The year at a glance

Let’s reflect on the past twelve months. Explore what shaped the investment landscape, see what’s new and chart a course for success in 2026.

A note from our Head of Investment Strategy

Elyse Ausenbaugh | J.P. Morgan Wealth Management

Rules weren’t just bent in 2025, they were rewritten in real time. Transitions of political power, policy zigzags, and technological disruption kept us on our toes. The global economy cooled just enough to stir recession chatter, even as AI innovation reshaped the macro and market landscape faster than many could keep up. Meanwhile, a world order fractured by protectionist policies and a corporate sector racing to adapt to the breakneck pace of change made uncertainty the only constant. Yet, through all the noise, markets delivered meaningful rewards to investors who stayed the course. This year reminded us that, even in a year defined by disruption, discipline has a tendency to beat short-term speculation. We now find ourselves in an investment landscape filled with both promise and pressure – and where opportunity favors those who are prepared. Keep reading to discover more insights and opportunities to charge ahead.

Let’s see how different sectors fared in 2025

2025 was a year of rapid change and uncertainty, yet disciplined investors saw strong results. As we enter 2026, opportunities remain for those ready to navigate the evolving market.

Source: Bloomberg Finance, L.P. (Data as of December 4th, 2025)

Best performing sub-sectors

- Semiconductors: +46.7%

- Media and entertainment: +36.9%

- Banks: +30.1%

- Capital goods: +25.2%

- Pharmaceuticals, biotech, and life sciences: +20.7%

Best performing sub-sectors

- Semiconductors: +46.7%

- Media and entertainment: +36.9%

- Banks: +30.1%

- Capital goods: +25.2%

- Pharmaceuticals, biotech, and life sciences: +20.7%

Worst performing sub-sectors

- Household and personal products: -11.5%

- Consumer durables and apparel: -5.3%

- Communication and professional services: -4.5%

- Insurance: +1.1%

- Consumer services: +2.2%

Worst performing sub-sectors

- Household and personal products: -11.5%

- Consumer durables and apparel: -5.3%

- Communication and professional services: -4.5%

- Insurance: +1.1%

- Consumer services: +2.2%

New opportunities—and new ways to reach your goals

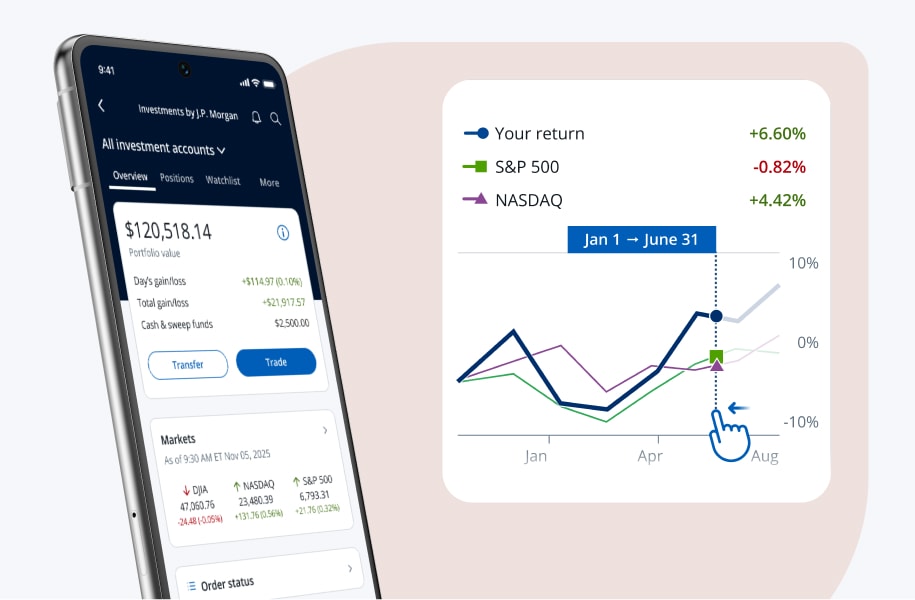

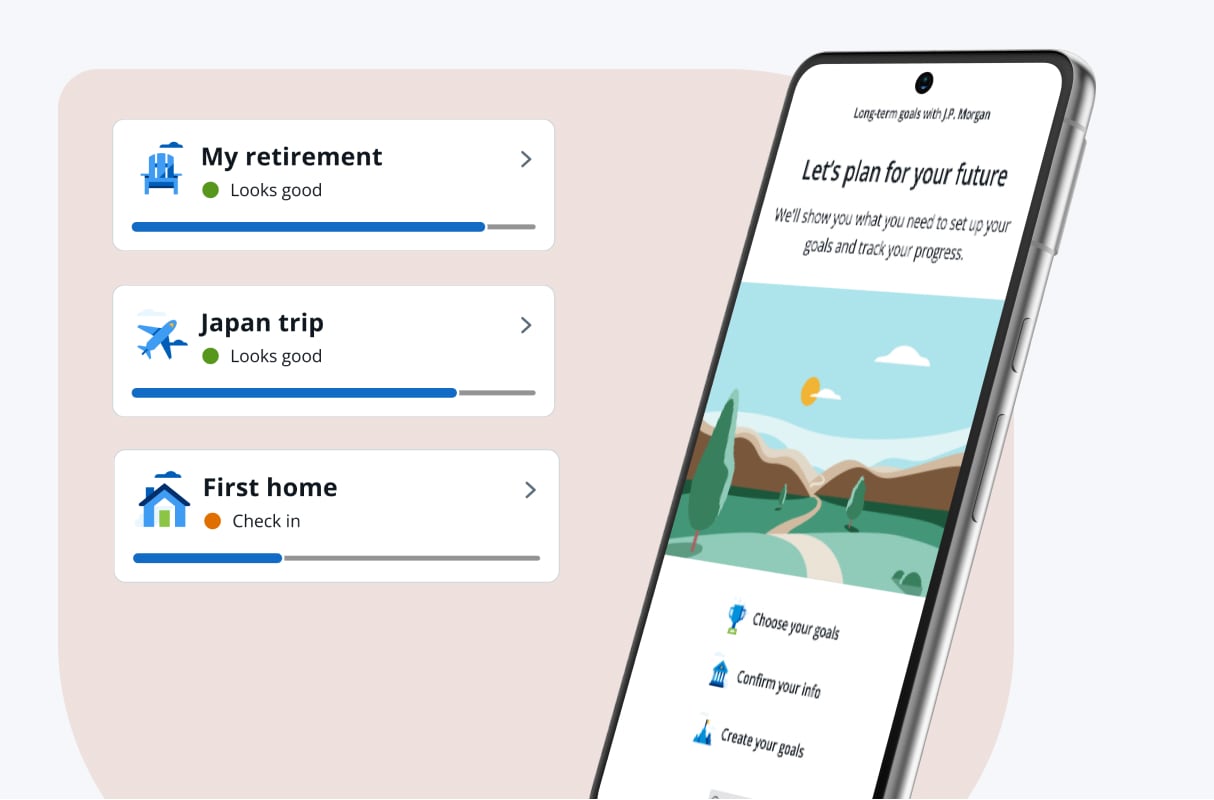

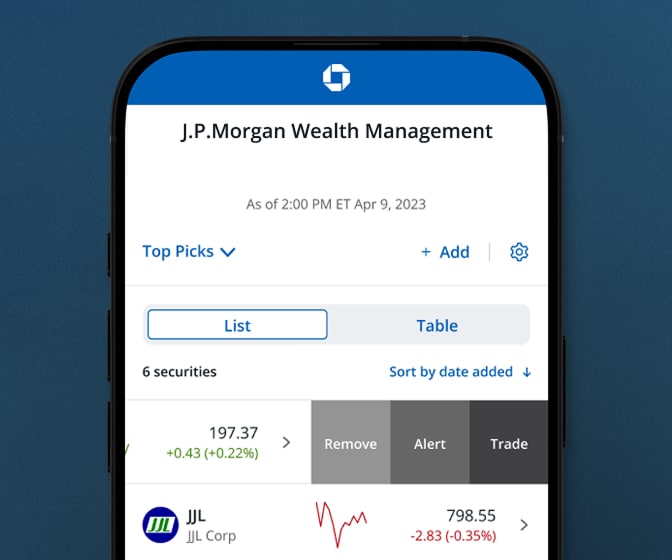

The tools we launched this year are designed to help give you deeper insights, smarter planning and more control of your investments.

Start the year off right with a few simple steps

- View your portfolio

- Review your 2025 performance

- Explore new investments

- Make contributions

- Discover investing insights and more with The Know

Working with an advisor? Schedule a meeting to review your 2025 portfolio and plan for the coming year.