To sign up for Chase Payment Solutions® reach out to a Payments Advisor at 1-877-843-5690 or fill out this short form.

Best-in-class terminal for fast and reliable payments

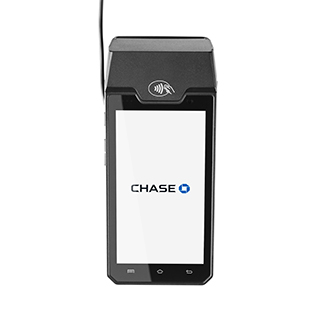

Sleek, wireless, easy-to-use credit card terminal with convenience at its core, so you never miss a sale — backed by the trusted power of Chase.

SELL ANYTIME, ANYWHERE IN THE U.S.

Wireless, handheld terminal

Lightweight, Wi-Fi and 4G-enabled credit card machine to accept tap, dip, swipe or keyed-in card payments at your counter or on-the-go. Print receipts on the spot.

ACCEPT PAYMENTS WITH STYLE

Modern design

Android-based terminal with a large color touchscreen and a variety of customization options to fit your business needs.

SPEED THROUGH CHECKOUT

Powerful payment processing

Our fastest terminal yet — more processing power and memory to speed up your transactions. Plus, it can handle up to 1,000 transactions on one charge.

SIMPLIFY YOUR BOOKKEEPING

Chase + Quickbooks® Online

Sync your card sales processed with Chase directly to Quickbooks.

GROW AND OPTIMIZE YOUR BUSINESS

Chase Customer Insights

A proprietary business intelligence platform with analytics you can use to better reach customers and manage your bottom line.

Fast access to cash

Improve your cash flow with next-day deposits, at no additional cost, when you direct your funds to a Chase business checking account.

24/7 customer support

Live expert guidance is available when you need it. Self-service is accessible anytime in the support center.

Sell with confidence

Chase’s fortress-level security, industry-leading systems and Fraud Protection services help keep your payments safe.

Fair and transparent pricing. No hidden fees.

Competitive credit card processing rates

Enjoy next-day funding at no additional cost when you direct your funds to a Chase business checking account.

2.6% + 10¢

Tap, dip, swipe transactions

3.5% + 10¢

Keyed in transactions

from $9.95

Monthly fee

To learn more about additional options, reach out to a Payments Advisor at 1-877-843-5690 or fill out this short form.

See our credit card terminals in action

Discover the features of the Chase Countertop and Wireless Terminals. Whether you prefer a reliable wired connection or the freedom to accept payments on the go, we have you covered.

Freedom card used for illustrative purposes.

"Ultimately, we chose Chase for the low credit card processing rates and the great customer service."

Lorraine Brock

Owner, Get Organized!

Customers were told in advance they may be featured in an ad.

Read more stories from our merchants

DEMYSTIFY PROCESSING FEES

A crash course on card processing fees

Learn to identify payment processing fees and choose the best options with our handy pricing cheat sheet.

To sign up for Chase Payment Solutions reach out to a Payments Advisor at 1-877-843-5690 or fill out this short form.

Explore our credit card terminal lineup

Chase Wireless Terminal

Our most powerful credit card terminal designed to process transactions quickly in-store or wherever you are.

$499

Chase Countertop Terminal™

Modern wired credit card terminal designed to process transactions quickly at the counter.

$399

Explore solutions for your industry

Sign up for Chase Payment Solutions today

Reach out to a Payments Advisor at 1-877-843-5690 or fill out this short form.

Frequently asked questions

Existing clients that already have a terminal can call into the support team to update equipment. New clients can contact our Sales team for onboarding details. Reach out to a Payments Advisor at 1-877-843-5690 or connect with us.

Visit the Chase Wireless Terminal support page for more details.

The Chase Wireless Terminal comes partially charged and normally takes approximately 2 hours to fully charge.

For merchants taking approximately 10 transactions an hour, the battery will last up to 105 hours on 4G and up to 129 hours on Wi-Fi.

For merchants taking approximately 50 transactions an hour, the battery will last up to 27 hours on 4G and up to 30 hours on Wi-Fi.

Chase Wireless Terminal model name is Ingenico DX8000.

The dimensions of the Chase Wireless Terminal are 7.79" x 3.26" x 2.46" and it has a 6" display.

Chase automatically imports your card payments into the QuickBooks Online bookkeeping accounts of your choice on a daily basis. As a Chase for Business customer, you may enable QuickBooks Online integration at no additional cost. However, pricing for QuickBooks Online software varies by plan.

Need help with the Chase Wireless Terminal?

Find the answers you need and get 24/7 merchant support.