Learn more about options

What are options?

Options are contracts that give investors the right to buy or sell a stock or ETF, at a specific price by a given date.

Who can options be appropriate for?

Options are more appropriate for experienced investors who are looking to manage the prospect of changes in market conditions through different options strategies.

Why consider trading options?

Options can be a flexible tool that can help invest in any market condition, hedge your portfolio or potentially generate income.

Investing with options at J.P. Morgan Wealth Management

- Trade options with zero-commissions and per-contract fee of just $0.65.

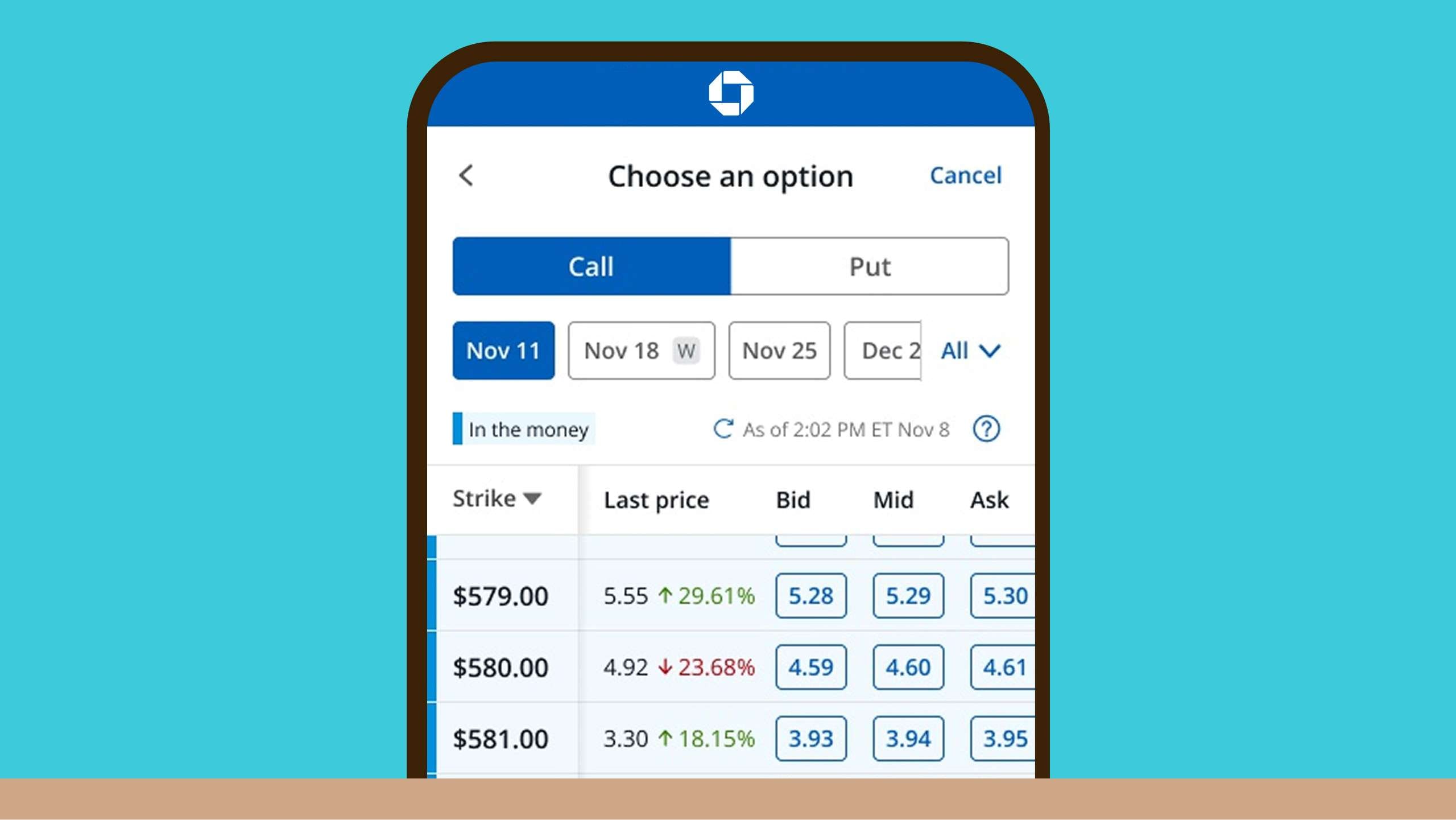

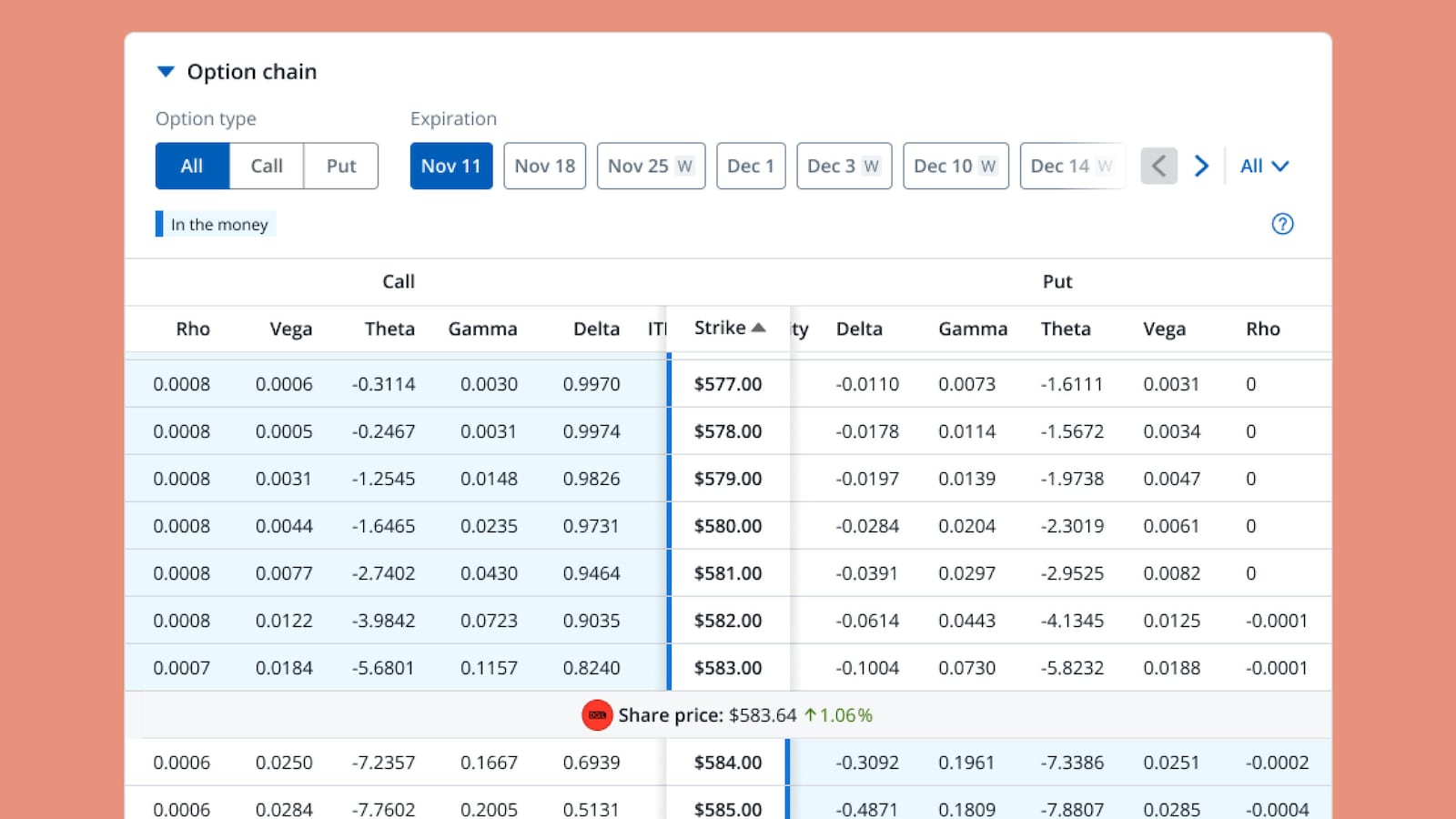

- Use options chains to trade directly from the bid, ask and midpoint prices (execution price may vary).

- Harness the power of J.P. Morgan’s market research to help make informed decisions.

- Monitor your calls and puts from anywhere with the Chase Mobile® app.

Available in general investment accounts and IRAs

Level 1 options strategies:

- Covered calls

- Cash secured puts

- Protective puts

Level 2 options strategies:

- All level 1 strategies, plus

- Long equity calls

- Long equity puts

Margin trading on options is permitted only in general investment accounts and is not available for IRA. Self-Directed Investing margin account is not permitted to sell puts as a cash secured strategy. Options are subject to pre-approval and are not suitable for all investors.

Options strategies in J.P. Morgan Self-Directed Investing

Long equity calls

Buying a call contract gives you the right to purchase shares of a stock or ETF on or before a given date (i.e., the expiration date), at a specific price (i.e., the strike price).

Long equity puts

Buying a put contract gives you the right to sell shares of a stock or ETF on or before a given date (i.e., the expiration date), at a specific price (i.e., the strike price).

Protective puts

If you already own shares of a stock or ETF, buying a put contract can help protect the value of those shares by giving you the right to sell them on or before a given date (i.e., the expiration date), at a specific price (i.e., the strike price).

Covered calls

Selling a call contract against shares of a stock or ETF you already own allows you to generate income; however, if the buyer of the contract exercises their option on or before a given date (i.e., the expiration date), you're obligated to sell the shares at a predetermined price (i.e., the strike price).

Cash secured puts

Selling a put contract by setting aside enough cash to purchase shares of a stock or ETF allows you to generate income; however, if the buyer of the contract exercises their option on or before a given date (i.e., the expiration date), you're obligated to buy the shares at a predetermined price (i.e., the strike price).

Here’s how we can work together

However you choose to invest, we’re here to help you make the most of your money.

WORK ONE-ON-ONE WITH AN ADVISORJ.P. Morgan

Private Client Advisor

Work 1:1 with a dedicated advisor in your local community to create a personalized financial strategy and build a custom investment portfolio.

WORK ONE-ON-ONE WITH AN ADVISORJ.P. Morgan

Private Client Advisor

Work 1:1 with a dedicated advisor in your local community to create a personalized financial strategy and build a custom investment portfolio.

INVEST ON YOUR OWNJ.P. Morgan

Self-Directed Investing

Build your investment portfolio on your own with unlimited $0 commission online trades.

INVEST ON YOUR OWNJ.P. Morgan

Self-Directed Investing

Build your investment portfolio on your own with unlimited $0 commission online trades.

Frequently asked questions

An option is a contract that entitles its owner to buy or sell a specific product (i.e., the underlying asset) at a specific price (i.e., the strike price) on or before a given date (i.e., the expiration date). In exchange for the right to buy or sell at the strike price, the option buyer pays a premium to the option seller.

Options trading is the practice of buying and selling options contracts. Options contracts usually comprise 100 shares or units of the underlying security.

In options trading, much depends on the type of option you’re trading and whether you’re buying or selling. Different types of options support a range of investor goals. For example, buying long equity calls gives you the right to purchase shares in the agreed-upon asset if its market value hits the strike price by or before the expiration date. Investors typically purchase long equity calls when they believe the share price of the security will increase markedly by the option’s expiration date.

By contrast, protective puts are options that give you the right to sell shares you already own if their market value drops to or below the strike price on or before the expiration date. They function as a kind of insurance policy against potential declines in the value of your asset.

Options trading carries risk and is subject to approval. For more information, please review Characteristics and Risks of Standardized Options.

When you purchase an option, you’re buying the future right to buy or sell shares of a security. However, you can only exercise the option if the security reaches the strike price by or before the option’s expiration date. Reaching the strike price is known as being “in the money” (ITM). Options that are outside the strike price are referred to as “out of the money” (OTM). In the case of buying a Call Option, if the Call Option is “out of the money” at the expiration date, the option expires worthless.

Whether it hits the strike price or not, the options buyer still pays a premium to the seller for the right to hold the option. In return for receiving the premium, the seller takes on the risk of potentially having to buy or sell a security at the agreed strike price.

Calls and puts are at the center of options trading. Call options are contracts that give the buyer the right to purchase shares of a security if the shares hit the strike price on or before the option’s expiration date. Put options give the owner the right to sell shares if the market value of the underlying asset drops to or below the strike price by or before the option's expiration date. In return for the right to own call or put options, the buyer pays the seller a premium.

Option contracts vary in duration, depending on the designated expiration date. Expiration dates can by monthly, typically the third Friday or every month, or weekly. The expiration date is always specified when you buy or sell an options contract. If an option is not “in the money” at expiration, the option expires worthless.

Stocks are shares in a corporation. Options are contracts that allow the option buyer to buy or sell stock (or ETF) if the shares hit a predetermined price by a certain date.

Investing in options with zero days to expiration (0DTE), multi leg and naked strategies are not currently available.

Sharpen your knowledge

Call vs. put options: Understanding the differences

Puts and calls are types of options that investors use to sell or buy financial securities in the future for a set price. Learn more about put and call options here.

What is options trading?

Options offer investors flexibility in managing the risk/reward profile of their portfolio. Learn about the potential gains and risks involved in buying and selling puts and calls.

How to trade options

An option is a contract between a buyer and seller that gives the buyer the right, but not the obligation, to buy or sell. Learn more about trading options.