Powering the digital revolution: Harnessing energy for AI and digital growth

Global Investment Strategist

It's crazy to think that Christmas is just around the corner. Every parent knows the unique mix of joy and stress that comes with hunting for that “it” toy for their child. I remember the thrill of unwrapping a gift as a kid – especially if it was the famous Teddy Ruxpin, a talking bear that read bedtime stories. For those who weren’t around back then, you can imagine the excitement of having a toy that could actually “talk.” But nothing kills the magic faster than opening a gift only to realize you forgot the batteries. After all, what good is that much-desired toy if you can’t play with it? Similarly, while artificial intelligence (AI) dazzles us with its capabilities, without the right power infrastructure, it's like a perfectly envisioned toy that simply can’t light up.

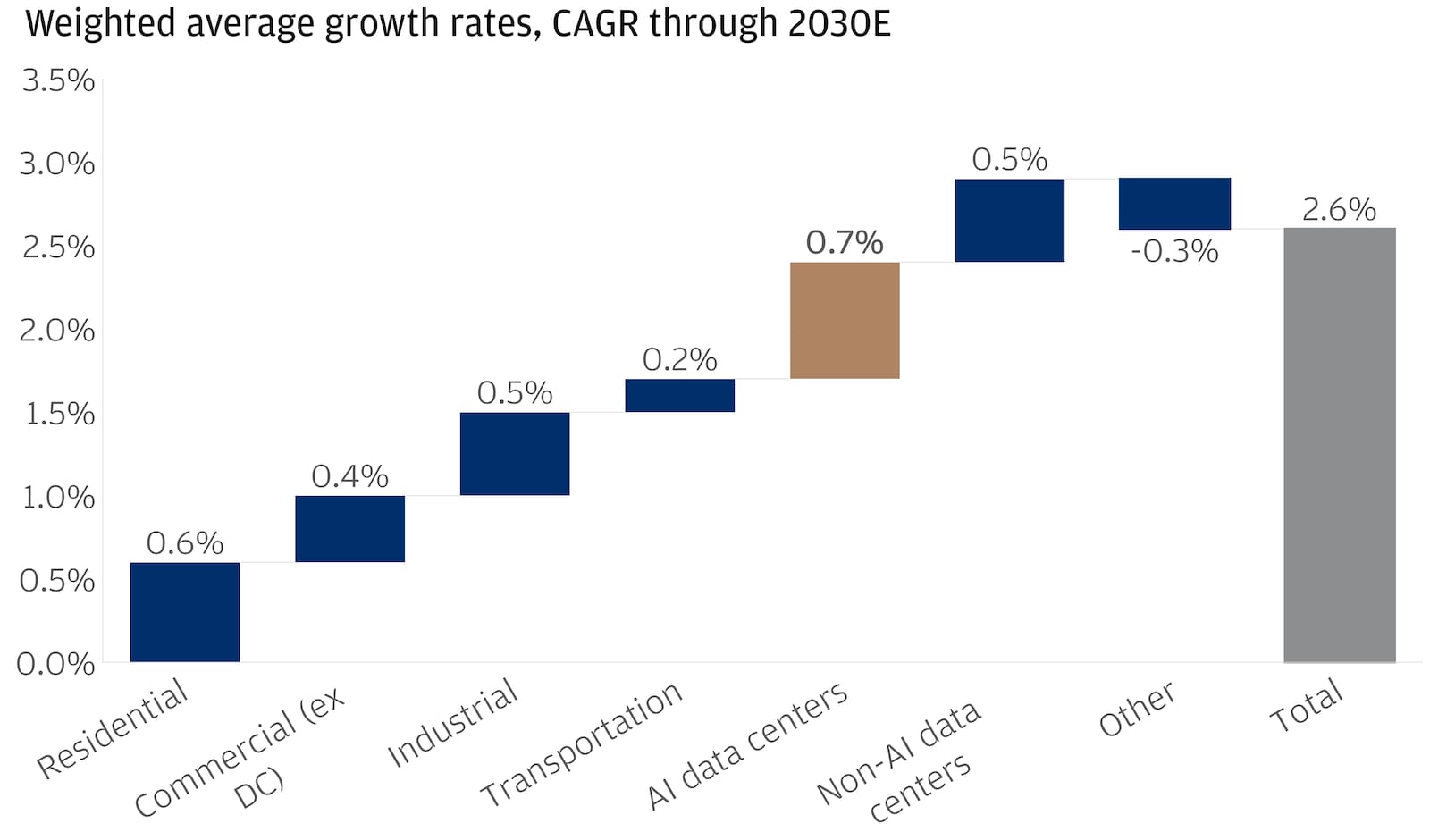

But the stakes are even higher than a missing set of batteries. U.S. data centers – the backbone of our digital world – are poised for a dramatic power surge. According to McKinsey, data center power demand is expected to jump from 25 gigawatts in 2024 to over 80 gigawatts by 2030, pushing the national power consumption share from roughly 4.4% to nearly 12%. This explosive growth, driven not only by AI but also by rising household usage, electric vehicle adoption and the resurgence of domestic manufacturing, vividly underscores the immense and rapidly expanding need for reliable power to drive our digital revolution.

Data centers make up the majority of expected power demand growth

Over recent years, AI has developed exponentially, powered by sophisticated data centers and breakthrough innovations. Yet, despite its promise, only about 9.1% of companies are currently leveraging this technology, leaving vast room for expansion. However, training these advanced AI models is no small feat. Consider that training GPT-4 is estimated to have consumed roughly 50 gigawatt-hours of energy – that's equivalent to the energy consumed by approximately 4,633 U.S. homes for a year or roughly 1% the annual output of a nuclear plant.

Ready to take the next step in investing?

We offer $0 commission online trades, intuitive investing tools and a range of advisor services, so you can take control of your financial future.

The key role of utilities in powering AI growth

This is where the utility space becomes a critical piece of the puzzle. Utilities provide the constant, reliable power that data centers and AI infrastructure depend on. With increasing demand for energy driven by the rapid expansion of data centers, utilities are transforming from simple energy providers into strategic growth opportunities. Traditional earnings growth in this sector generally hovered around 4%–5%, but as the energy needs of digital technologies surge, expectations are now shifting toward an 8% growth trajectory. Investors have come to view utilities not merely as defensive plays, but as dynamic engines capable of delivering significant growth.

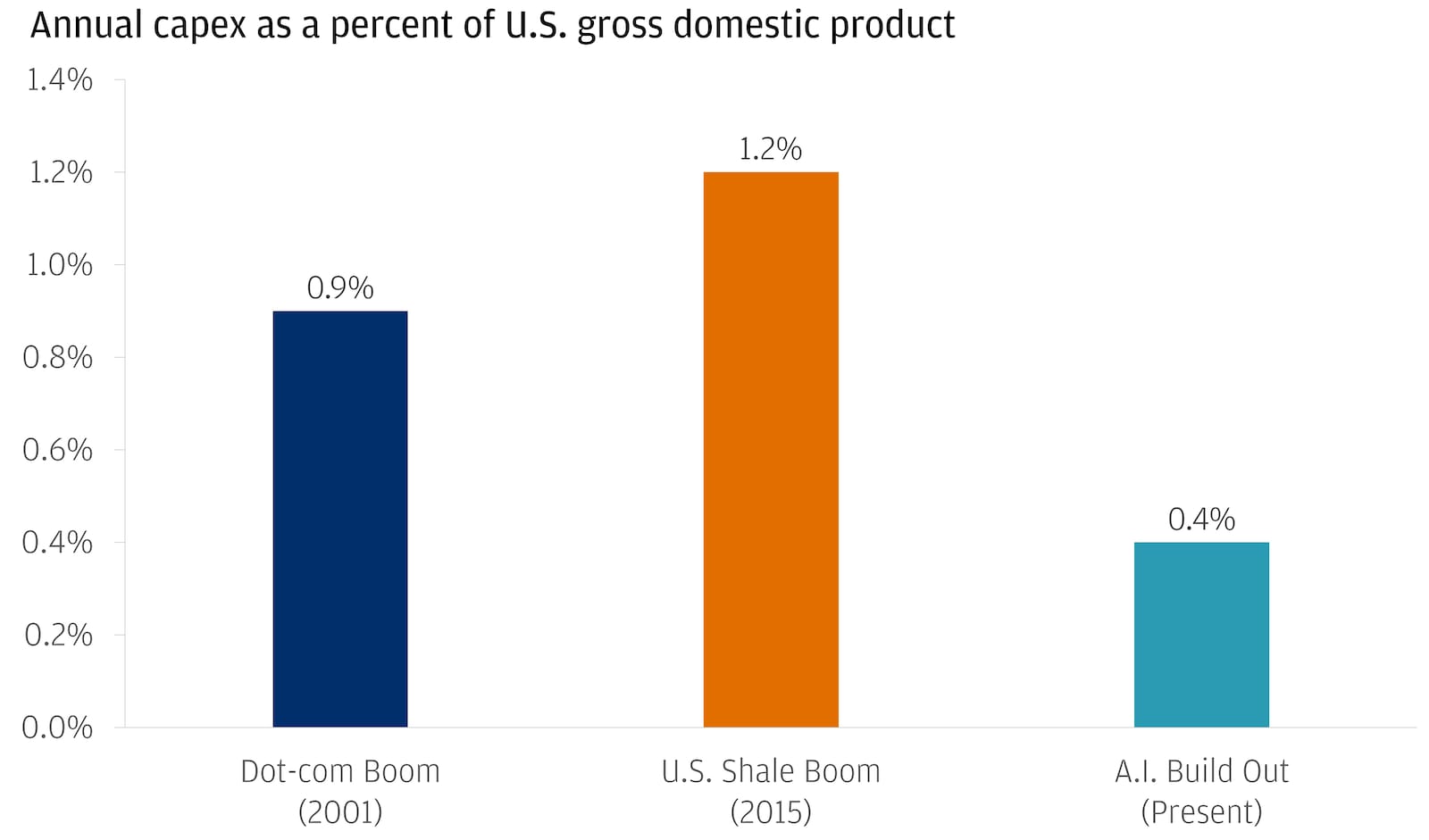

The discussion becomes even more compelling when we consider the role of hyperscalers. These tech behemoths – companies that manage vast amounts of data and digital services – are making monumental investments in expanding their digital infrastructure. Expected to spend over $350 billion on AI-centric capital expenditures this year alone, they are not only deepening their digital footprints but are also fundamentally reshaping the energy landscape. Their robust cash reserves and prudent management of debt position them well to drive demand for reliable power. This aggressive expansion by hyperscalers is complemented by increasing investments from private market players, leading to a broad and sustainable boost in the energy infrastructure that utilities are set to benefit from.

AI spending below notable capex peaks

The bottom line

What does this mean for investors? While the performance of hyperscalers and semiconductor names has been undeniable, there remains substantial growth potential in the broader AI ecosystem – a comprehensive value chain powering the digital revolution. This potential extends beyond the impressive digital capacity of established tech firms and rests on a network of critical enablers, which include utilities – one of our preferred sectors – that deliver the reliable power needed to run massive data centers, as well as advanced storage solutions, efficient HVAC and cooling systems, robotics, innovative software and other indispensable infrastructure components. By investing across this interconnected spectrum, investors may be able to diversify their portfolios and seek to capture the momentum of leading tech names while also potentially benefiting from the real-world enablers driving sustained growth in the ongoing AI revolution.

All market and economic data as of 10/21/2025 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

You're invited to subscribe to our newsletters

We'll send you the latest market news, investing insights and more when you subscribe to our newsletters.

Global Investment Strategist