Debunking the top five sustainable investing myths

Head of Sustainable Investing, J.P. Morgan Wealth Management

- Sustainable investing is often misunderstood, making it hard to separate fact from fiction.

- At J.P. Morgan, sustainable investing is an umbrella term that describes investment approaches that incorporate financial as well as social and environmental objectives.

- Let’s bust the five most common sustainable investing myths, from performance to potential fees.

Myth #1: Investing sustainably leads to lower returns and underperformance

Fact: Not necessarily. Sustainable investments can generate comparable returns to a traditional benchmark.

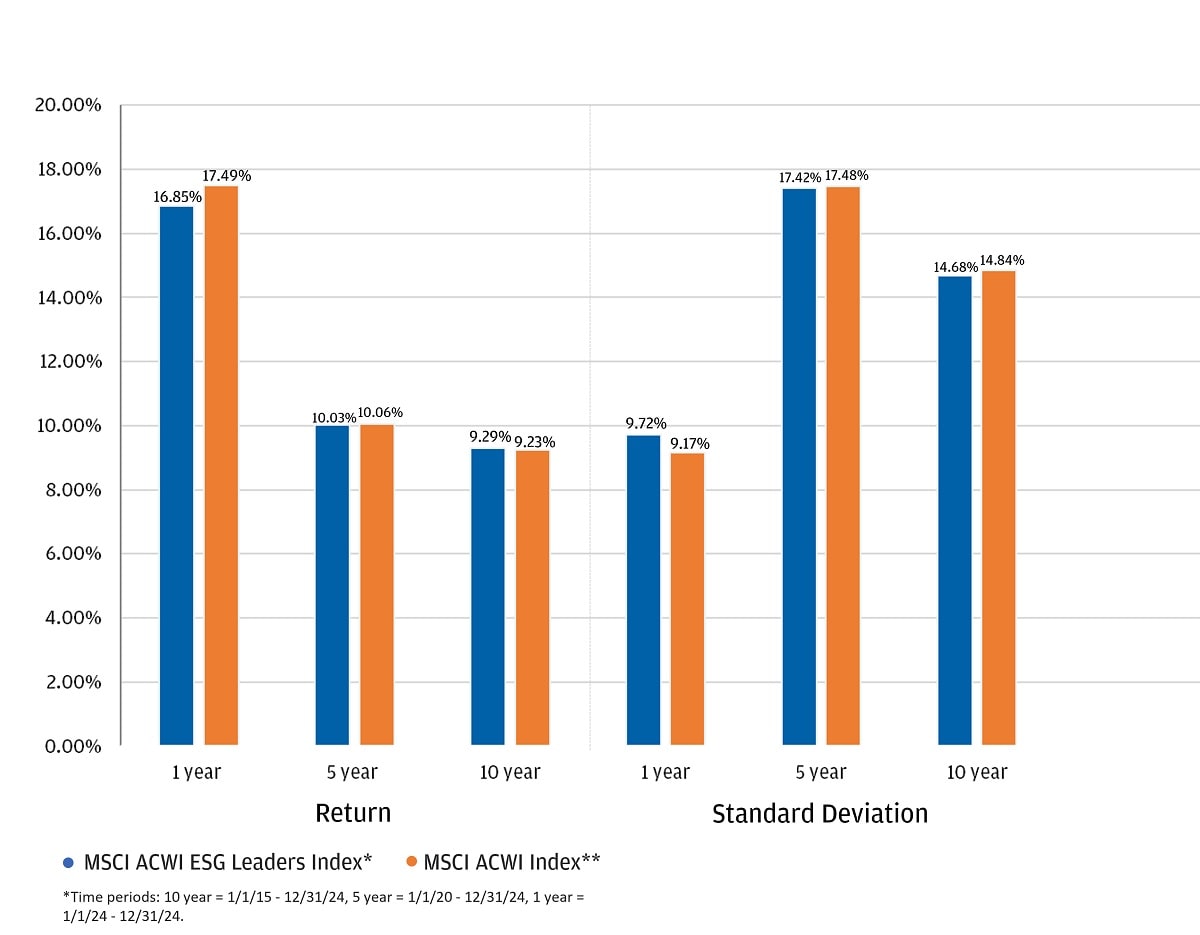

Performance of a global ESG equity index vs. a global equity index over multiple timeframes

Past performance is no guarantee of future returns. It is not possible to invest directly in an index.

One of the frequent sustainable investing myths is that it generates lower returns. Years of performance data now shows that sustainable strategies often perform in line with – or in some cases, outperform – a traditional benchmark as shown in the chart above. Here are some reasons why:

- Extensive data, corporate disclosure and regulatory reports give investors new insights into how well companies are managing environmental, social and governance (ESG) concerns. When done right, focusing on key ESG issues can potentially lower investment risk. ESG factors such as human capital management and land use could have significant effects – both positive and negative – on a company’s business model.

- Sustainability megatrends can impact the economy and society, as well as profitability. A relevant example is the clean energy transition, which includes wind and solar, smart grids and energy storage. The most recent estimates found that clean energy added around USD 320 billion to the world economy, representing 10% of global GDP growth. For scale, that’s more than the value added by the global aerospace industry or the economy of the Czech Republic.

Myth #2: Sustainable investing excludes things from my portfolio and only focuses on the environment

Fact: There are many ways to invest sustainably.

Different approaches to sustainable investing can help you better align your portfolio with your goals – and you can go beyond divesting or environmental concerns.

Climate change is a focus for many sustainable investors. However, social and governance issues – the S and G in ESG – are top of mind as well. Arguably, every investment should focus on the G – sound governance practices are critical to the long-term success of businesses. And social issues like employee wellbeing are increasingly more important to investors.

If you’re interested in bringing personal values to the forefront, divesting from business practices like tobacco or firearms might be a viable option. For those concerned about long-term risks like climate change, you may want to consider ESG factors in your portfolio or investment strategy. It’s also possible to invest in certain environmental and social themes (think water or gender diversity) or focus on generating a positive impact alongside financial returns.

Remember that sustainable investing can vary in approach from manager to manager, just like any other investment. Portfolio managers often choose certain factors or opportunities to emphasize based on their investment thesis, and sustainable investing is no different. Work with your advisor to build a sustainable investing portfolio that meets your individual needs.

Myth #3: Sustainable investing doesn’t drive real change

Fact: It has, and it can. You can have a voice through active managers and corporate engagement strategies

Companies often have a global influence, sometimes for the better (e.g., by being a good employer) and sometimes for the worse (e.g., by polluting a local ecosystem). It’s possible to sponsor specific causes through your investments and potentially impact company behavior.

Let’s dive deeper with a real-life case study. An investment manager holds a leading U.S. manufacturer of cement in its sustainable portfolio. However, it is the portfolio’s significant carbon emitter. Manufacturing construction supplies is a carbon-intensive process that produces “clinker” – a component in cement – which is responsible for about 60% of total cement-manufacturing emissions.

After engagement from the investment manager, the manufacturer has taken steps to decarbonize its operations by:

- Increasing use of alternative fuels

- Reducing clinker content

- Employing carbon capture, utilization and storage technology

The manufacturer has a 20% carbon intensity reduction goal by 2030 versus a 2011 baseline. To encourage further change, the manager will continue proposing a new science-based emissions target.

This is just one example of how sustainable investing can help drive change. By investing in actively managed strategies that engage directly with companies, it’s possible to drive positive change over time.

Myth #4: Sustainable investing is a passing fad

Fact: It doesn’t seem to be – sustainable assets have increased and stabilized over time.

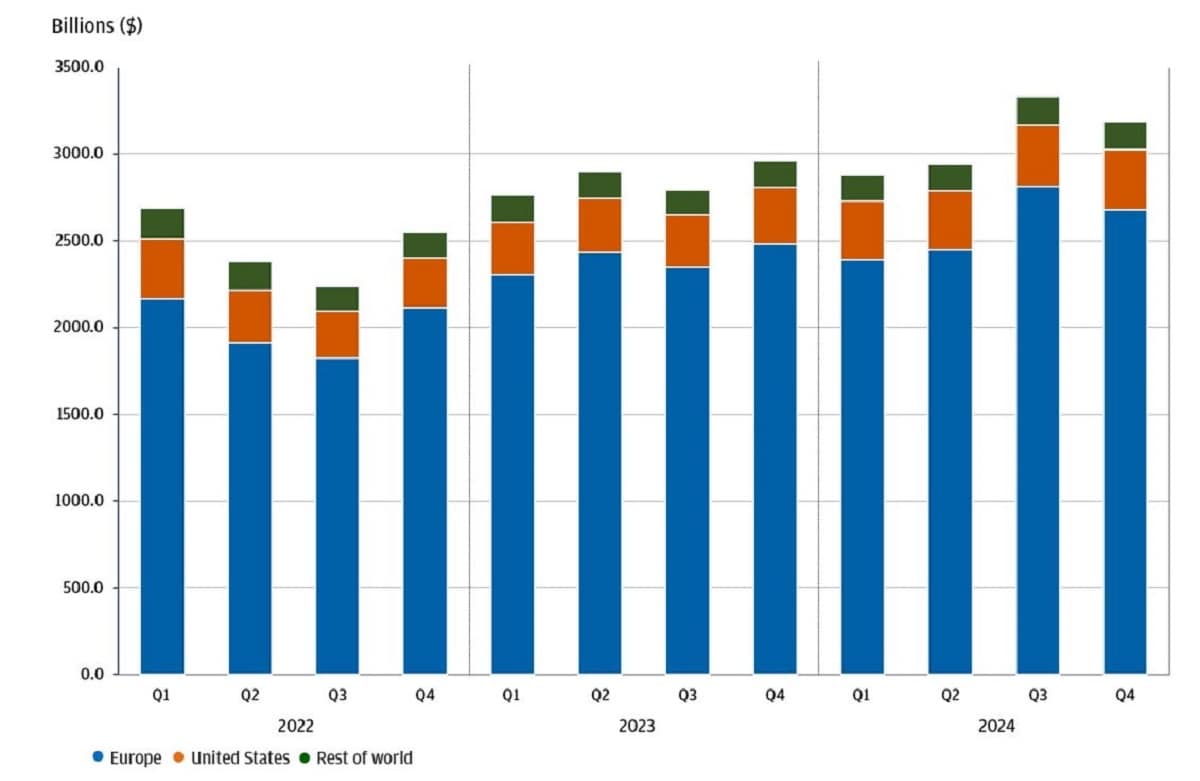

Performance of a global ESG equity index vs. a global equity index over multiple timeframes

Despite market volatility, sustainable investment fund totals have remained stable as illustrated in the chart above.

The above data shows that global assets under management in sustainable funds are around $3.2 trillion as of December 2024., increasing 18% since 2022.

We expect this growth will continue due to several factors, including:

- Shifting investor preferences, particularly among Gen Z and millennials, who prioritize sustainability

- Growth in corporate net zero pledges

- Policy and regulatory changes, such as the Sustainable Finance Disclosure Regulation (SFDR) in Europe

- Macro tailwinds, such as the clean energy transition and sustainable technology, which require up to $5 trillion in spending per year and may create continual long-term investment opportunities

Myth #5: Sustainable investing is expensive and requires a large asset base

Fact: Not always, but it depends on the portfolio.

While having a larger asset base can provide a broader range of investment options, you can invest sustainably regardless of portfolio size. In fact, sustainable investors are more diverse than you think – from individuals who invest a small portion of their portfolio to large foundations or non-profits with specific mandates.

The fees associated with sustainable investments can vary, and fees depend on several factors, including the type of investment, the fund manager and the specific strategies employed. Here are some considerations:

- Mutual funds and ETFs: Some sustainable mutual funds and exchange-traded funds (ETFs) may have higher expense ratios compared to their non-sustainable counterparts. This can be due to the additional effort required to evaluate companies based on ESG criteria. However, the difference in fees is not always significant, and many sustainable funds are cost-competitive.

- Active versus passive management: Actively managed sustainable funds (where fund managers actively select investments based on ESG criteria) tend to have higher fees compared to passively managed funds. Passive sustainable funds often have lower expense ratios.

- Impact investing and private equity: More specialized sustainable investments, such as impact investing funds or private equity funds focused on sustainability, may have higher fees due to their niche nature and intensive due diligence.

It's important to carefully review the fee structure of any investment product, sustainable or otherwise. Look for information on expense ratios, management fees and any other associated costs with your advisor.

Discover more about sustainable investing

Sustainable investing offers unique opportunities to better align a portfolio with personal goals beyond just financial returns.

To explore sustainable investing and the range of strategies available on our platform, get in touch with an advisor.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Head of Sustainable Investing, J.P. Morgan Wealth Management