Preserving your wealth

Managing Director, Head of Wealth Planning and Advice, J.P. Morgan Wealth Management

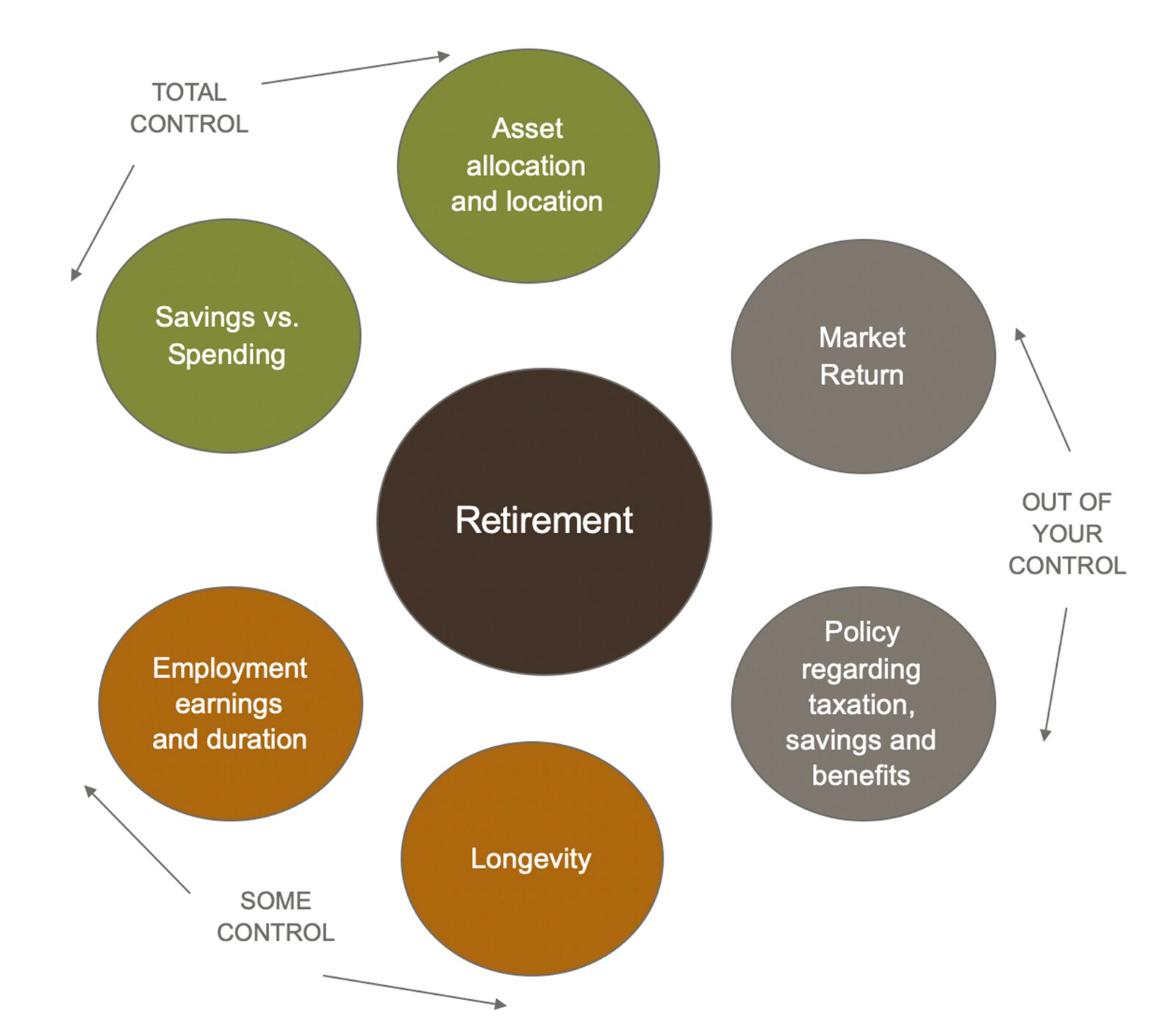

Managing factors within your control that impact your wealth, such as spending and saving, and preparing yourself for factors you cannot control, such as down markets and changes in financial and tax policy, are essential when thinking about how to hold and invest your wealth. Whether your goal is to enjoy your wealth during your lifetime, create a lasting legacy for your family members, engage in philanthropy, or all of the above, there are multiple factors that can affect whether you will have sufficient assets to achieve your goals.

Know and monitor your spending

Monitoring spending is a critical factor in preserving wealth, in particular because your spending is within your control. Expenses generally fall into two categories: necessary spending (e.g., housing costs, food) and discretionary spending (e.g., restaurants, vacations, gifts, second residences). Monitoring your spending is an easy way to identify discretionary spending that can be curtailed if necessary. This includes reducing spending not only in times of global or market uncertainty, but also when expenses arise that were unexpected but become necessary over time (e.g., caring for an aging parent, home improvement).

Your spending habits and rate of savings can also impact your ability to retire. A low current spending rate coupled with a high current saving rate could provide for sufficient future income to allow you to retire earlier than anticipated. On the other hand, spending more now may require that you continue to work past your desired retirement age in order to amass sufficient savings to provide for retirement.

Knowing your spending habits will enable you to adapt them as necessary from time to time; this can have a meaningful effect on whether your portfolio will be able to last for the long term and enable you to retire when you’d like.

Plan for the future you want with J.P. Morgan Wealth PlanSM

Having a plan can help you achieve financial freedom. Get started on yours with J.P. Morgan Wealth PlanSM, an award-winning digital money coach in the Chase Mobile app® and chase.com.

Benefits of diversifying a portfolio

Diversifying your portfolio can also help ensure that your wealth is positioned well to bear the brunt of forces beyond your control (e.g., market volatility and changes in tax policy). While it is almost impossible to eliminate the wealth-eroding effects of external forces, there are ways to temper them. Asset allocation is one of the most effective long-term investment techniques. Asset allocation generally can be more significant than asset selection or even market timing when considering the likelihood of a portfolio’s success, since it balances an investor’s risk tolerance (i.e., willingness to take risk) against his or her financial situation and risk capacity (i.e., ability to take risk and potentially lose money). Though the returns of a fully diversified portfolio may not always be as high as they might otherwise be with a less-diversified portfolio, losses are usually lower, which can help to protect an investor’s wealth in times of financial decline.

Asset location matters too. As one simple example, owning municipal bonds in a tax-deferred or tax-free account doesn’t make a lot of sense; you’re giving up yield without getting any benefit. Instead, owning municipal bonds in a taxable account (where you can realize the benefit of tax-free income) and taxable bonds in a tax-deferred or tax-free account can allow you to increase your overall return. Similarly, high-turnover stock strategies that result in a lot of realized capital gains often yield better overall results in a tax-deferred account. While everyone’s situation is different, optimizing the location of your assets can provide you with additional benefits as you work to achieve your financial goals.

A holistic view of your portfolio, with an eye to the long term, can help to set you on the path to live the life you want to live and leave the legacy you want to leave. Contact a J.P. Morgan professional to review or create a wealth management plan that helps protect against wealth erosion.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Managing Director, Head of Wealth Planning and Advice, J.P. Morgan Wealth Management