A crash course on taking the mystery out of payments

Learn to identify payment processing fees and choose the best options with our handy pricing cheat sheet. Presented by Chase Payment Solutions®

Fees related to taking card payments may be an unavoidable cost of doing business, but by understanding the costs associated with payment transactions, you can take more control of your business and your finances.

What happens after a swipe, tap, dip?

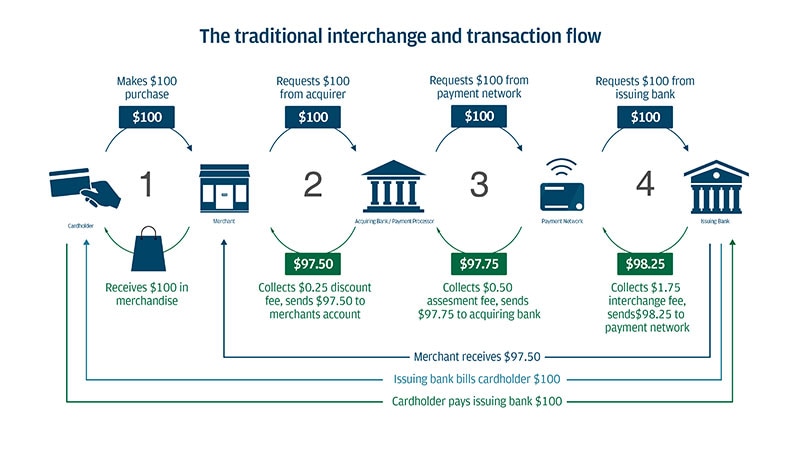

First let’s start with what happens when your customer pays with a debit or credit card. Whether you’re taking the card payment at a physical location, online or via mobile, every transaction goes through the same steps.

- Authorization: The payment network provides the “rails” that the card payment runs on. It is the brand shown on the card, such as Visa, MasterCard, Discover or American Express that confirms that the customer’s account has sufficient funds and reserves the payment amount so that it’s not available for other transactions.

- Clearing: Payment information is sent through the network to the issuing bank, that is the bank/organization that issued your customer’s credit/debit card.

- Settlement: The issuing bank then sends the payment through the network to the acquiring bank (the seller’s bank) / payment processor.

- Funding: The payment processor sends the funds to your account to complete the payment.

The traditional interchange and transaction flow. For illustrative purposes only. These are not JPMorganChase prices.

Learn the language

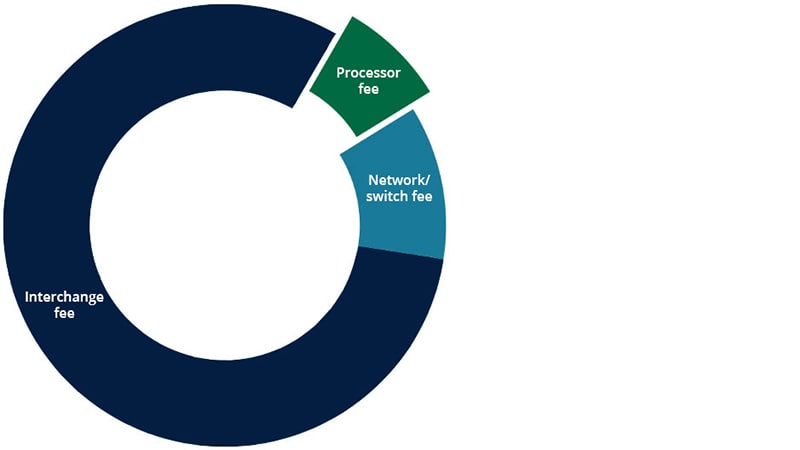

Payment processing fees can be hard to understand. That’s partly because multiple parties charge fees during the process, but they appear bundled together on the bill from the payment processor. Typical fees fall into three categories:

- Processor fee: Charged by your payment processor for coordinating authorization, settlement, chargebacks, reporting and customer service

- Network/switch fee: Charged by a payment network (e.g. Visa, Mastercard, etc.) for use of its network

- Interchange fee: Charged by the debit/credit card company who issued the card to your customer to compensate for the risk and cost of the card transaction

Processors may charge fees in addition to those already mentioned. The following may also show up on your statement.

- Withdrawal fees: Some processors charge businesses to move funds from the processing account to the business’s bank account the same or next day. Chase does not charge a withdrawal fee for businesses that have a Chase banking account, and we provide fast funding, often the same or next day.

- Cancellation fees: Your payment processor may charge a fee if you cancel your payment processing relationship before an agreed-upon, contractual term. These agreements can allow for extra cost savings through temporary commitments. Businesses that enroll under Chase’s standard month-to-month agreement do not face cancellation fees.

- Fixed monthly fees: Some processors charge fixed fees, like PCI compliance (card security) and gateway fees. It’s always important to be aware of these when selecting a processor. Chase does not charge additional PCI-related fees.

- Chargeback or Dispute fees: These fees occur when a customer formally disputes a purchase. There is a charge back fee by the processor. In addition, the customer’s issuing bank temporarily withdraws funds from the business while the claim is being reviewed and provides a reason code. The business then accepts or challenges the dispute. If they challenge and the dispute is deemed fraudulent, the issuing bank or settlement service returns the funds to the business, less the chargeback fee. If the dispute is deemed legitimate, the customer may keep the funds. Visit our disputes support page.

Shrink chargeback fees

Naturally, every business owner wants to avoid disputes from customers. While challenging a fraudulent chargeback is always an option, it’s often easier to prevent chargebacks or disputes in the first place. The fewer disputes you receive, the fewer you need to contest.

A simple misunderstanding during the transaction can often result in a chargeback. Here are several best practices that can reduce the likelihood of a dispute or chargeback.

- Ensure your business name is recognizable on your customers’ card statements. Customers may not recognize the charge on their credit card bill if it comes from a name they don’t know.

- Make sure product descriptions are accurate. Customers know what they’ve bought. However, if the description on their card statement doesn’t sound familiar, they may not recognize the purchase and dispute it.

- Be clear about your return and refund policies. By displaying your policies prominently at the point of sale, both online and in store, you can avoid return issues later.

- Use delivery tracking services from shipping companies. If you can prove that the product arrived or the shipping company was at fault, you can save your good name — and your profits.

- Invest in an ID verification service. By verifying the card user’s identity at the time of purchase, you can avoid fraudulent transactions that would likely be disputed by the legitimate cardholder.

- Keep records of all transactions. By maintaining a record of all transactions, you have evidence of what was purchased, when and by whom, which will improve your odds of contesting a disputed charge.

Select the best fee structure for your business

Payment processing fee structures can vary by provider. Some fee structures will be more advantageous based on your business needs. When you understand the most common fee structures, you can make a more informed choice for your business today — and adjust appropriately as your business grows or needs change.

- Bundled rates, also known as flat rates, are very common. A flat percentage of each card transaction is charged as a fee for that transaction. Bundled rates are easy to understand and make forecasting your monthly or quarterly fees simpler.

- Swiped/keyed rates: Swiped/keyed rates are also very common. In this case, payment fees vary according to the type of transaction, with a lower rate for swiped, tapped or dipped credit card transactions and a higher rate for transactions keyed in manually by an employee (such as a cashier) or the customer (such as for online purchases). This can be a good solution if you’re taking most of your card payments through a card reader or similar device. However, it may be more expensive than other fee structures if you’re submitting a lot of keyed transactions, which include customers making online purchases.

- Interchange plus rates: In this pricing model, the payment processor passes on the interchange fee (which can vary by card type) directly to the merchant, plus a markup. This is generally the most cost-effective option, and processors often offer customized rates for select industries, such as restaurants and small ticket retailers. However, since the interchange rates can vary per transaction, this pricing structure can be the most difficult to understand.

Remove the guesswork

Choose a payment processor that cares about your business. If you’re ready to work with us or would like more information, talk with a Chase Payments advisor.