seen a notable year-to-date increase.

Since two-thirds of household furniture and a significant portion of other household items are imported, fluctuations in tariffs can have a substantial effect on consumer prices. As we entered 2025, the U.S. effective tariff rate was approximately 2.4%, but it has risen steadily, currently hovering around 8%–9%. This increase is akin to running a marathon, where each mile marker represents a new challenge – each tariff adjustment adds weight to the runner's pack, forcing businesses to adapt their strategies over time.

Tariffs materializing in consumer inflation components

Work with an advisor

Our advisors can provide ongoing financial advice on how your portfolio can adapt to the changes in the market, your life and your goals.

The tariff landscape: Implications for businesses

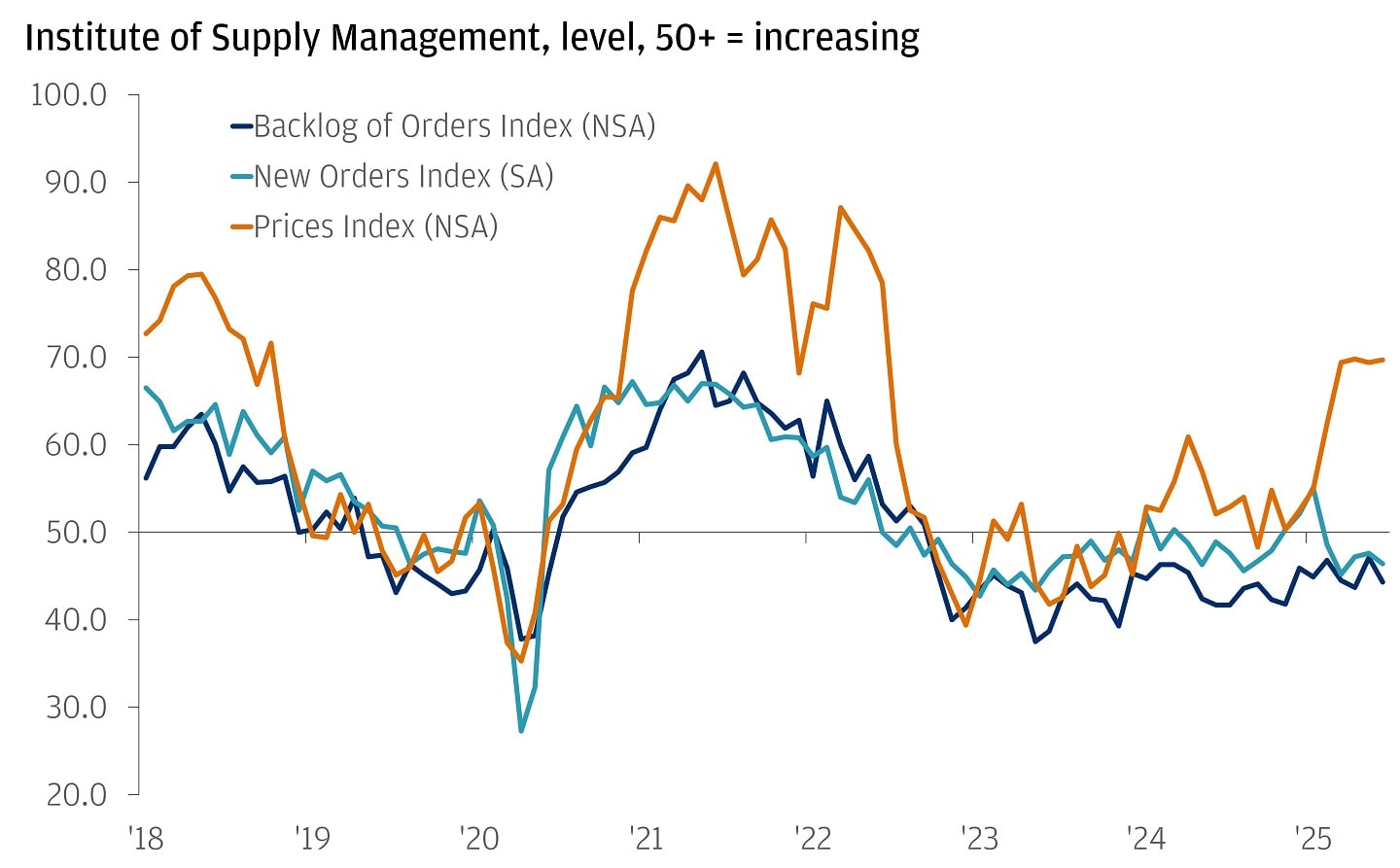

To better understand how tariffs influence businesses, we can look at insights from the Institute for Supply Management (ISM). Their recent data indicates that while the Prices Index registered at a striking 69.7 level in June, reflecting consistent price increases in raw materials, the New Orders Index has contracted for five consecutive months, now standing at 46.4. This divergence illustrates a growing concern among businesses regarding demand, as they grapple with the fallout of rising costs due to tariffs.

In June, U.S. customs collected over $27 billion in tariffs, three times the previous year's $7.9 billion. This surge underscores the significant challenges businesses face from rising input prices, particularly in textiles, metals and food products. In fact, the effective tariff rate may increase further, potentially reaching approximately 18% on August 1, driven by a hike on copper and reciprocal increases for countries without trade deals. However, this effective rate will lag behind the announcements for two to three months due to shipping and payment delays. Ultimately, we expect the effective tariff rate to settle between 10% to 15% as further negotiations and trade deals unfold.

Businesses face rising prices and falling demand due to tariffs

Our view: Be the tortoise

Our view emphasizes a patient approach to investing, akin to the tortoise. In the face of a turbulent economic landscape, consistency and patience are crucial for long-term success. While the reduction in tariff rates on China has provided some immediate relief, the full impact of tariffs is expected to manifest in the coming months, potentially leading to increased consumer inflation and reduced purchasing power.

This scenario underscores the importance of focusing on long-term goals rather than short-term market fluctuations. By maintaining a disciplined approach and concentrating on controllable factors, investors and advisors can confidently navigate the complexities of inflation and tariffs, ultimately achieving success through a steady and patient investment strategy.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Global Investment Strategist