Fast and reliable payments for your services business

Accept payments with versatile point-of-sale and invoicing solutions anytime, anywhere. Plus, enjoy deposits as soon as same day at no extra cost.,

Existing Chase Business Complete Banking® customers: get started in your account today.

Process payments with the #1 merchant acquirer and bank in the U.S.

Fast access to funds

Improve cash flow with deposits as soon as same day at no extra cost when you use a Chase business checking account.

Sell with confidence

Chase’s fortress-level security, industry leading systems and Fraud Protection services help keep your payments safe.

24/7 customer support

Live expert guidance is available when you need it. Self-service is accessible anytime in the support center.

Get paid with billing and invoicing solutions

Run your business more efficiently and improve cash flow with our secure invoicing and billing solutions that help you get paid quickly.

SIMPLE BILLING

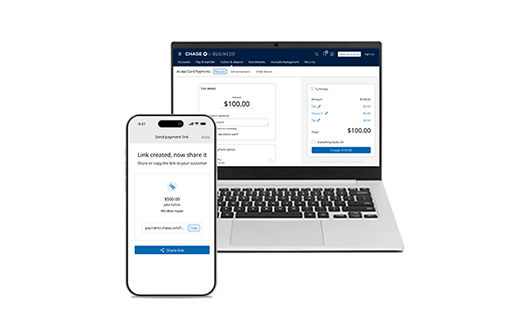

Invoicing and Payment links

Create professional, digital invoices straight from your business bank account and automatically track all payments made using Chase QuickAccept®,. Or text your customers a secure payment link to get paid fast.

Already available in your Chase Business Complete Banking account.

COMPREHENSIVE VIRTUAL TERMINAL

Authorize.net®

Transforms your computer into a credit card processing hub. Ideal for remote billing or accepting card payments over the phone. Enter manual orders into a browser-based virtual terminal or set up recurring billing.

Get paid in person with a POS system built into your bank account

Process payments, track sales and manage services seamlessly across devices with the point-of-sale system available through your Chase Business Complete Banking account with QuickAccept. Plus, enjoy same-day deposits at no extra cost.

Chase POS Terminal

Our all-in-one POS terminal with the essential features to accept payments, print and send receipts, preset tax and tip, and preload products and prices in a catalog for faster checkout.

Limited time offer — Get $100 off the Chase POS Terminal when you use code CHASEPOS at checkout.

Chase POS℠ app

Turn your phone into a mobile POS with this 4+ star-rated app to process payments, create a product catalog, connect a card reader and more.

Chase Card Reader™

This pocket-sized card reader with an LCD screen and stylish base pairs with the Chase POS app and provides a simple, secure and versatile way to take more payments in more places.

Tap to Pay on iPhone

With Tap to Pay on iPhone, you can take payments at your business or on-the-go — no extra hardware needed. It’s easy, secure and private.

Get started with the Chase POS system

2

Download Chase POS app℠

New to Chase Business Complete Banking®?

Let’s find the best products and pricing options for your business. Reach out to a Payments Advisor at 1-877-843-5690 or fill out this short form.

"Chase has given me the same customer service I give to my customers. And that's one thing that I love about Chase."

Miriam Corrales

Owner, On Broadway Auto Care

Customers were told in advance they might be featured in an ad.

More ways to get paid in person with our classic credit card machines

Explore reliable credit card terminals and mobile card readers to take payments at your business or on the go. Plus, enjoy deposits as soon as next-day deposits at no extra cost.

Credit card terminals

Use our Chase Wireless Terminal™ or Chase Countertop Terminal™ to process debit and credit card transactions quickly at the counter or on the go.

Chase Mobile Checkout

Accept credit cards right from your smartphone using the Chase Mobile Checkout app and contactless mobile card reader.

Let’s find the best products and pricing options for your business

Reach out to a Payments Advisor — call

1-877-843-5690 or fill out this short form.

Get more when you process payments with Chase

GROW AND OPTIMIZE YOUR BUSINESS Chase Customer Insights

A proprietary business intelligence platform with analytics you can use to better reach customers and manage your bottom line. Available when you use Chase Payment Solutions® for credit card processing. Special offer: new Google Ads customers will get $500 in Ads credit after spending $500.

EASILY PAY YOUR TEAM Chase Payroll℠,

Enjoy simplified payroll embedded in Chase Business Online, powered by Gusto—freeing you to focus on your business.

SIMPLIFY YOUR BOOKKEEPING Chase + Quickbooks® Online

Sync your card sales processed with Chase directly to Quickbooks.

Frequently asked questions

Chase POS is a versatile cloud-based system combining software and hardware to facilitate both in-person and remote payment acceptance.The POS software provides effortless effeciancies such as managing sales, creating a product catalog, tracking inventory and more. Chase POS system is available exclusively through Chase QuickAccept — a suite of POS solutions built into Chase Business Complete Banking.

It includes mobile apps (Chase Mobile and Chase POS app), hardware (Chase Card Reader, Chase POS Terminal), and remote payment capabilities (Chase Business Online and Invoicing). Plus, key features like payment links and Chase Customer Insights.

You can get set up with Chase POS in minutes by activating Chase QuickAccept in your Chase Business Complete Banking account and take payments in the same day. If you are new to Chase for Business Complete Banking, or interested in NCR Voyix or our Chase terminals, please reach out to a Payments Advisor at 1-877-843-5690 or connect with us.

Chase Business Complete Banking clients can easily create digital invoices in Chase Business Online or the Chase Mobile app. Just activate invoicing, then safely create and send invoices through a secure link by text or email. We also offer invoicing and billing through Authorize.net Virtual Terminal.

Authorize.net provides a virtual terminal with invoicing and recurring billing capabilities powered by Chase payments. To get started with Authorize.net please contact a Payments Advisor at 1-877-843-5690 or connect with us.

Chase POS Terminal is a wireless, handheld terminal that can be used to process payments and leverages cloud-based software to provide the ability to manage sales, product catalog, inventory and employee access—all from the terminal, whether you’re moving around your store or at your counter.

Plus, it syncs with other solutions in the Chase POS suite (Chase Card Reader, Chase POS app and Chase Business Online) so you can access everything across multiple devices.

Chase offers mobile apps (Chase POS app, Chase Mobile app) with built-in features like Tap to Pay on iPhone to take contactless payments on the go using just your iPhone. You can also connect the Chase Card Reader to the Chase POS app to process chip and contactless card payments. And for higher volume merchants we offer the Chase Mobile Checkout app and card reader for on-the-go payments.

Yes. Chase offers a Bluetooth-enabled credit card reader and Tap to Pay on iPhone that you can use with cell signal. Chase Countertop Terminal has a built-in Ethernet cable for reliable hardwired connection and Chase Wireless Terminal can run on 4G cellular connection. You can also accept credit cards right from your smartphone using the Chase Mobile Checkout app and contactless mobile card reader.

If you have more questions, visit our support site for other commonly asked questions.

Need help with Chase Payment Solutions?

Find the answers you need and get 24/7 merchant support.