Crypto ownership surges, new JPMorgan Chase research reveals

President, JPMorganChase Institute

- New JPMorgan Chase Institute research reveals that crypto ownership has surged over the last five years, rising from just 3% before 2020 to 13% by June 2022.

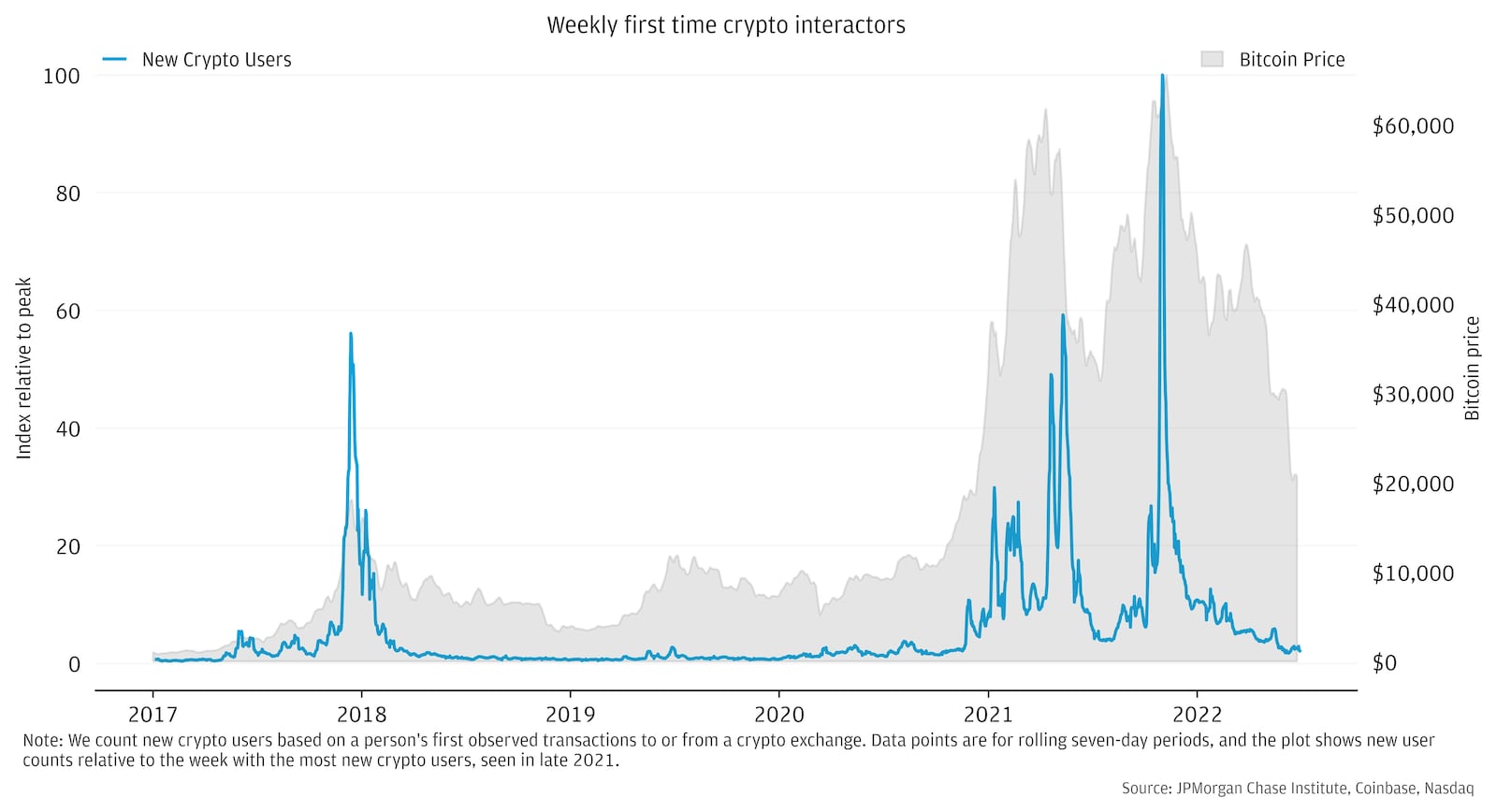

- Many people began their crypto journeys during the pandemic, coinciding with rising savings and spikes in crypto prices.

- Lower income Americans faced worse investment returns.

- However, broader economic risk may not be a huge concern as most people invested limited amounts, and many who did might be able to recover in the long-term.

Crypto ownership has surged over the last five years, rising from just 3% before 2020 to 13% by June 2022, according to the JPMorgan Institute.

As little as five years ago, crypto-assets were a niche topic, used only by the most risk-tolerant early adopters. However, as the value of crypto has risen and more people built up savings during the pandemic, investing has become more mainstream, with major companies dipping their toes in the water and more Americans taking the plunge. However, the recent fall of key crypto players, and its ripple effect across the industry, coupled with inflation and the threat of recession looming over household budgets, has left many people wondering how big the crypto market is for the average American, and how will it impact people’s financial health?

New research from the JPMorgan Chase Institute, “The Dynamics and Demographics of U.S. Household Crypto-Asset Use” looks at how Americans have engaged with the crypto market over the last few years, and the impact it can have on people’s overall wealth.

Looking to invest in cryptocurrency ETFs?

We offer unlimited $0 commission online trades on a variety of cryptocurrency ETFs with a J.P. Morgan Self-Directed Investing account

How it started

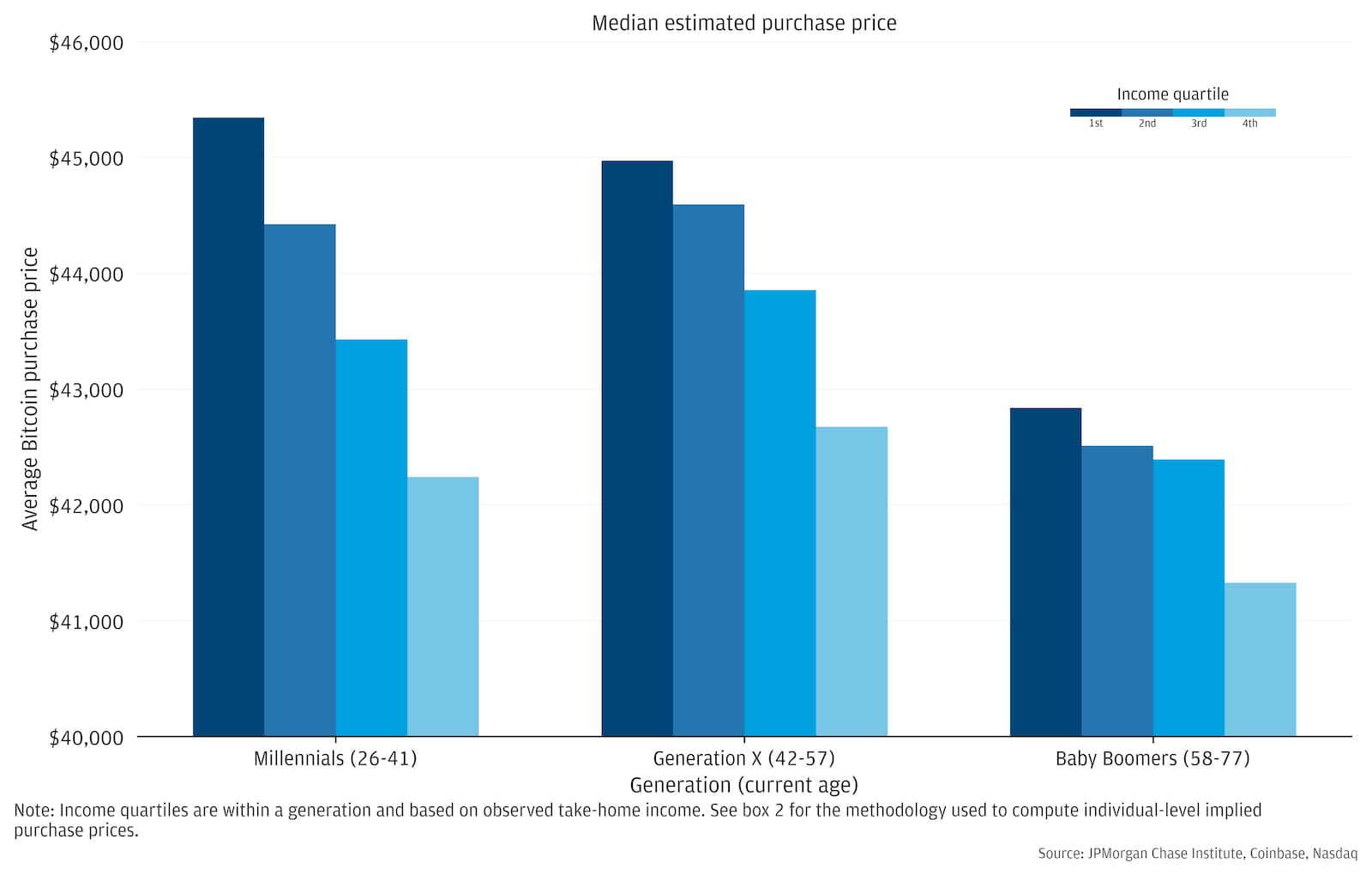

So many people began their crypto journeys during the pandemic, coinciding with rising savings and spikes in crypto prices. The report found that the typical transfer occurred when bitcoin was around $43,900. However, that number varied across income groups – higher income individuals tended to make transfers at a lower average price of $42,400, while the figure for lower-income individuals was $45,400. These differences suggest that lower income Americans faced worse investment returns. As of June 2022, the price of Bitcoin was around $17,000, less than half the value that people bought at.

What does this mean moving forward?

Following the recent crypto crash, does this mean that the Americans who invested should anticipate a harder year?

Probably not—or at least not drastically. While the typical investor faces significant losses on their investments, especially compared to the value they invested, the majority of Americans only dabbled. According to the report, most people only had small holdings in crypto, around $620 or equal to, on average equal to a week’s worth of take-home income. For individuals with higher incomes, that meant higher transfers into crypto accounts, but also a higher ability to weather the risks that come with a new and relatively unregulated asset.

As crypto values began dropping in 2022 following spikes the year earlier, the majority of Americans engaging in trades likely lost a lot of the money they had invested. However, because the investments were relatively small compared to their overall wealth, the long-term effects on their financial health would be less. However, 15% of Americans transferred more than a month’s worth of their income into crypto during this time, leaving them more vulnerable to the significant shocks to the market.

Who was impacted?

13%, or nearly one in eight Americans, were introduced to crypto during this time period, but not everyone was investing equally. According to the report, crypto usage was broader and deeper amongst men, Asians, and younger Americans with higher incomes. Across age groups, men were more likely to have jumped into crypto, with average transfers of $1,000, compared to $400 for women. Asians were also more likely to trade in crypto, making up 27% of crypto users. In comparison, Black and Hispanic and Latino users made up 21% of users, and White individuals made up 20%.

Finally, the report found that the majority of crypto users in the United States were overwhelmingly younger, with millennials making up 20% of crypto involvement rates, compared to 11% and 4% for Generation X and baby boomers, respectively. Younger Americans might have more disposable income and more years of earning power that enable them to make this decision.

The bottom line

Overall, while average American involvement in the crypto market has increased significantly over the last couple of years, broader economic risk may not be a huge concern as most people invested limited amounts, and many who did might be able to recover in the long-term.

As elected officials, industry leaders and consumers consider the future of crypto and the average American’s participation in it, steps taken to protect investors, companies and the broader economy should consider the wide spectrum of people involved.

Invest your way

Not working with us yet? Find a J.P. Morgan Advisor or explore ways to invest online.

President, JPMorganChase Institute