Sectors to watch in 2025: Opportunities and risks for long-term investors

Editorial staff, J.P. Morgan Wealth Management

- Policy uncertainty and innovation are prompting investors to adopt a more selective approach to the sectors they invest in.

- Artificial intelligence, bank deregulation and security spending are cross-sector trends.

- Financials, utilities and international industrials offer potential; health care and energy face headwinds.

Investing through a shifting economic and policy backdrop

Approaching the halfway point of 2025, investors face an environment where macroeconomic direction is unclear and returns are concentrated in a narrow set of stocks. "This doesn’t feel like a rising tide lifting all boats kind of year," said Elyse Ausenbaugh, Head of Investment Strategy, J.P. Morgan Wealth Management. Instead of counting on broad market growth, many are reassessing sector exposure to better align with the current policy environment and economic trends.

Recent shifts in government spending priorities, global security concerns and the spread of new technologies are influencing where people are putting their money. Themes such as artificial intelligence (AI), easing of financial regulations, and increased focus on national and energy security are touching multiple sectors, pushing investors to think more carefully about where future returns might come from.

Technology: More than just Big Tech

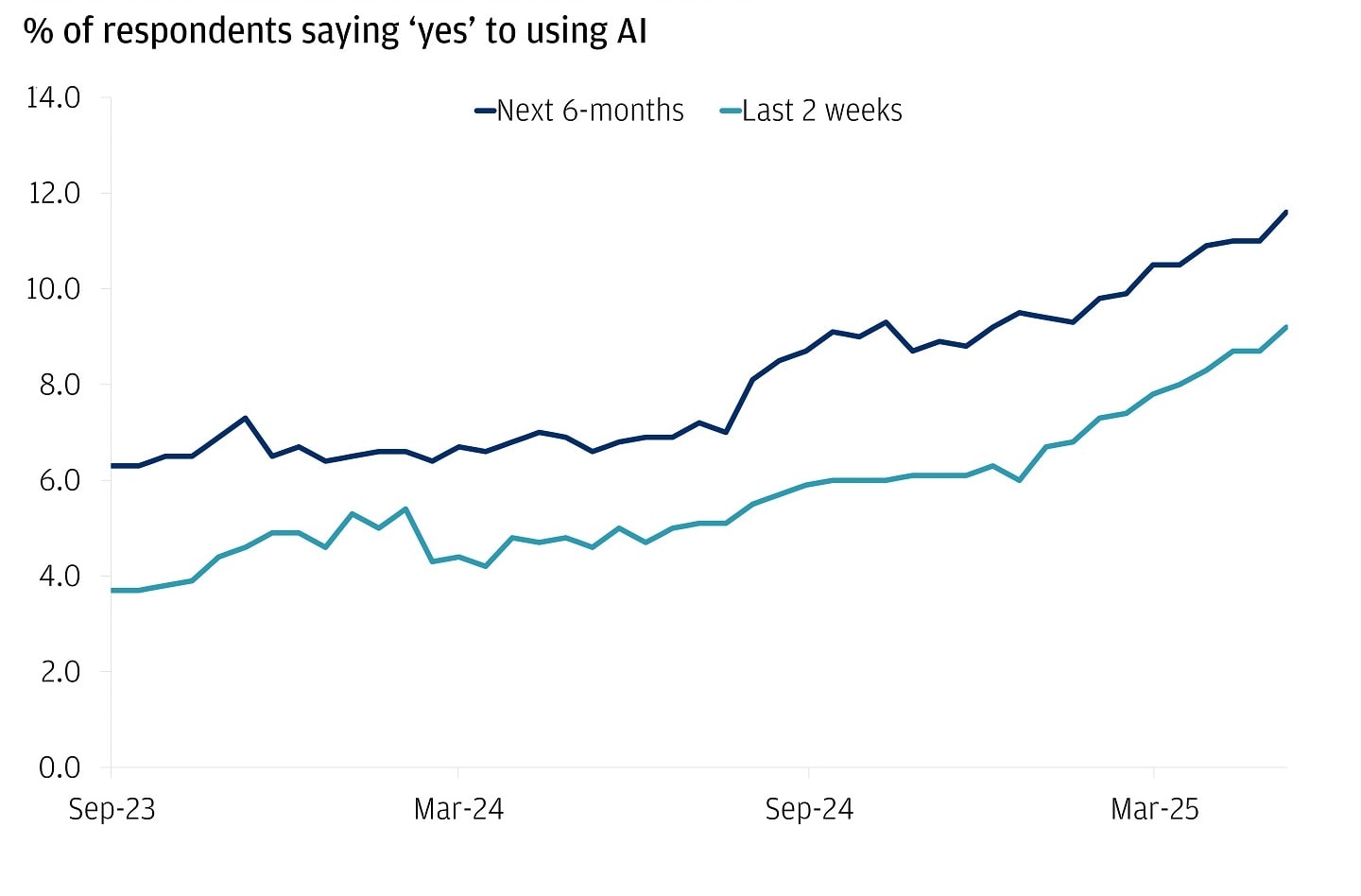

AI is no longer a niche story. As the cost of this technology has decreased, corporate adoption has doubled, noted Abigail Yoder, Equity Strategist at J.P. Morgan. This trend is expanding across industries, with companies adopting AI to enhance productivity, streamline operations and reduce costs. While large tech firms remain prominent in portfolios, it’s increasingly the supporting players, like those enabling cloud infrastructure, enterprise software and data security, where investors are focusing their attention.

More companies are expecting to use AI

Watch: Navigating Market Opportunities In Uncertain Times: Powerful Insights for Online Investors

Tuesday, June 17, 2025

J.P. Morgan Wealth Management hosted a webcast on the potential opportunities and challenges in the current market landscape; perspectives on sectors that may outperform or underperform in the year ahead; and how to use the Chase Mobile app and Chase.com to help find investments, validate an idea and manage your portfolio. Watch our webcast, featuring Andrea Finan, Head of Self-Directed Investing, J.P. Morgan Wealth Management, in conversation with Elyse Ausenbaugh, Head of Investment Strategy, J.P. Morgan Wealth Management, and Abigail Yoder, Equity Strategist, J.P. Morgan.

Financials: More flexibility, more potential

Regulatory easing is shaping investor expectations for the financial sector. “It opens up the ability for larger banks to lend to the economy. They have $200 billion in excess capital on their balance sheet, and they have more options with what to do with it,” Yoder said, referring to major U.S. banks. That capital could fuel new lending, acquisitions or capital returns to shareholders. If banks are allowed to take a more active role in capital deployment, the sector may see more consistent performance.

Utilities: Stable with growth potential

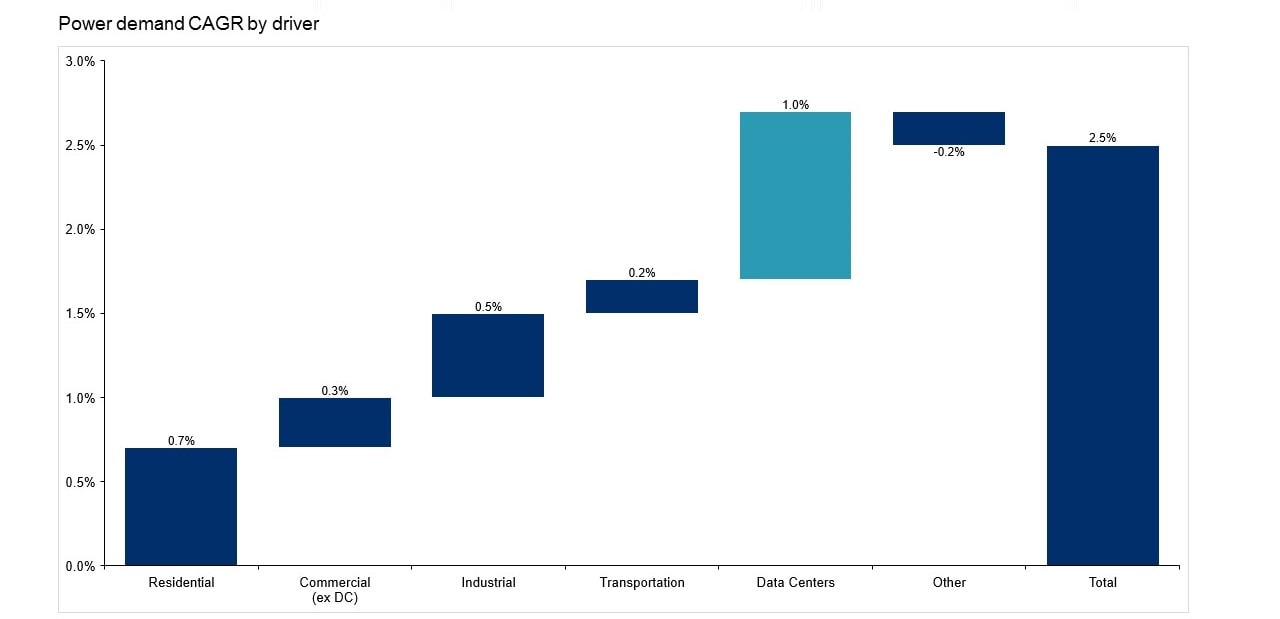

Utilities are typically viewed as conservative holdings. But growing electricity demand, especially from AI data centers and infrastructure upgrades, is shifting that view. The sector, which has historically grown earnings by about 5% per year, could now accelerate to 8%, according to Yoder. This change is prompting investors to look at utilities as a potential source of both income and long-term growth.

Power demand is expected to grow at a 2.5% CAGR through 2030 due to multiple drivers

Industrials and infrastructure: Building for security

Spending on national resilience is supporting a wide range of industrial businesses. It’s not just defense – it’s energy security, cybersecurity and supply chain resilience. Governments are prioritizing infrastructure and logistics upgrades, and companies that support those initiatives are getting more attention. From equipment providers to engineering firms, these areas are increasingly tied to broader policy agendas.

Outside the U.S., similar themes are playing out. In Europe and Japan, government investments in energy security, industrial resilience and digital infrastructure are expected to drive demand for regional firms. This has made international industrials and infrastructure providers more relevant for long-term portfolios. Additionally, if foreign currencies strengthen against the dollar, that could enhance returns for U.S.-based investors holding international assets.

Sectors that may face headwinds

Health care, which has often been seen as a safe haven, is under pressure. It has been the worst-performing sector so far this year, and Yoder expects that may not change in the near term. New drug pricing rules, concerns over public health funding and international trade policies are all contributing to lower investor confidence. While some areas, such as obesity treatments, are growing, the broader sector outlook remains too uncertain to get excited about.

Additionally, energy companies are grappling with potential oversupply of oil. With both U.S. and global producers planning more output, oil prices may stay subdued unless demand meaningfully exceeds expectations with an acceleration in the global economy.

The bottom line

Selectivity, diversification and staying invested all matter this year. The trends shaping 2025 suggest it’s less about broad exposure and more about identifying areas with clearer earnings visibility and lighter policy headwinds.

Combining exposure to growing areas like AI, infrastructure and security with more stable sectors such as utilities may help investors build portfolios that are better equipped for uncertainty.

Looking internationally could also support this balance. In markets like Europe and Japan, increased government investment is creating new demand in industries that often don’t get as much attention in the U.S.

Rather than trying to anticipate short-term market direction, the current environment may reward investors who stay grounded in longer-term themes and evaluate where both public and private capital are headed.

Frequently asked questions about sector investing

Technology, financials, utilities and industrials related to security spending are drawing more attention. These areas are influenced by trends like AI adoption and infrastructure investment.

Policies on drug pricing, funding and trade are dampening confidence in the industry’s profit expectations. While some treatments are seeing demand, the broader outlook for health care remains uncertain.

AI is leading more companies to invest in software and infrastructure that improves efficiency. This is affecting not only tech firms but also utilities and service providers that support data operations.

Shifts in regulation and public budgets can significantly impact a company's performance. In 2025, easier bank rules and larger security-related budgets are shaping the financials and industrials outlook.

Yes. Global regions like Europe and Japan are seeing an investment landscape shaped by similar themes. For some investors, this makes international exposure a potential complement to U.S. holdings.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Editorial staff, J.P. Morgan Wealth Management