Invest in stocks to help grow your wealth

J.P. Morgan Wealth Management makes trading stocks easy with $0 commission online trades.

Already have a J.P. Morgan account? Keep an eye on your investments and review your portfolio to help you reach your goals.

Learn more about stocks

What is a stock?

A financial security that represents a share of a company, which makes stockholders partial owners of the company. Depending on the type of stock, investors may receive dividends and have voting rights in the company's shareholder votes.

How do stocks work?

Stocks are generally bought and sold on stock exchanges-in the U.S., mainly on the New York Stock Exchange (NYSE) and the National Association of Securities Dealers (NASDAQ), through a brokerage account such as J.P.Morgan Self-Directed Investing. Most investors trade stocks through brokerage firms like J.P. Morgan.

Why trade stocks?

As companies grow and build wealth, so can you. Trading stocks may help you build your wealth by earning capital when you sell stocks at a higher price than you paid or by receiving dividends through your stock ownership. Keep in mind that stock prices can also go down, leading to potential losses.

Investing in stocks with J.P. Morgan

- Securely access all of your J.P. Morgan investment and Chase banking accounts anywhere, anytime on our Chase Mobile® app or at chase.com

- Access thousands of stocks and other investment opportunities from a variety of public companies.

- Save money with unlimited $0 commission online trades so you keep more of your investment.

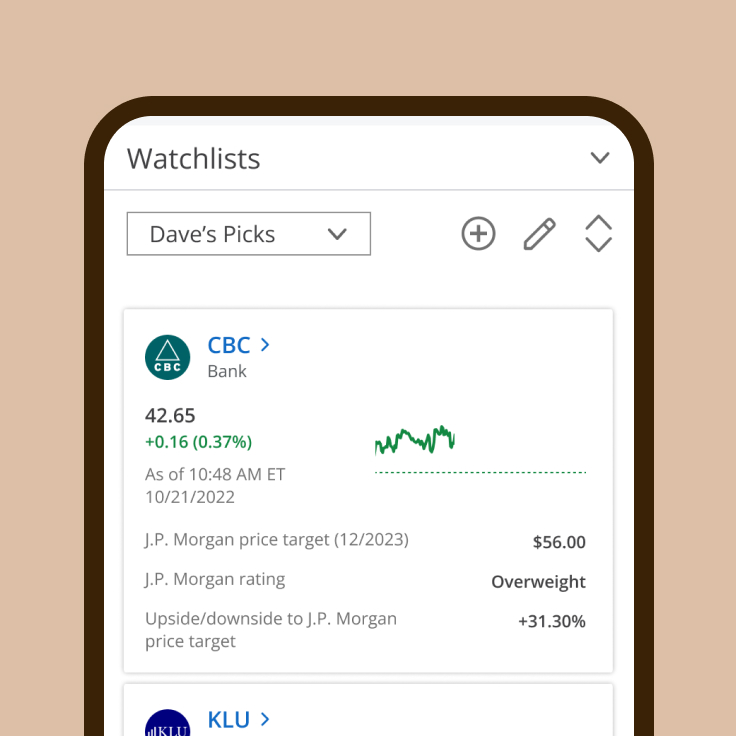

- Tap into J.P. Morgan Research to identify stock market opportunities and help invest with confidence.

Here’s how we can work together

INVEST ON YOUR OWNJ.P. Morgan

Self-Directed Investing

Build your investment portfolio on your own with unlimited $0 commission online trades.

INVEST ON YOUR OWNJ.P. Morgan

Self-Directed Investing

Build your investment portfolio on your own with unlimited $0 commission online trades.

WORK ONE-ON-ONE WITH AN ADVISORJ.P. Morgan

Private Client Advisor

Work 1:1 with a dedicated advisor in your local community to create a personalized financial strategy and build a custom investment portfolio.

WORK ONE-ON-ONE WITH AN ADVISORJ.P. Morgan

Private Client Advisor

Work 1:1 with a dedicated advisor in your local community to create a personalized financial strategy and build a custom investment portfolio.

Already a J.P. Morgan Wealth Management client?

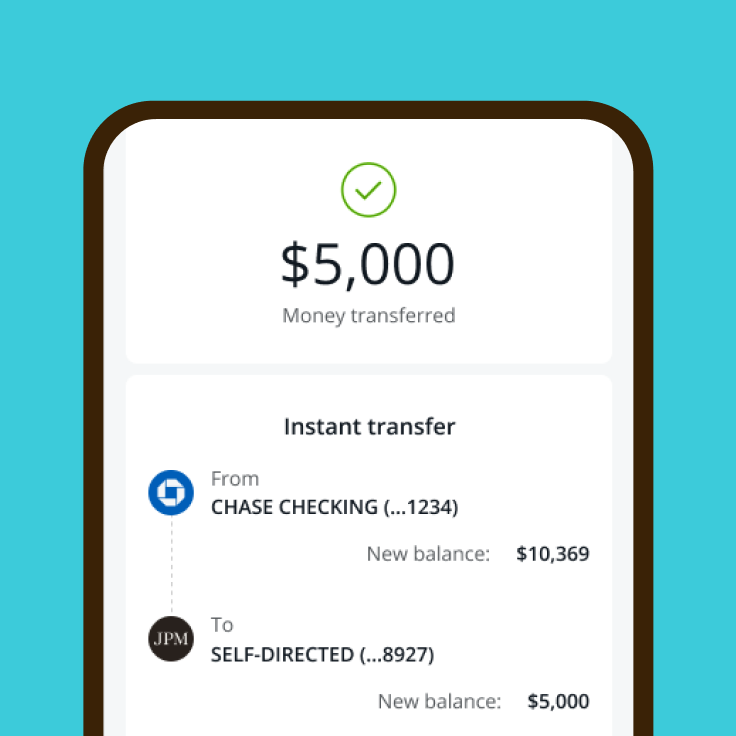

Fund your account

Move cash instantly from a Chase checking or savings account to your J.P. Morgan Wealth Management account—as often as you want.

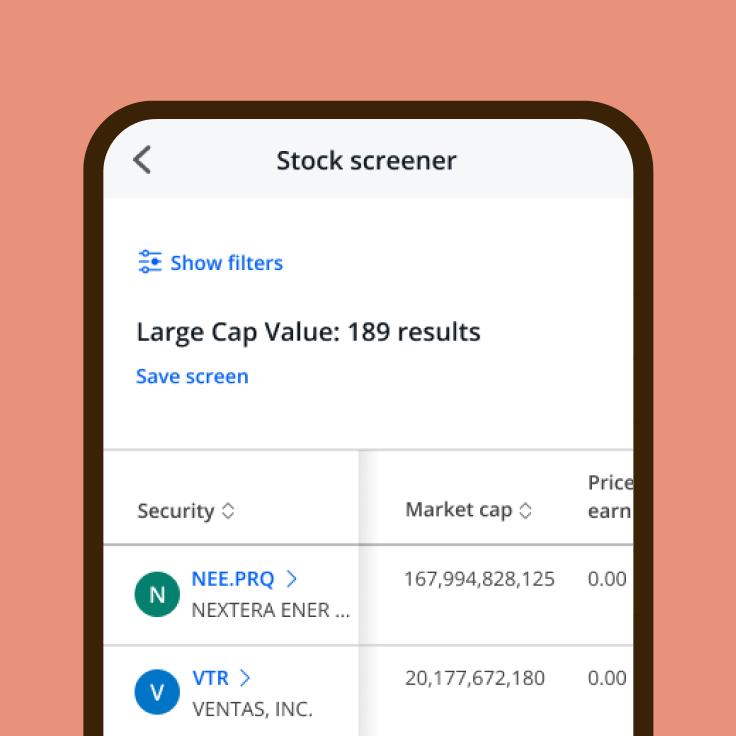

Find stocks

Use our screeners to help you find the stocks that fit your criteria. You can easily add them to your portfolio right in the Chase Mobile® app or at chase.com.

Learn more about our other investment products and accounts

Frequently asked questions

Investing in stocks is investing in publicly traded companies and their potential. As the share price of your stock goes up, the value of the company goes up and you can reap benefits from that growth. Similarly, if the value of the company goes down, you can lose money on your investment.

When a company moves from private to public ownership, it makes shares available to interested investors through the stock market. When you choose to invest, you are buying that company’s shares on a stock exchange. As the share price of your stock goes up, the value of the company goes up and you can reap benefits from that growth. You can also sell stock at a profit as the shares appreciate. However, if the company declines in value, you lose money on your investment.

There are many different types of stocks to invest in, but most fall into two categories: Common stocks and preferred stocks. Both provide investors with a share of the company, but only common stocks allow investors to vote. Common stocks are the most popular type of stock in the market and represent a claim on profits, also called dividends, which fluctuates with the company’s success. Preferred stocks pay investors a fixed dividend, no matter how the stock itself fluctuates.

There are a few ways to invest in stocks with J.P. Morgan. Once you open a brokerage account, you can trade stocks commission-free with Self-Directed Investing, or work with a J.P. Morgan Advisor to plan a financial strategy for your goals.

Anyone 18 years or older can invest in stocks with J.P. Morgan. After opening a brokerage account, you can invest as little or as much as you’d like using our investment tools.

Sharpen your knowledge

What is a stock split?

In a stock split, a company breaks up shares into lower-value shares, reducing the trading price and increasing liquidity. The market cap does not change.

How does the stock market work?

The stock market helps facilitate trades between buyers and sellers. Learn how the stock market works, how to invest and about different markets.

The impact of holding a concentrated stock position

If you have a large portion of your investment portfolio in a single stock, you are in a concentrated stock position, which can create unwanted risk to your portfolio.