New York estate planning

When putting together an estate plan or any financial plan, you and your tax and legal advisors should consider the various different state laws that could impact the plan in addition to federal laws. Here are some important items to think about for individuals with ties to New York State.

Estate taxes and calculation of estate taxes

New York is one of 15 states (and the District of Columbia) that imposes a state level estate or inheritance tax on its residents (and even some non-resident property owners) at the time of death. This tax is in addition to the estate tax imposed by the Federal government. The top New York estate tax rate is 16%.

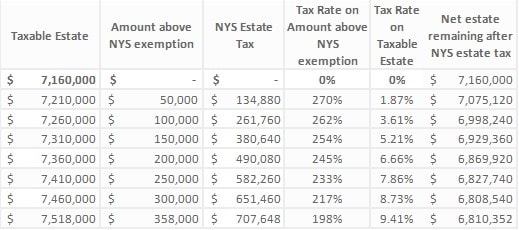

The New York estate tax is calculated quite differently from the Federal estate tax. Generally, for New York estate tax purposes, if the value of assets passing to beneficiaries other than a spouse or charity is below a certain threshold ($7.16 million in 2025), the assets are fully exempt from tax and no New York estate taxes will be due. However, the exemption begins to phase out at values over the threshold, and if an estate is more than 5% over the threshold (which is $7.518 million in 2025), the estate completely loses the exemption and the full value of the estate’s assets will be subject to New York estate tax. Because of this drastic drop in estate tax protection for estates over the New York threshold, the New York estate tax is often called a “cliff tax.” Estates whose values fall between the threshold amount and the 5% excess will be partially subject to New York estate tax.

Very few people understand how this works in practice. The table below can help illustrate the impact of the New York “cliff tax” on estates valued between the threshold ($7.16 million in 2025) and 105% of that amount ($7.518 million in 2025).

Speak with your J.P. Morgan and legal advisors if you’re interested in discussing strategies that can help mitigate the effects of the New York cliff tax.

Protect your legacy with a trust

Explore self-directed investing and managed trust account options with J.P. Morgan Wealth Management to help you distribute your assets according to your wishes and make your estate planning easier.

Estate tax portability

Portability is the ability for married couples to aggregate their lifetime gift and estate tax exemption amounts. In practice, this means that a surviving spouse inherits any unused portion of the deceased spouse’s estate tax exemption. Portability is only available at the federal level (and only for gift and estate tax; it does not apply to the generation-skipping transfer tax.) Portability also does not apply to the New York estate tax. This means that the New York estate tax exclusion must be used by each spouse at his or her respective death; if the first spouse to die does not use his or her exclusion, it is wasted.

If the first spouse to die leaves all assets to the surviving spouse – whether directly under a will or revocable trust or because assets are held jointly with rights of survivorship – that spouse would not use up his or her exclusion amount since there is no estate tax imposed on transfers between U.S. citizen spouses. Therefore, married New Yorkers who think they may be subject to New York’s estate tax may want to structure their estate plans so that the first spouse’s exclusion is used on the first spouse’s death while still providing the surviving spouse access to the funds during his or her lifetime. Note that certain information must be filed with the IRS on the first spouse’s death in order to get the benefit of portability.

Gift tax

There is no New York gift tax, meaning that New York taxpayers can make gifts to beneficiaries during their lifetimes without the imposition of a New York gift tax. However, the value of gifts made within three years before death are included when calculating the New York estate tax, thereby imposing a “de facto” gift tax on assets given away within three years before death. A donor will need to survive for at least three years from the date of a gift to ensure that the value of a gift avoids New York estate tax upon their death. Note that there is a Federal gift tax on transfers during lifetime.

There are some exceptions to this rule, notably for real property or tangible personal property located outside of New York State. If you are concerned that you may be subject to the New York clawback, work with your tax and legal advisors to determine whether you may be able to make gifts of non-New York assets to bring your estate below the threshold.

Income tax

New York levies a state personal income tax in addition to the Federal income tax. New York applies two distinct tests to determine whether an individual is subject to the New York income tax in a given year. The first test is called the domicile test, and this covers individuals who are domiciled in New York – that is, individuals who always expect to come back to New York and treat New York as their home, regardless of whether they are physically located in New York. This is a subjective test so it is important to work with a tax advisor to understand whether you are considered domiciled in New York for New York income tax purposes.

The second test is the statutory residency test, which covers individuals who are not domiciled in New York but who both spend at least 183 days in New York and maintain a residence in New York for 10 or more months of the year. This test is more objective and should be considered with your tax advisor as you plan your income taxes each year.

Rights of spouses upon death or divorce

Death: New York typically entitles the surviving spouse to an outright one-third of a deceased spouse’s assets upon death regardless of what the deceased spouse’s estate planning documents dictate. While many spouses may decide to provide less than this in their estate planning documents (or provide assets in trust rather than outright), the surviving spouse will have the option – unless it’s been waived in a marital or other agreement – to take what is given to them in the documents or elect to take their one-third outright.

Divorce: When a couple divorces in New York, each spouse typically receives by default one-half of the couple’s marital property – that is, the assets that the couple acquired during the marriage, plus any appreciation on both the couple’s marital property and separate property. A spouse’s separate property – that is, the property with which they entered the marriage – typically will be kept by that spouse upon divorce. Inheritances and gifts are generally considered a spouse’s separate property and, unless they were converted to marital property, should be protected from division upon divorce. The application of this rule is beyond the scope of this document; you should consult a family lawyer to discuss your personal situation.

Regardless of the rights upon death or divorce in New York, spouses can negotiate different rights under a pre- or post-nuptial agreement (and often do when the defaults under New York law may not be desirable).

This article discusses only a number of the many special considerations for New York residents and taxpayers as they think about their tax, trust and estate planning. Your J.P. Morgan professional is here to partner with you and your tax and legal advisors to ensure that your wealth plan takes into account these and other important state nuances.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Managing Director, Head of Wealth Planning and Advice, J.P. Morgan Wealth Management

Associate, Wealth Planning & Advice