Analyzing the sustainability of the S&P 500's August 2025 rally

The August 2025 market performance highlighted better-than-expected earnings results, the potential for a Fed rate cut and the sustainability of the S&P 500's rise amid elevated valuations and fading economic uncertainties. Talk about ending the summer in style.

For starters, U.S. equities had an impressive month. The S&P 500 notched new highs in August and closed above $6,500 for the first time ever as investors leaned into stronger-than-expected earnings growth and gained increasing clarity on some of 2025’s biggest sources of uncertainty. In tandem with subsequently elevated stock valuations and dwindling fears of an imminent recession, markets were buoyed by investors’ hopes of the Federal Reserve cutting interest rates at the Federal Open Market Committee (FOMC) meeting on September 17.

Going forward, though, the question is whether the S&P 500's rally and historically high valuations are justifiable, and more importantly, sustainable. We see an argument for a thumbs up to that question – and potential for even more upside ahead. Let’s dive in.

Q2 2025 earnings surpassed market expectations

Back in the spring, analysts revised their expectations for S&P 500 earnings lower, bracing themselves against the possibility that tariffs could weigh on economic growth and squeeze corporate profits. But the S&P 500 has risen nearly 30% from April’s lows, and the latest round of Q2 2025 earnings results instead showed investors that the tariff drag hasn’t materialized as severely – or at least as quickly – as many feared. Thanks to this splash of optimism, companies were now in a position to clear their lowered bars: With over 95% of the S&P 500 having released their Q2 2025 report cards by the end of August, approximately 82% exceeded earnings-per-share (EPS) estimates, versus a 10-year average of 75%.

More importantly, while this earnings season was strong relative to low expectations, it was also solid from an absolute perspective. Consensus came into this earnings season expecting 5% growth, and that figure is shaping up to be around 12%, well above the average earnings growth over the last 20 years (i.e., approximately 6%).

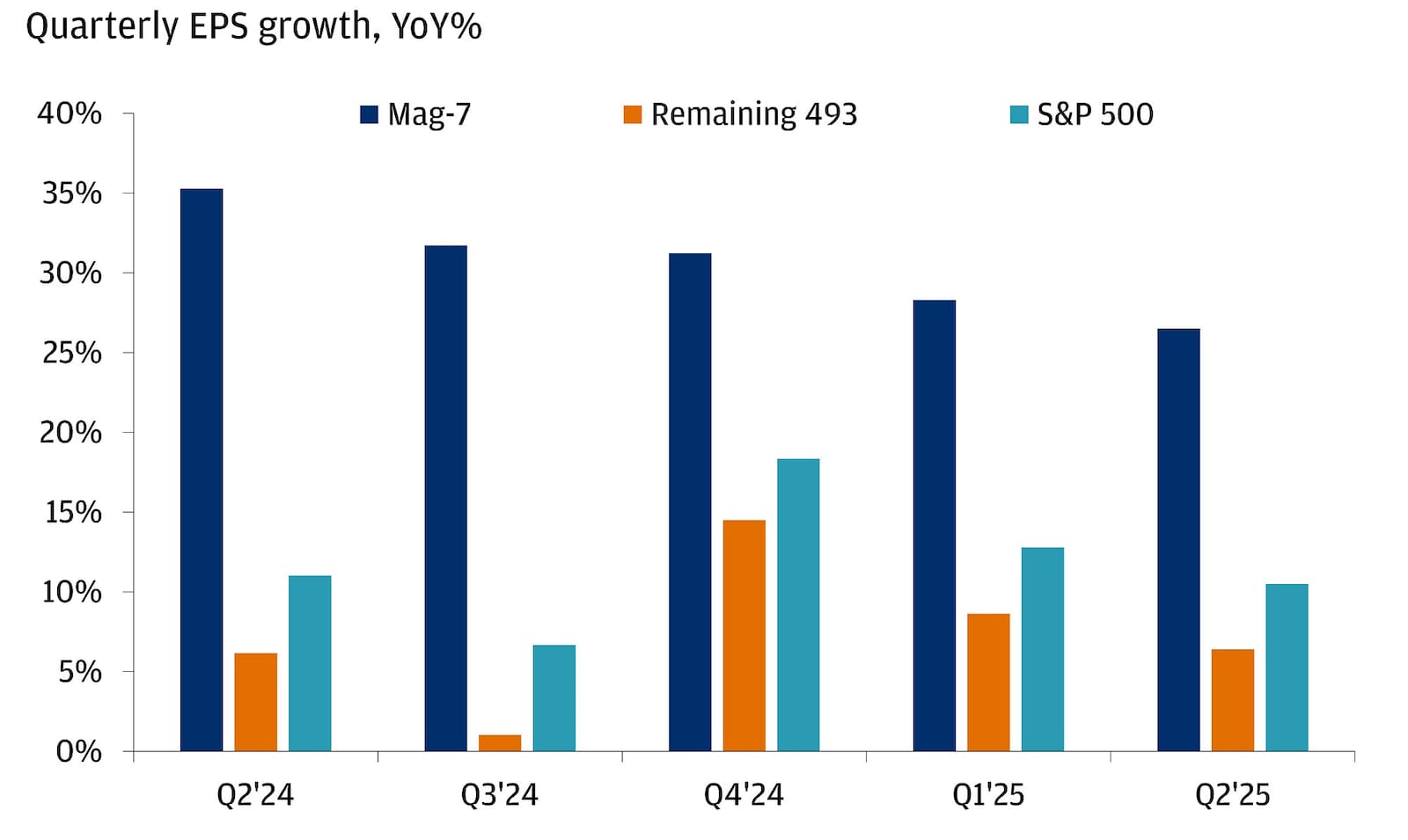

To be fair, much of the upside was driven by index heavy hitters otherwise known as the Magnificent Seven. As a group, these seven companies crushed expectations by delivering earnings growth of 27%, beating estimates by 12%. For comparison, the broader market showed average earnings growth of 6% and an average 4% beat.

Earnings growth for the Mag-7 remains strong

Regardless, the collective strength of the S&P 500’s Q2 2025 earnings growth fueled the continuation of the index’s August rally. Bets that it can continue – not just over the next year, but even further into the future – have pushed valuations to levels well above historical averages. Many investors are questioning, though, whether this upward trend can continue.

Ready to take the next step in investing?

We offer $0 commission online trades, intuitive investing tools and a range of advisor services, so you can take control of your financial future.

Examining elevated stock valuations: Are they justifiable?

Price-to-earnings (P/E) ratios are just one item in an investor’s toolkit that can help calculate investments’ potential valuations. To reiterate, these ratios measure how much investors are willing to pay for each dollar of a company’s future earnings, providing insight into market sentiment and growth expectations.

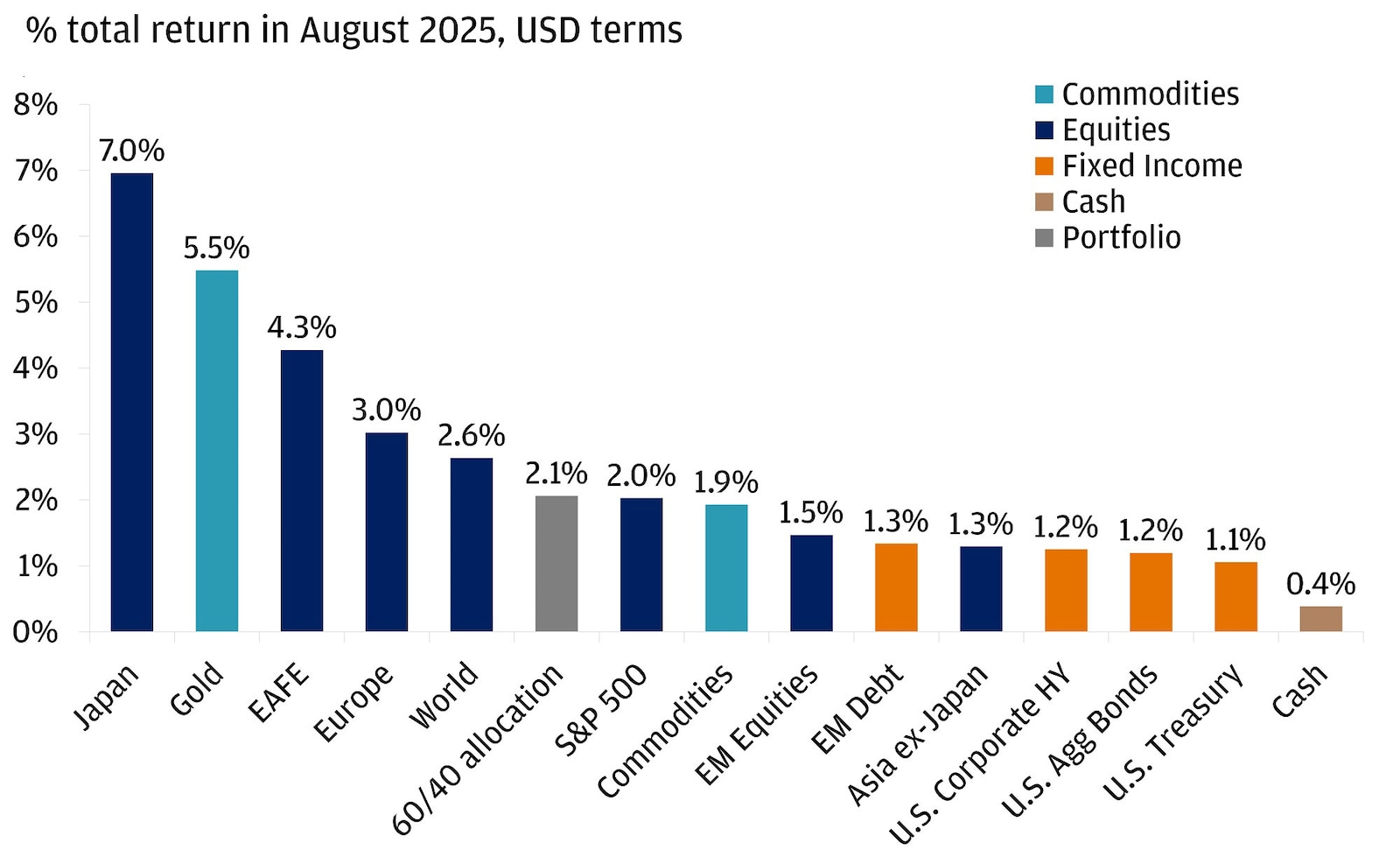

By the end of August, the S&P 500’s price had risen back to 22.4 times the next-12-months earnings expectations. For context, that valuation is nearly where the index started at the beginning of 2025, before this year’s tariff tumult and amid ongoing hype over continued U.S. exceptionalism. Investors also experienced a rally in risk assets last month, with international equities leading the way. This outperformance over their U.S. peers was related to a combination of a weaker U.S. dollar, lower valuations overseas, excitement around European defense and infrastructure spending and ongoing investor efforts to increase allocations to international equities.

Risk assets continued to notch higher in August

Similar to earnings expectations, Magnificent Seven companies play a big role in propping up the S&P 500’s valuation. They’re trading at 28.5 times Q2 2025 earnings expectations; compare this to a 10-year average of 25.3 times for the S&P 500 as a whole. While the other 493 companies are also trading at an above-average P/E ratio of 20.1, the heavy weighting of these magnificent mega-cap stocks is ballooning the overall S&P 500 valuation. What’s more, given that these seven companies represent over a third of the index market cap, skeptics worry that this may be nearing the irrational exuberance that characterized the early 2000s market environment.

But we don’t believe this is the dot-com bubble all over again. These companies’ profitability and cash returns to investors have grown meaningfully over the last few years, offering investors fundamental support. And with artificial intelligence (AI) adoption continuing to accelerate, these companies are investing heavily in the burgeoning technology, supporting expectations for future gains in their productivity and profit margins. In sum, strong results and future potential bolster today’s market leaders – not just mere hype.

The U.S. economic slowdown and fading uncertainty

Beyond corporate fundamentals, shifts in the macro backdrop also offered some support to risk assets. For one, the turbulent, unexpected tariff announcements have slowed. Signs of the expected inflationary impacts of tariffs are still popping up but being met with cautious expectations that they will prove temporary. Fed Chair Jerome Powell laid the groundwork for rate cuts between now and year-end at the Jackson Hole Economic Symposium in late August: Unless there are significant surprises in jobs or inflation data come early September, we believe a rate cut at the Fed’s September 17 meeting is likely.

It’s not that the economic backdrop is picture perfect right now – it isn’t – but rather that the fog of many of 2025’s uncertainties is starting to clear. We still anticipate an economic slowdown, but we maintain our view that it won’t be recessionary. The good news is that it seems U.S. companies are adopting a similar mindset.

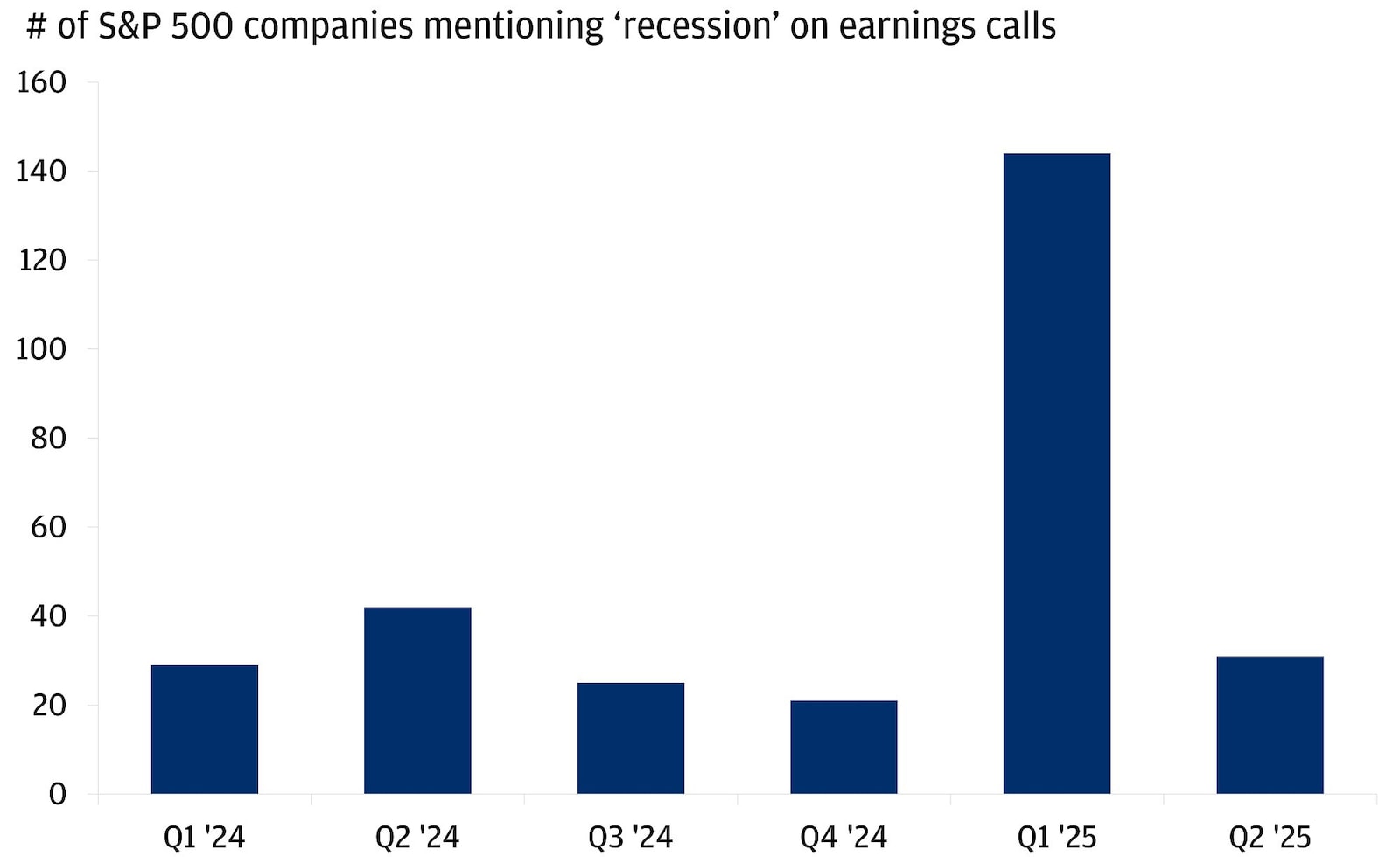

Recession fears dropped in Q2 ’25 as trade policy uncertainty eased

After spiking in the first quarter of 2025, the percentage of S&P 500 companies who mentioned the word “recession” on earnings calls dropped nearly 80% in the second quarter. This decrease could help shift investors’ focus to fundamentals – such as earnings and secular trends like AI – that we believe could help push markets to new highs.

Looking ahead: Expectations that the Fed will cut interest rates

Market expectations for a rate cut at the Fed’s meeting this month are over 90%. We think investors should be mindful that reinvestment risk on short-term investments, such as cash, is here. If you’re willing to do some homework, take the time to review your goals and your asset allocations to determine what may be out of balance – we’ll be back next month with a recap of the Fed’s decision and its reasoning behind it, offering up some considerations from our playbook to help you position for the central bank’s latest policy move.

In the meantime, a bit of hope in the market is warranted. Between stellar Q2 2025 earnings reports, elevated stock valuations and the strengthening outlook that a recession is likely not headed our way, there’s reason to believe that the S&P 500’s robust performance could continue through year-end. As always, a J.P. Morgan advisor is here to help you evaluate your portfolio and investment strategy against the backdrop of these market movements.

You're invited to subscribe to our newsletters

We'll send you the latest market news, investing insights and more when you subscribe to our newsletters.

Head of Investment Strategy, J.P. Morgan Wealth Management

Global Investment Strategist