Estate planning in a low interest rate environment

Managing Director, Head of Wealth Planning and Advice, J.P. Morgan Wealth Management

Low interest rates may provide an opportunity to transfer wealth with little or no gift tax cost.

Consider estate planning opportunities while rates are low

In a low interest rate environment, investors are able to take advantage of certain lending strategies that can potentially leverage the low interest rates in order to transfer wealth with little or no gift tax. To the extent that an investment made with borrowed money returns an amount that exceeds the interest rate on the loan, the excess will belong to the borrower. The impact of a low interest rate can be magnified when lending non-cash assets whose value can be discounted, since the annual loan payments will be calculated on the discounted value. (If the loan payments are made “in kind” – that is, using the discounted asset – the benefit of the discount will be reduced. In addition, planning with a discount will require an appraisal.)

The techniques described below enable senior family members (lenders) to:

- “Freeze” the value of the assets that they lend, which would generally be included in their estates for estate tax purposes

- Pass the asset’s appreciation to junior family members or trusts for their benefit (borrowers)

This planning could be especially beneficial for an individual who has already used up his or her gift tax exemption since, if structured properly, the transaction can be accomplished gift-tax-free.

In the past, Congress had proposed legislation to diminish or, in certain cases, eliminate the benefits of some of these strategies. In addition, as interest rates rise, the benefit of these strategies is reduced. As a result, you may want to capitalize on these opportunities while interest rates are low should future legislation or interest rate changes make them less economical.

Intra-family loans

The simplest way for an individual to plan around low interest rates is to make a cash loan to the person whom he or she wishes to benefit. The loan should be documented with a note, which can provide for interest-only payments for a term of years (which generally will be taxable to the lender, and may be deductible by the borrower) and a balloon payment upon maturity. The borrower should be creditworthy.

If the assets purchased with the loan appreciate in excess of the interest rate on the note, the spread between the return and the interest rate will accrue to the borrower on a gift-tax-free basis. In addition, if the interest rates in effect at the time the loan matures remain low, the lender and borrower can refinance at that time, extending the benefits of this strategy.

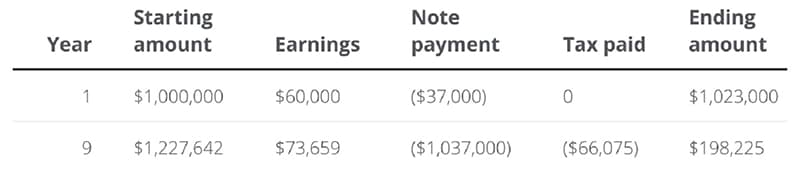

Example 1: 9-year intra-family loan

Assume a $1 million cash loan made in December 2024 to a child in exchange for a 9-year, 3.7% interest-only note with a balloon payment upon maturity. The cash is invested in an asset that generates a 6% pretax annual return. After nine years, the child would have $198,225.

Protect your legacy with a trust

Explore self-directed investing and managed trust account options with J.P. Morgan Wealth Management to help you distribute your assets according to your wishes and make your estate planning easier.

Installment sale to an intentionally defective grantor trust (IDGT)

Before diving into the strategy, let’s understand what an “intentionally defective grantor trust” (often known simply as a grantor trust) is. An IDGT is a trust that is structured so that the grantor – not the trust – is responsible for paying tax on income earned in the trust. This allows the trust’s assets to grow effectively income-tax-free. (A non-grantor trust pays its own taxes, with highly compressed brackets.)

If a trust is a grantor trust, it also means that transactions between the trust and the grantor are ignored for income tax purposes. This means that sales by a grantor to his or her trust do not trigger capital gains tax, and interest paid on a note is neither deductible by the trust nor taxable to the grantor.

An installment sale to an IDGT functions like an intra-family loan, except that:

- The borrower is a trust, structured as a grantor trust for income tax purposes, and the lender is the donor of the trust

- The sale is often of non-cash assets.

Any asset appreciation over the applicable interest rate will accrue to the trust rather than the donor. This strategy is more complex than an intra-family loan, since the lender needs to create a trust and fund it with seed capital to ensure that the trust is a creditworthy borrower – a transaction involving a loan to an undercapitalized IDGT could have negative estate tax consequences for the donor. However, the estate planning benefits of this transaction can be greater than those of an intra-family loan since the assets in the trust grow on an income-tax-free basis. These benefits can be even more significant when the sale is of a discounted asset.

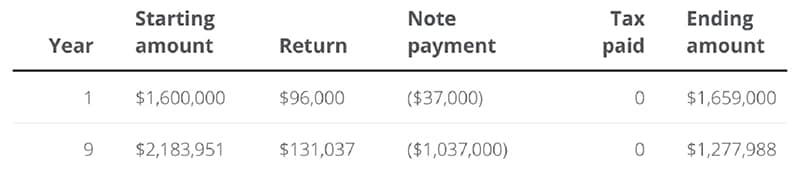

Example 2: 9-year IDGT installment sale

Assume a sale to an IDGT in December 2024 of a partnership interest with a net asset value of $1.5 million and a discounted fair-market value of $1 million. The sale is in exchange for a $1 million, 9-year, 3.7% interest only note with a balloon payment upon maturity. The partnership interest generates a 6% pre-tax return. After paying off the note in nine years, the IDGT would have $1,277,988 of value – which is now held by the trust for its beneficiaries.

Grantor retained annuity trust (GRAT)

A GRAT is a grantor trust to which the donor transfers property and from which the donor receives an annuity payment each year for a term of years. Each annuity payment (whose value is fixed as of the date the GRAT is funded) consists of both an interest and principal portion. If any property remains in the GRAT after the final annuity payment is made (i.e., if the assets appreciate more than the applicable interest rate) and the GRAT is “zeroed-out,” the property will pass to the remainder beneficiaries (outright or in trust) free of gift tax; people who have already used up their lifetime gift tax exemptions will often use zeroed-out GRATs to transfer wealth to their beneficiaries gift-tax-free. “Zeroing out” a GRAT means that the annuity payments are calculated to result in no or a nominal residual value when the GRAT is created. In this way, a GRAT can potentially transfer value with no use of gift tax exemption and no gift tax cost, unlike a sale to an IDGT, where an initial gift is required to make the IDGT creditworthy.

Similar to an installment sale to an IDGT, the transfer of property to the trust will not trigger a capital gains tax to the donor, and the annuity payments from the trust to the donor will not be taxable. However, because the annuity payments include repayment of principal, unlike in an installment sale, the economic benefits of a GRAT may not be as favorable. As a result, individuals sometimes create a series of short-term, rolling GRATs (the donor funds a new GRAT each year with the annuity from the previous GRAT) rather than a single GRAT, to increase the wealth transfer benefits and capitalize on market volatility.

Example 3: 5-year GRAT

Assume a gift to a 5-year GRAT of a partnership interest with a net asset value of $1.5 million and a discounted value of $1 million, with a 4.4% IRS interest rate. The partnership interest is reinvested in an asset that generates a 6% pretax return. After five years, the remainder beneficiaries would receive $726,821.

Charitable lead annuity trust (CLAT)

A CLAT functions in the same way as a GRAT except for one key difference: the annuitant is a charity rather than the grantor. As compared to other techniques, CLATs serve to reduce a donor’s estate rather than freeze its value, since the donor does not receive any annuity payments. As a result, a CLAT can be an attractive solution for individuals who:

- Are philanthropic

- Are comfortable with losing control of, and income from, the assets with which they want to do planning

- Wish to transfer asset appreciation to individual beneficiaries without paying gift tax (if they zero-out the CLAT by selecting an appropriate annuity payment)

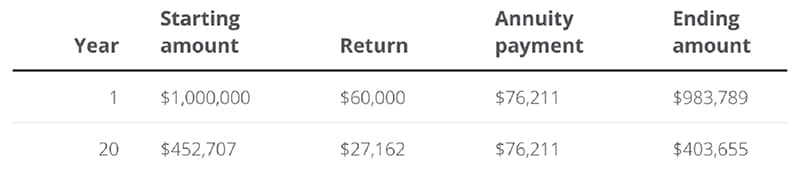

Example 4: 20-year CLAT

Assume a cash gift of $1 million to a 20-year CLAT, with a 4.4% IRS interest rate. The cash is invested in an asset that generates a 6% pre-tax return. After 20 years, charity would have received a total of $1,524.227.60 and the remainder beneficiaries would receive $403,654.85.

For more information and additional considerations relating to any of these strategies, contact a J.P. Morgan professional.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

Managing Director, Head of Wealth Planning and Advice, J.P. Morgan Wealth Management