How do geopolitical shocks impact markets?

Senior Markets Economist, J.P. Morgan Private Bank

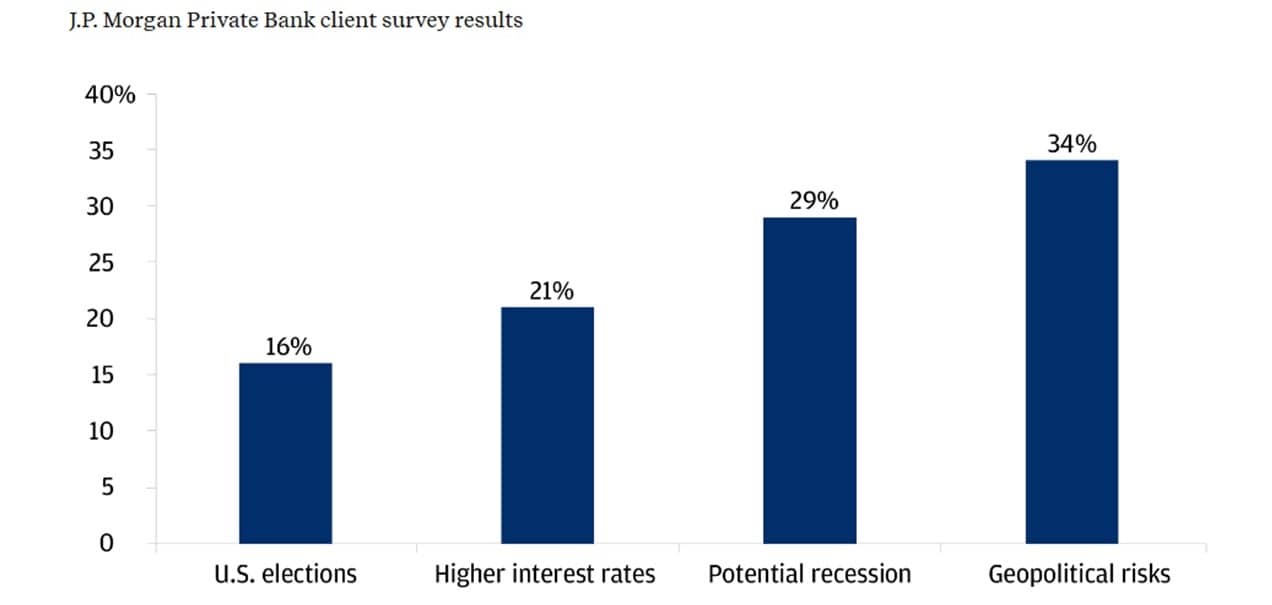

With elections looming in more than 50 countries this year, and no signs of an end to wars in Europe and the Middle East, worries about geopolitics consistently rank as a top concern for our clients as they consider their financial plans.

What potential investment risk are you most worried about in 2024?

But what is the connection between geopolitical concerns and market returns? It’s not always easy to discern.

In this article, we explore the nexus between geopolitical events and their market impact, analyzing over 80 years’ worth of data. We find that geopolitical events usually have no lasting impact on large-cap equity returns.

However, geopolitics can have profound market impacts at the local level. We look at three examples: small-cap German stocks; Hong Kong versus Singapore real estate values; and shifting dynamics in the gold market. Gold, we note, has historically been one of the best-performing tactical hedges against geopolitical risk.

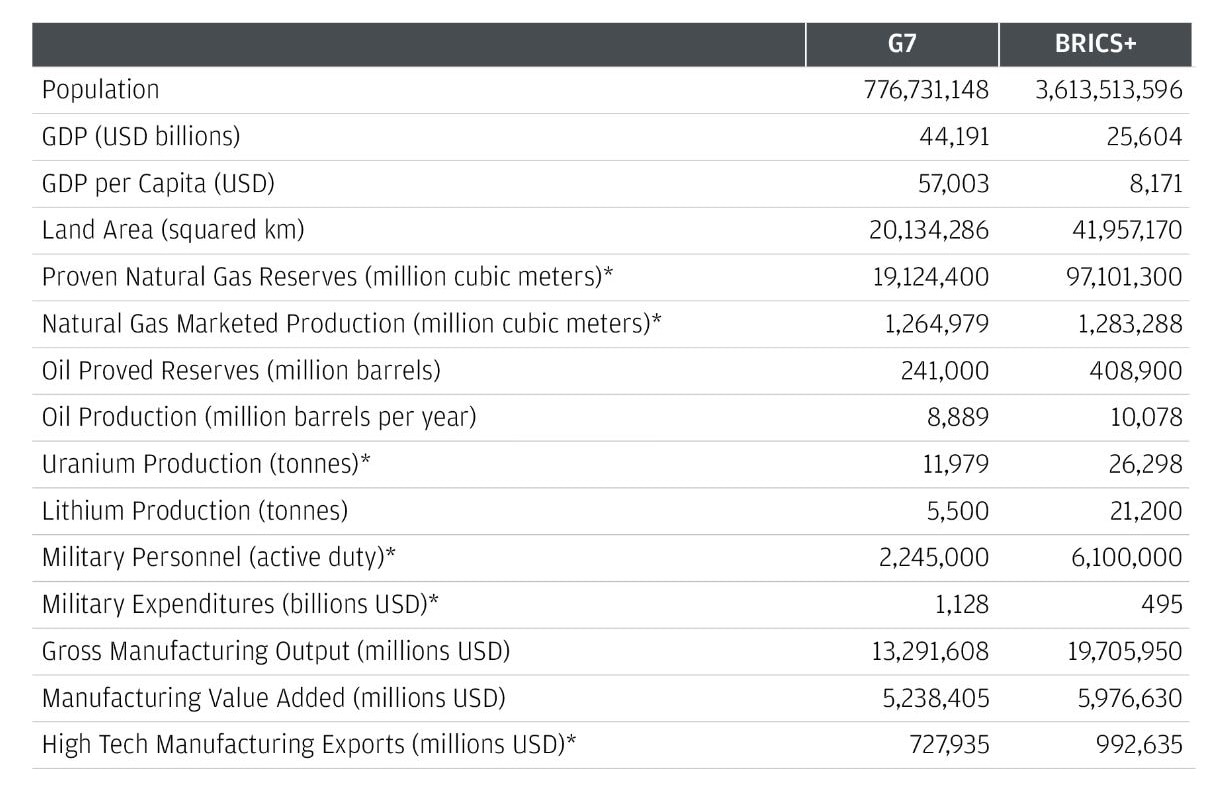

In a separate and final section, we examine the growing economic and political power of the BRICS economies. The BRICS traditionally referred to Brazil, Russia, India, China and South Africa, but the bloc now includes Egypt, Ethiopia, Iran and the United Arab Emirates (known as BRICS+). We consider the possibility of a G7 versus BRICS+ divide and what that might mean for the U.S. dollar as the world’s global reserve currency.

History lessons

Our tally of significant geopolitical events, shown below, begins with Germany’s invasion of France in 1940, and ends with Russia’s invasion of Ukraine in 2022.

Key geopolitical events, 1940–2022

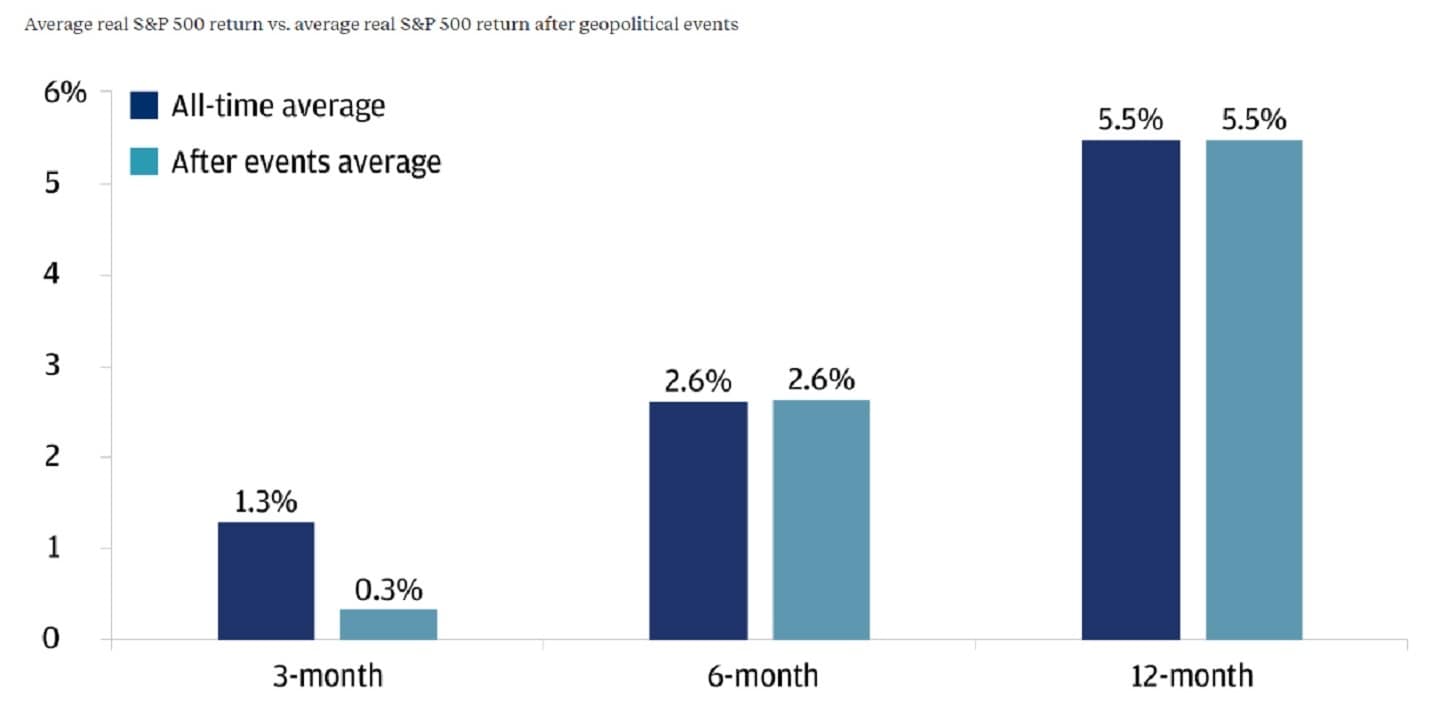

The subsequent analysis considers equity market performance three, six and 12 months after each event, comparing the results to three-, six- and 12-month equity market returns during periods when there was no notable geopolitical event. We conclude that in the three months after an event the market underperforms, on average, but – this is key – six-month and 12-month subsequent returns are identical. When you consider the average equity investor experience, it’s as though the event never happened.

Get up to $1,000

When you open a J.P. Morgan Self-Directed Investing account, you get a trading experience that puts you in control and up to $1,000 in cash bonus.

Historical data shows the typically fleeting impact of geopolitical events on equity returns

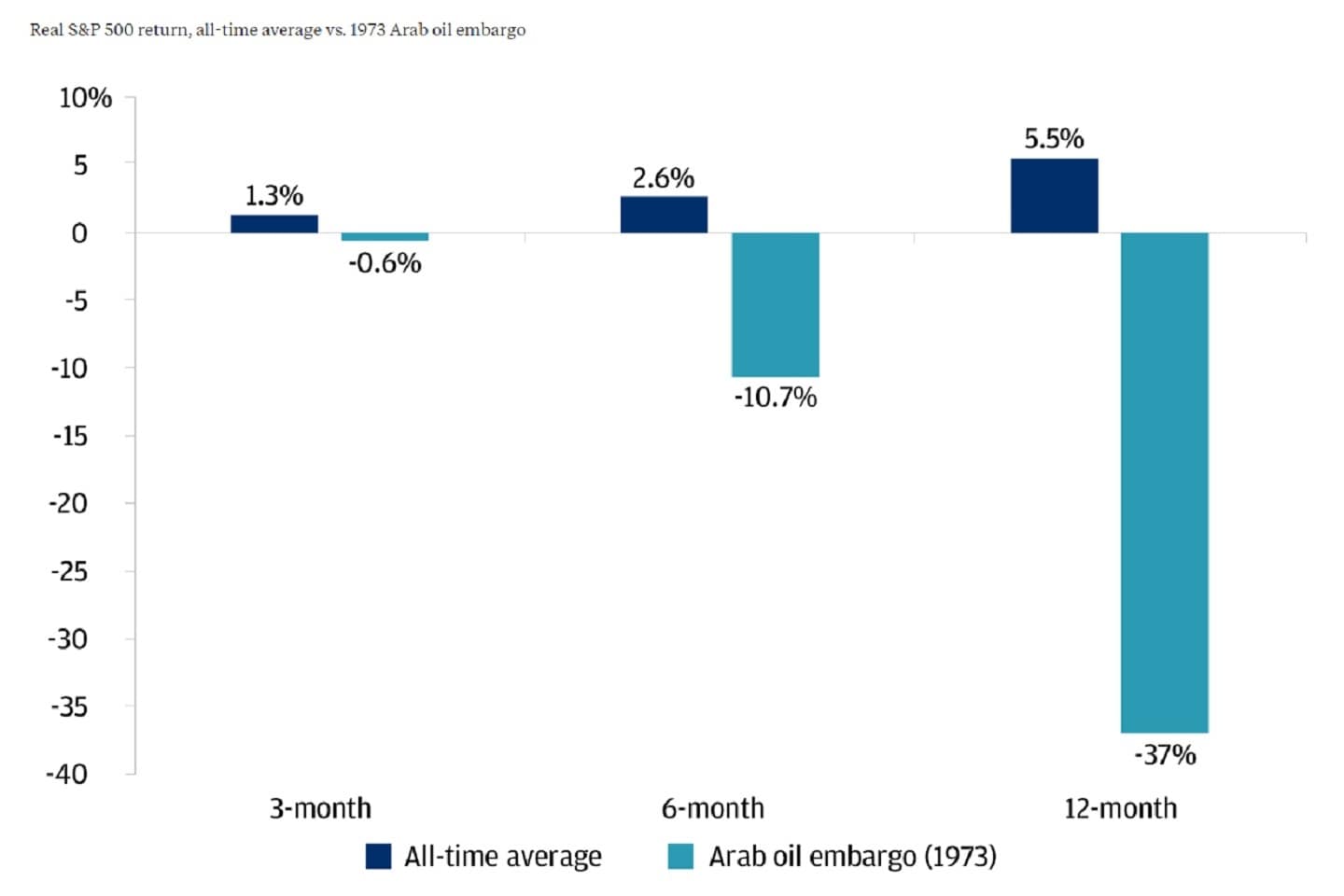

Still, sometimes geopolitical events did have a lasting impact on large cap equity markets. The 1973 oil price shock, which depressed market returns over the next year, is a case in point, as the below chart reveals.

Unlike most other geopolitical events, the 1973 oil shock did lasting damage to equity returns

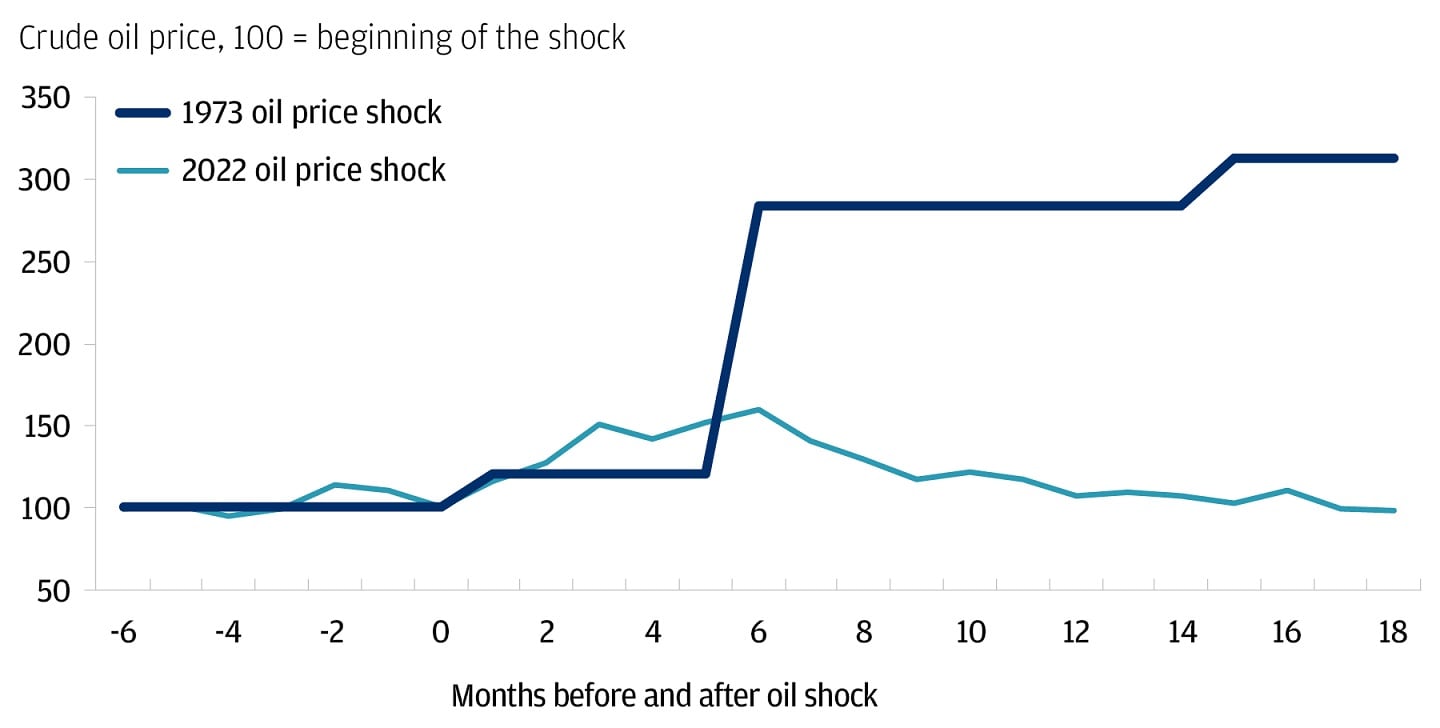

The 1973 oil shock did have a lasting impact on equity returns. That is mainly because oil remained in short supply for an extended period, resulting in a macro state of “stagflation” (high inflation amid deteriorating productivity growth). In other words, high oil prices essentially stopped the economy from operating efficiently in the 1970s. In contrast, after Russia’s invasion of Ukraine shocked global energy markets in 2022, additional oil supply rapidly came on stream. As a result, the economic and market impact of the recent shock was less severe and sustained than its 1970s counterpart.

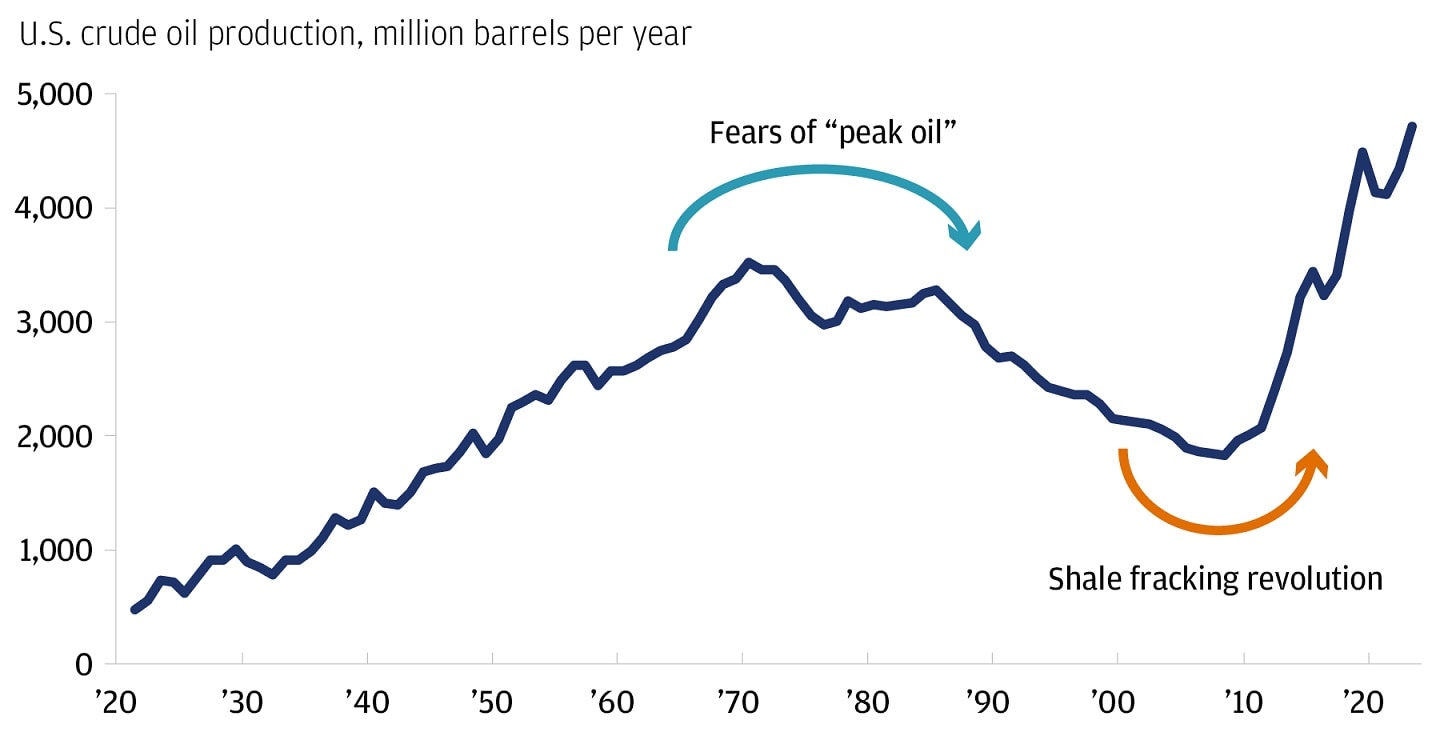

The main structural difference between the two episodes relates to U.S. oil production. In the 1970s, the United States was producing as much oil as it could with the technology available at the time. Thus the United States relied heavily on oil produced in the Middle East. Today, by contrast, production is flexible and U.S. oil is generally plentiful thanks in large part to the boom in shale fracking.

Unlike the 1970's, today the United States has ample supply of domestically produced oil

Unlike the 1970's, today the United States has ample supply of domestically produced oil

Geopolitical shocks can hit local markets hard

Still, we don’t think investors can completely ignore geopolitical shocks. While the data shows that geopolitical events generally don’t have enduring impacts on large-cap (globally diversified) equity markets, the story is very different at the local level, as we discuss with a few topical examples in the following section.

German small cap versus large cap companies

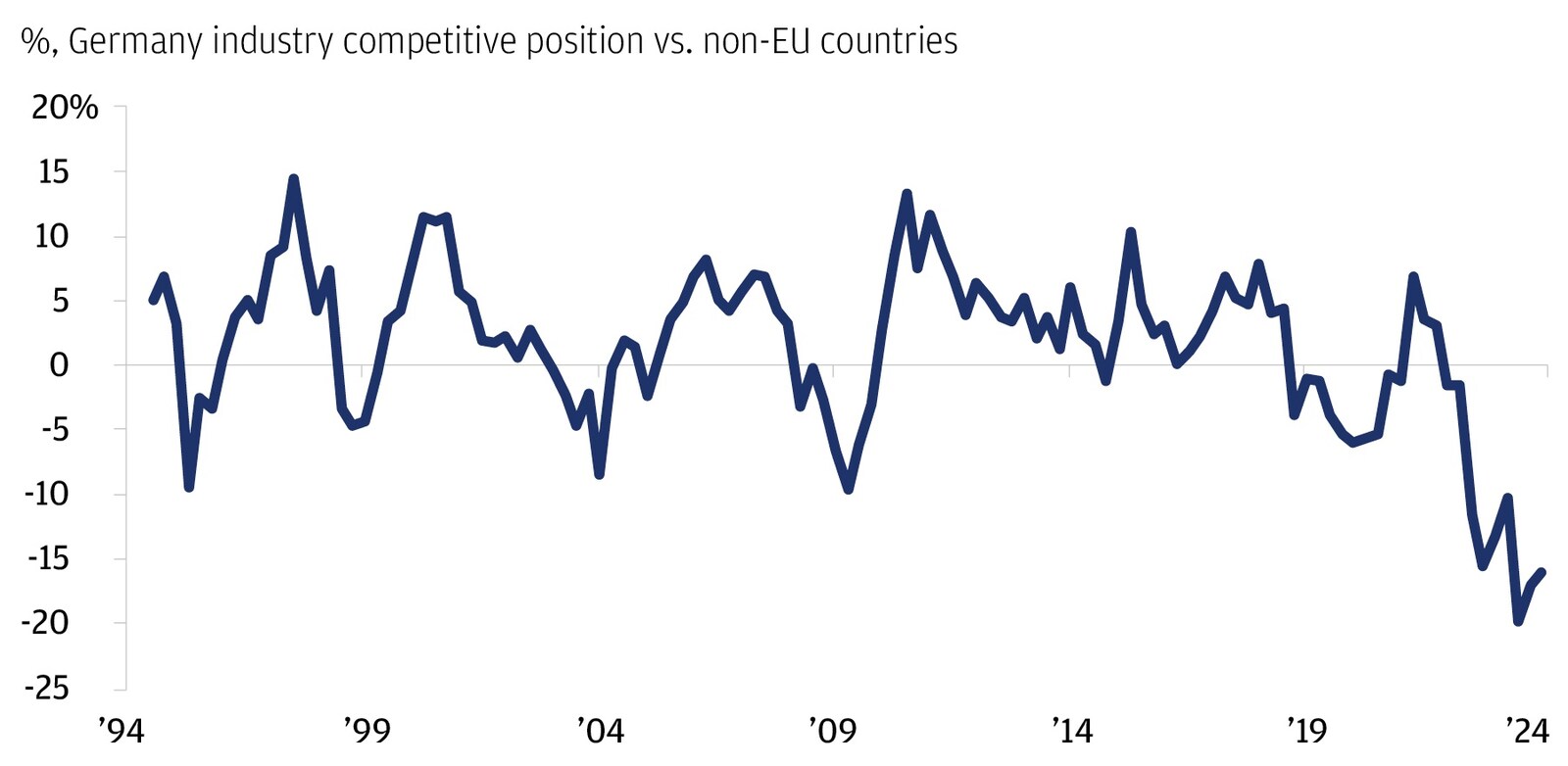

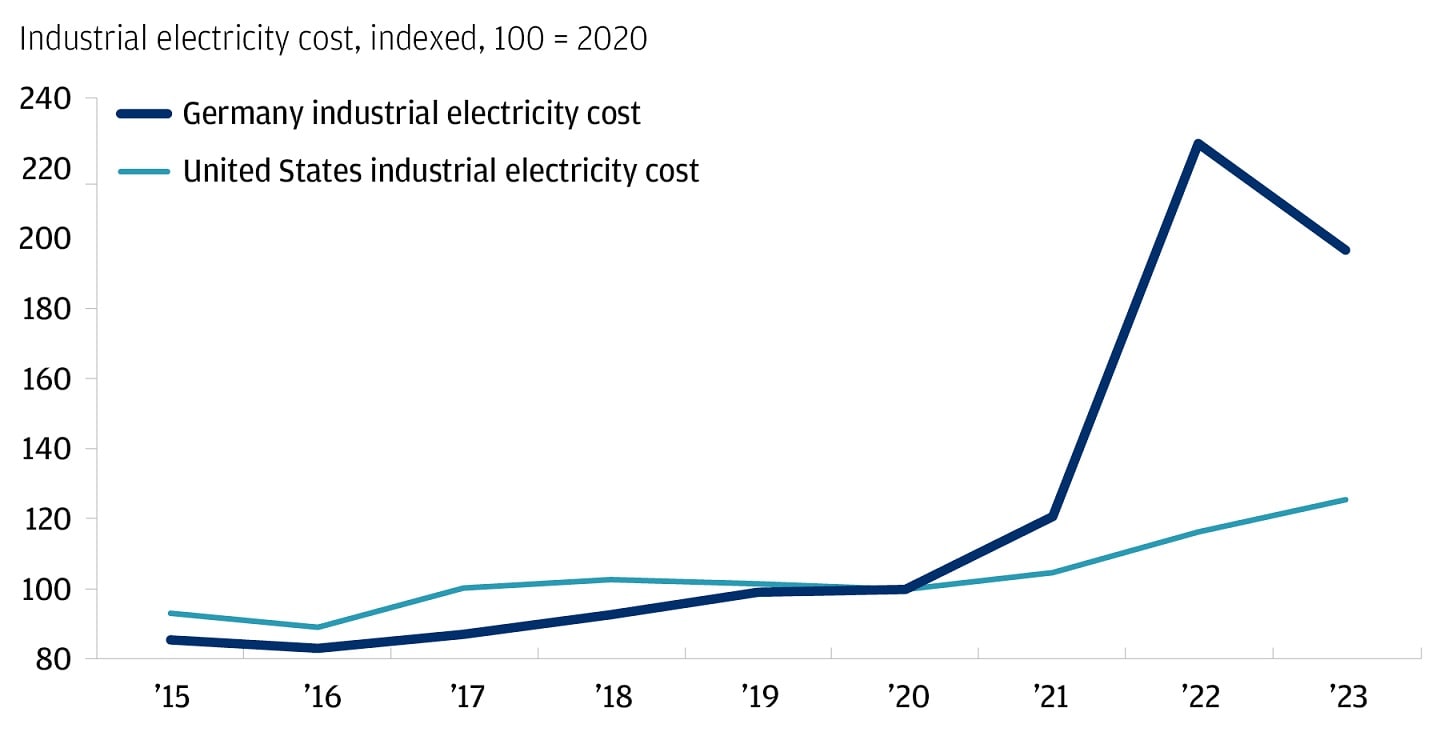

Global equity markets have essentially shrugged off the risks associated with the war in Ukraine (a significant geopolitical event by any definition). But the shock itself has led to a collapse in Europe’s manufacturing competitiveness, due to substantially higher energy costs (as Europe broke its link to Russian energy in the wake of the 2022 invasion). Germany has been especially hard hit.

German manufacturers have borne the brunt of higher energy costs

German manufacturers have borne the brunt of higher energy costs

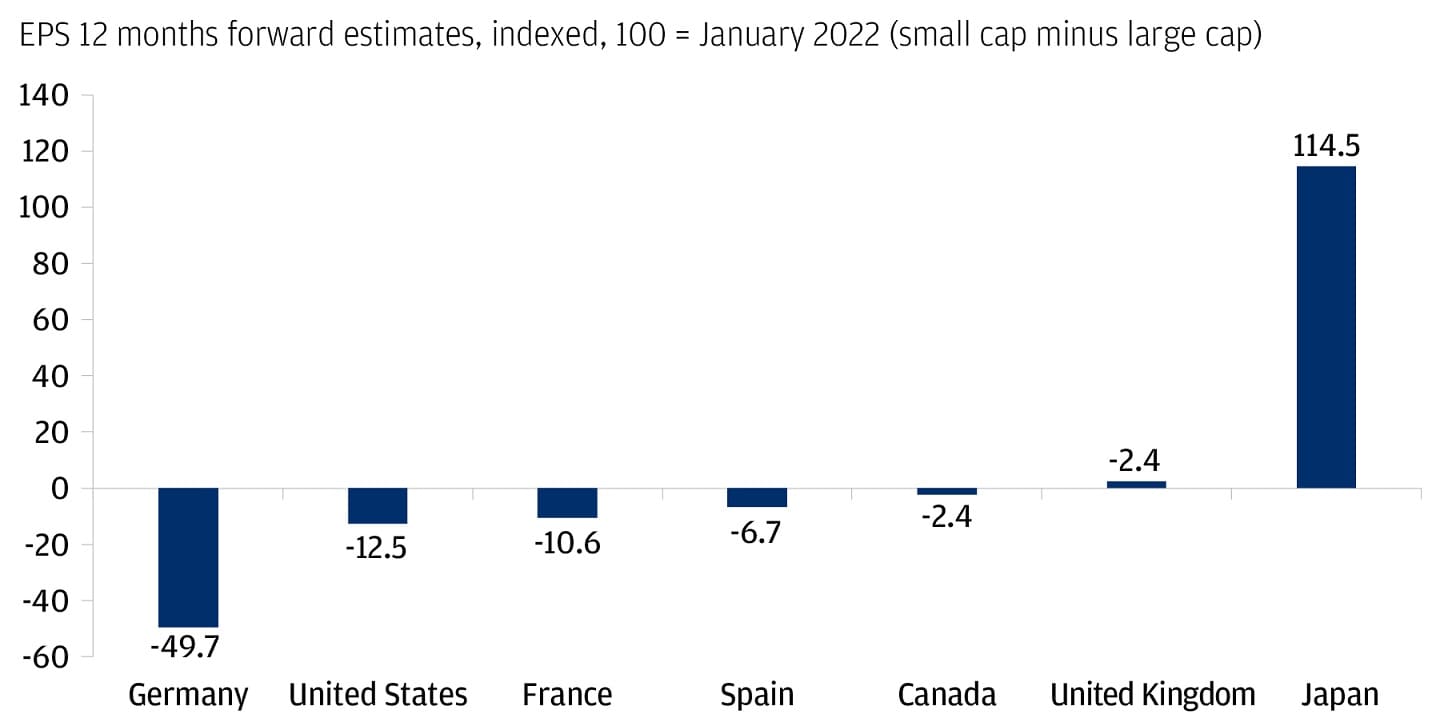

As a result, small-cap German companies have significantly underperformed relative to their large-cap peers. What’s more, the underperformance in Germany is much greater than is the small cap–large cap gap in other developed economies, as the chart below illustrates. That’s essentially because German small cap companies have been in a multi-year earnings recession – and it’s not over yet.

In part because they are more diversified globally, German large caps have outperformed their small cap peers

In part because they are more diversified globally, German large caps have outperformed their small cap peers

Meanwhile, compared with German small caps, large-cap companies are more diversified globally and have a higher weighting to the technology sector and a lower weighting to energy-intensive sectors such as industrials and materials. As a result, large caps have better managed the challenges facing the German economy as a result of the war in Ukraine.

Hong Kong versus Singapore real estate

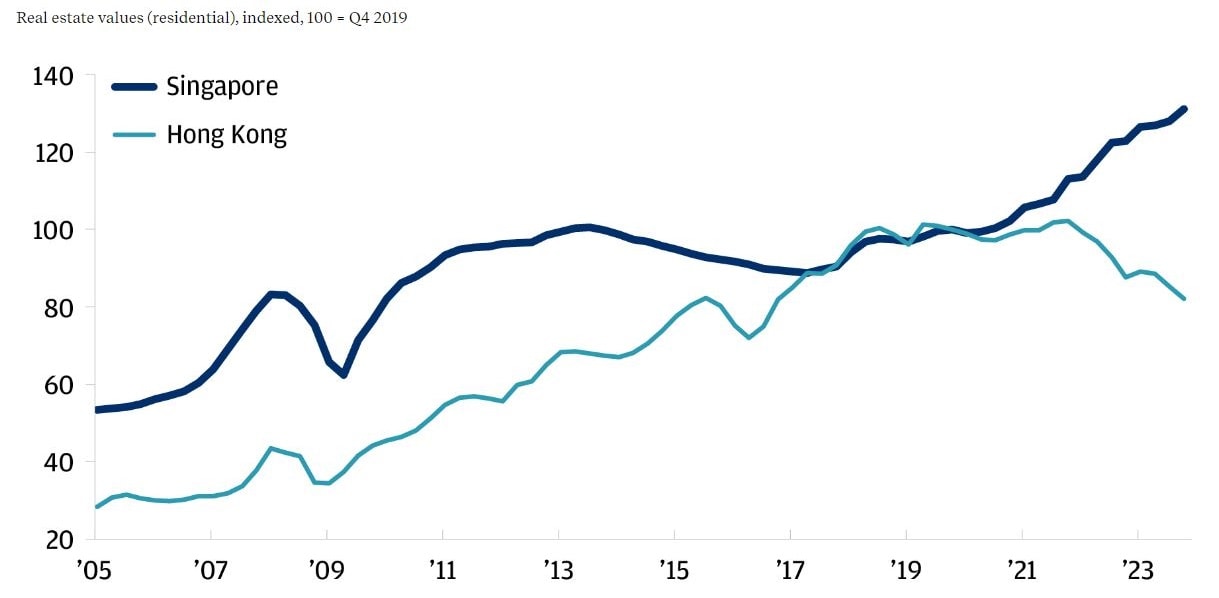

The changing geopolitical dynamics between China and Hong Kong in recent years have had a chilling impact on real estate values – and the economy more generally – in Hong Kong. The result: a widening gap between real estate values in Hong Kong and Singapore.

Geopolitics has shaped the market backdrop. As a result of a series of events in Hong Kong, including a 2019 protest and the enactment of the National Security Law in 2020, it is widely believed that China has tightened its grip on Hong Kong. And since 2019, observers have noted a wave of population outflows from Hong Kong to alternative locations such as Singapore, Canada and the United Kingdom.

Hong Kong’s total population declined by 2.2% from 2019 to 2022. More dramatically, the younger part of Hong Kong’s labor force (people aged 15–29) has contracted by nearly 25% as of March 2024.

A shrinking population along with concern about the future and corporate de-risking have accelerated the downturn in the Hong Kong property market. This has led to a widening gap between real estate values in Hong Kong versus Singapore, a key destination for people leaving Hong Kong. As illustrated in the chart below, from 2019 to the present, real estate values in Singapore have risen more than 30%, but in Hong Kong they have dropped nearly 20%.

As Hong Kong's population has shrunk, real estate values have fallen and the gap with Singapore has widened

To be sure, Singapore’s real estate market was always undervalued relative to Hong Kong’s, so a convergence was likely to happen in the long run. But the abrupt shift in recent years likely reflects political developments in the region.

Shifting dynamics in the gold market

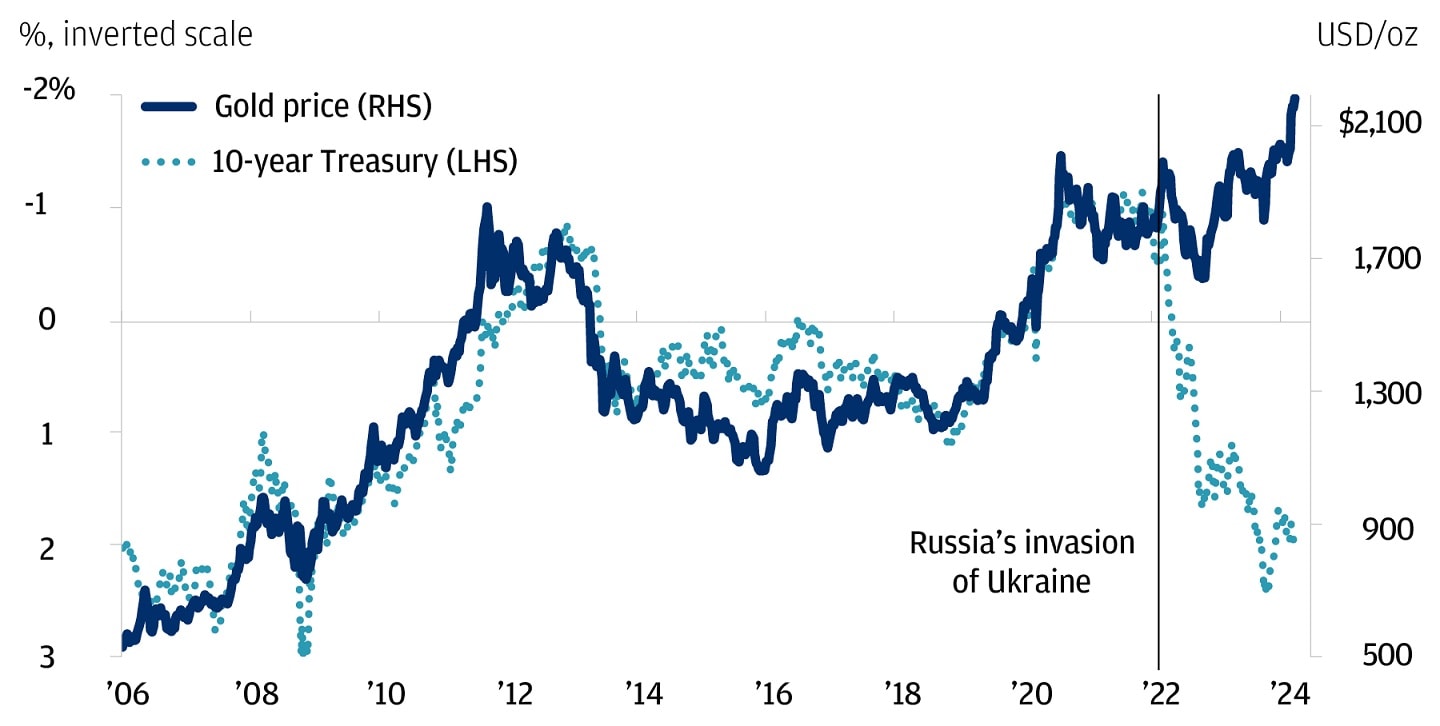

Historically, gold prices have shown an inverse relationship with real yields on U.S. Treasuries (i.e., inflation-adjusted interest rates). For example, when real yields declined, gold appreciated in value (and vice versa). As gold itself does not generate income, real yields could be seen as the opportunity cost for owning the asset.

But changes in U.S. Treasury real rates no longer drive gold prices. The historical relationship has been largely irrelevant since 2022. The reason: geopolitics.

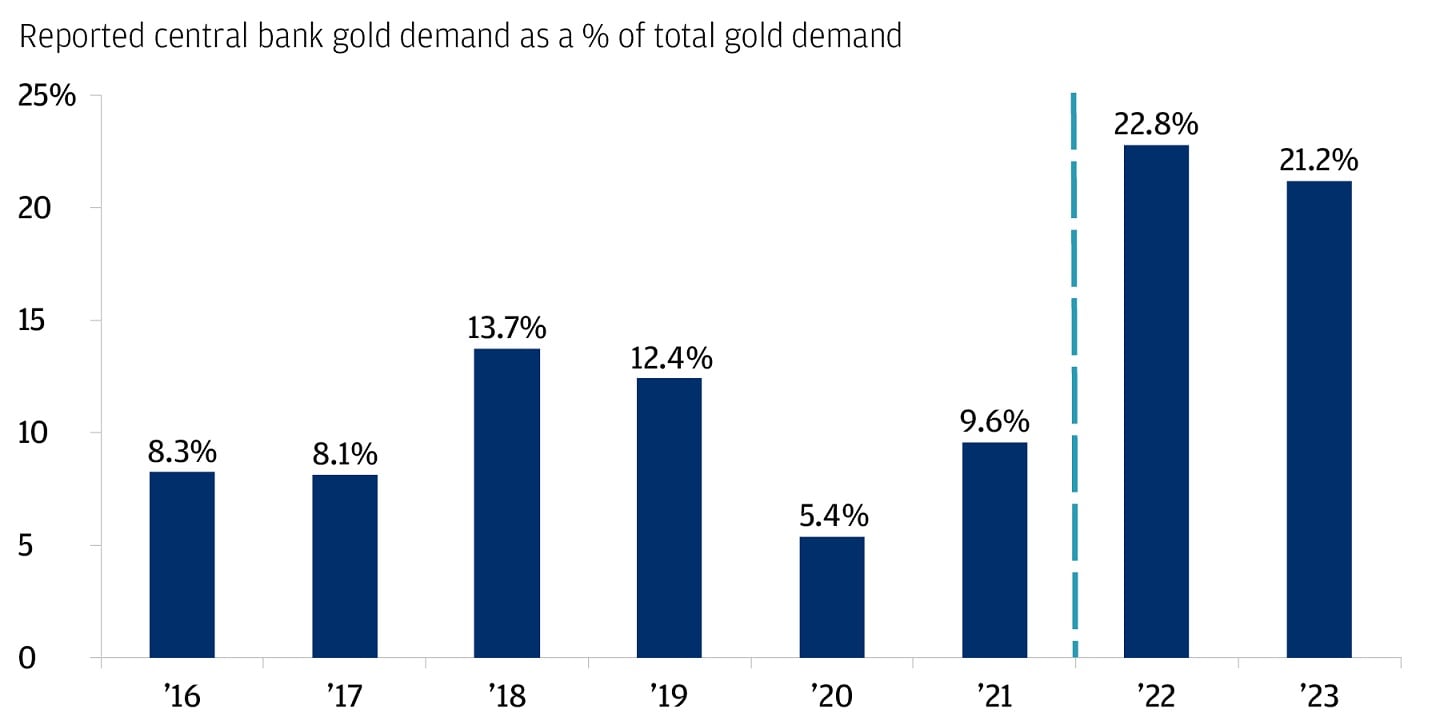

The United States and its allies froze Russia’s foreign exchange reserves after the outbreak of war in Ukraine. Most of Russia’s reserves were held in U.S. dollars, and those reserves were unable to be used in a time of stress – a profound change in modern warfare. Since then, global central bank demand for gold has more than doubled as a percentage of overall demand. Central banks are diversifying toward gold, irrespective of the real interest rate backdrop, as gold is seen as “unsanctionable."

The long-established link between U.S. 10-year Treasury yield and gold prices has broken, while global central bank gold demand has risen significantly since 2022

The long-established link between U.S. 10-year Treasury yield and gold prices has broken, while global central bank gold demand has risen significantly since 2022

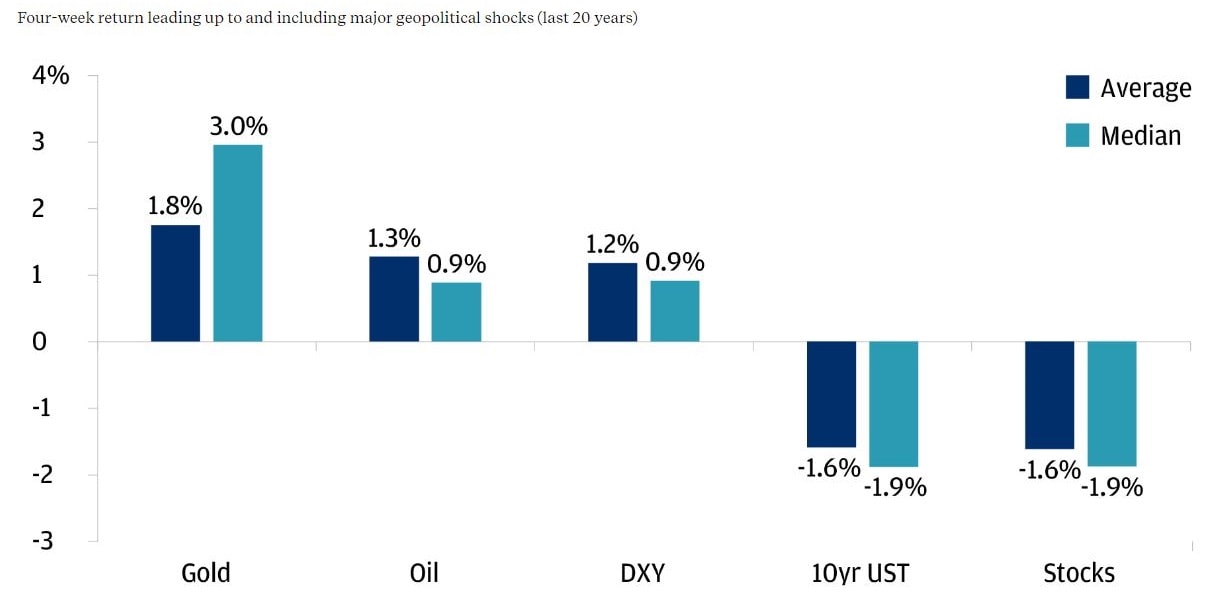

An analysis of high-frequency gold price dynamics is revealing. Although, as we’ve discussed, geopolitical shocks typically don’t have a lasting impact on global equity markets, these shocks can lead to near-term drawdowns in both stock and sovereign bond prices. Gold has typically been an effective hedge against such short-term volatility – in fact, it is one of the best tactical hedges against geopolitical risk that we are aware of.

The chart below illustrates that in the window leading up to and including a geopolitical shock, gold has typically been the best tactical hedge (although oil and the U.S. dollar have also usually worked to a lesser extent).,

Gold has often proven to be a performer as a tactical hedge against geopolitical risk

What this means for your portfolio

As our analysis suggests, some concerns about the market impact of geopolitics are overstated. But investors cannot ignore geopolitics. While history shows that geopolitical events do not have lasting effects on globally diversified equities, the impact on local markets can be substantial.

Are your investments highly concentrated in specific markets (e.g., is your wealth concentrated in the equity you hold in a small business)? If so, you may want your assets to be more globally diversified. For investors who would like to mitigate the short-term volatility that can come from geopolitical shocks, it may make sense to add exposures to gold and oil as portfolio hedges.

What about the BRICS+?

At this juncture, we pivot to a discussion of the growing geopolitical influence of the BRICS+ economies. It’s an evolving story.

We quantified the growing geopolitical influence of the BRICS+ vis-à-vis the G7 economies in the table below. It includes various “geopolitical power” metrics such as population size, resource production and advanced manufacturing output.

Key geopolitical power metrics for G7 and BRICS+ economics

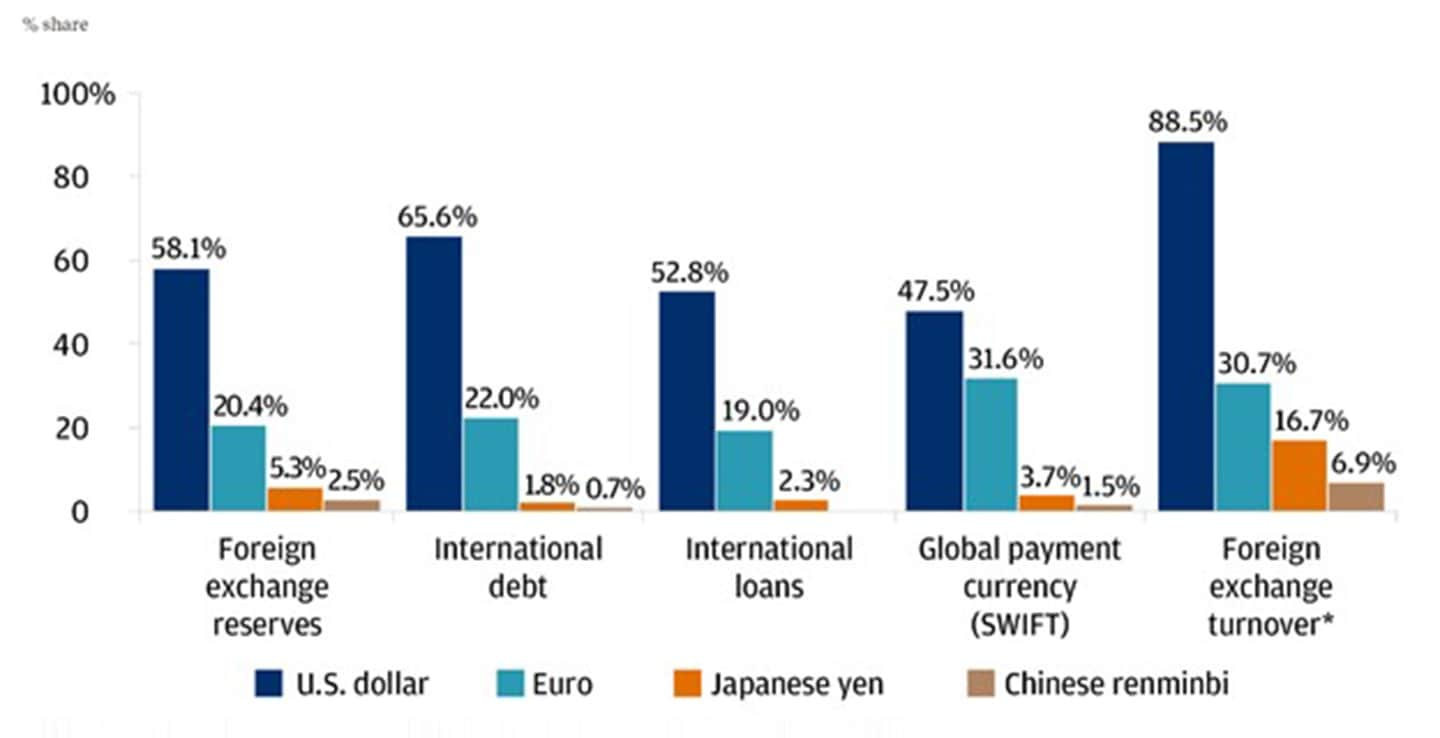

Clearly, the BRICS+ are growing in strength and power – even as they lack a common currency. The U.S. dollar remains entrenched as the world’s global reserve currency, and even the BRICS+’s most powerful economy, China, has made little progress in making its currency, the RMB, more internationally held as a reserve currency.

The chart below illustrates the dominance of the U.S. dollar across key metrics, including foreign exchange holdings by central banks and other official institutions, international lending and global currency payments.

The U.S. dollar is still the world's dominant reserve currency, and it's unlikely to be replaced anytime soon

We also examined the liabilities of the BRICS+’s multilateral development bank, the New Development Bank (NDB), which is the BRICS+ analog to the World Bank. We found that the NDB is heavily attached to the U.S. dollar: Nearly 70% of its outstanding loans are made in U.S. dollars versus just under 20% for the RMB.

To diversify their reserve holdings, the BRICS+ economies have been heavy buyers of gold in recent years. In 2022 and 2023, more than 50% of net global official gold purchases were made by BRICS+ institutions. There are even anecdotal accounts that gold is being used to settle excesses in growing local currency trade between BRICS+ members.

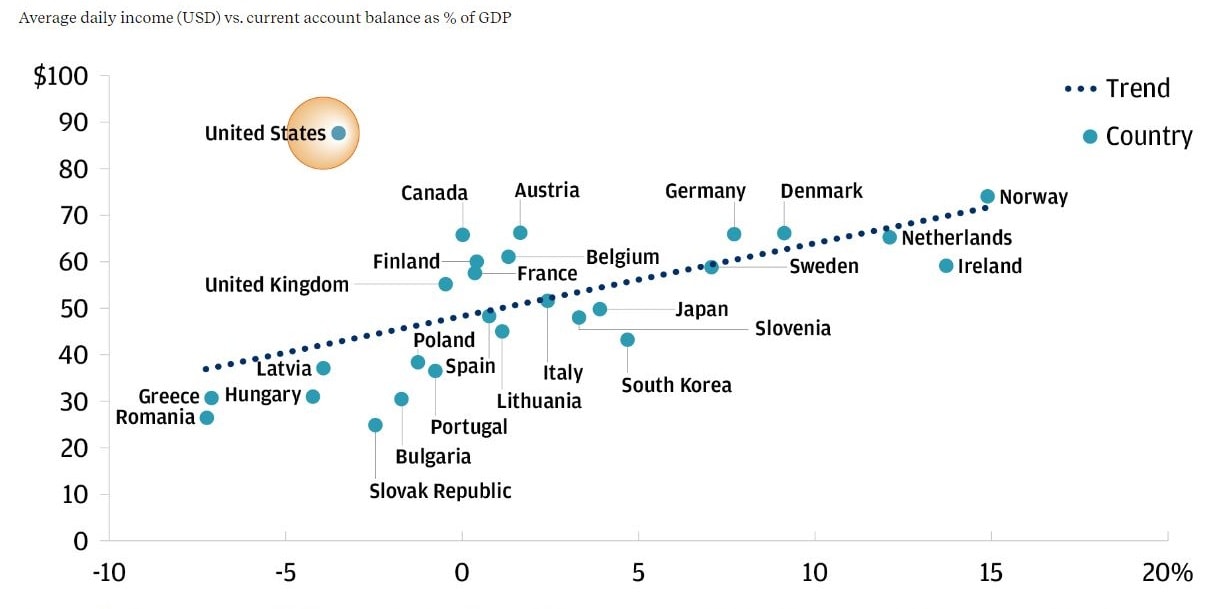

We don’t expect the U.S. dollar to lose its dominant role in the global economy and financial system anytime soon. But there are longer-term – and unresolved – questions about the U.S. fiscal deficit (as we wrote about last fall). Clearly, too, the fact that the U.S. dollar is the global reserve currency allows U.S. citizens to live beyond the means of their country’s production capabilities.

To illustrate this phenomenon, the chart below plots current account balances versus average incomes. The assumption is that growth can be “constrained” by a country’s ability to grow its exports in line with GDP.

As the chart underscores, the United States is an extreme outlier in the global economy. With the trendline plotted, we can calculate how much U.S. living standards (i.e., average daily incomes) would need to fall if the U.S. dollar were to hypothetically lose its reserve currency status. The decline would be catastrophic – about a 50% drop in living standards.

As we’ve said, we expect the U.S. dollar to keep its status as the world’s reserve currency for the foreseeable future. But the exercise does remind us that when a single nation’s currency dominates the global financial and trading system, imbalances may be inevitable. John Maynard Keynes warned of these imbalances when the international monetary system needed to be reconstructed in the wake of World War II.

The dollar's status as the global reserve currency bolsters living standards for U.S. citizens

We can help

Geopolitics can be a difficult subject. Your J.P. Morgan advisor can offer their perspective on how to evaluate the relevant risks and opportunities, as well as what portfolio changes – perhaps including added exposure to gold – might help you hedge geopolitical risk and achieve your financial goals.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.