Fractional shares trading—from $5

Now, you can trade fractional shares in your J.P. Morgan Self-Directed Investing account. Fractional shares are available for S&P 500 and NASDAQ 100 stocks and ETFs in any amount starting with $5, regardless of the share price.

Get commission-free online trades and up to $700 when you open and fund a Self-Directed Investing account with qualifying new money by 07/19/24.

What are fractional shares?

Fractional shares trading lets you buy portions of a stock or ETF for any amount from $5, so you can own a fraction of a company for less than its stock price and build the portfolio you want.

For example, if you invest $100 in a stock priced at $1,000, you’d own 0.1 of a share.

Benefits of fractional shares trading

Precision

Fine-tune your investment to the exact amount, and fully invest the cash in your portfolio.

Diversification

You can use fractional shares to build a diversified portfolio of stocks and ETFs.

Dollar cost averaging

Get more flexibility with fractional shares. Invest the same amount on a regular basis, regardless of the share price.

How to buy fractional shares

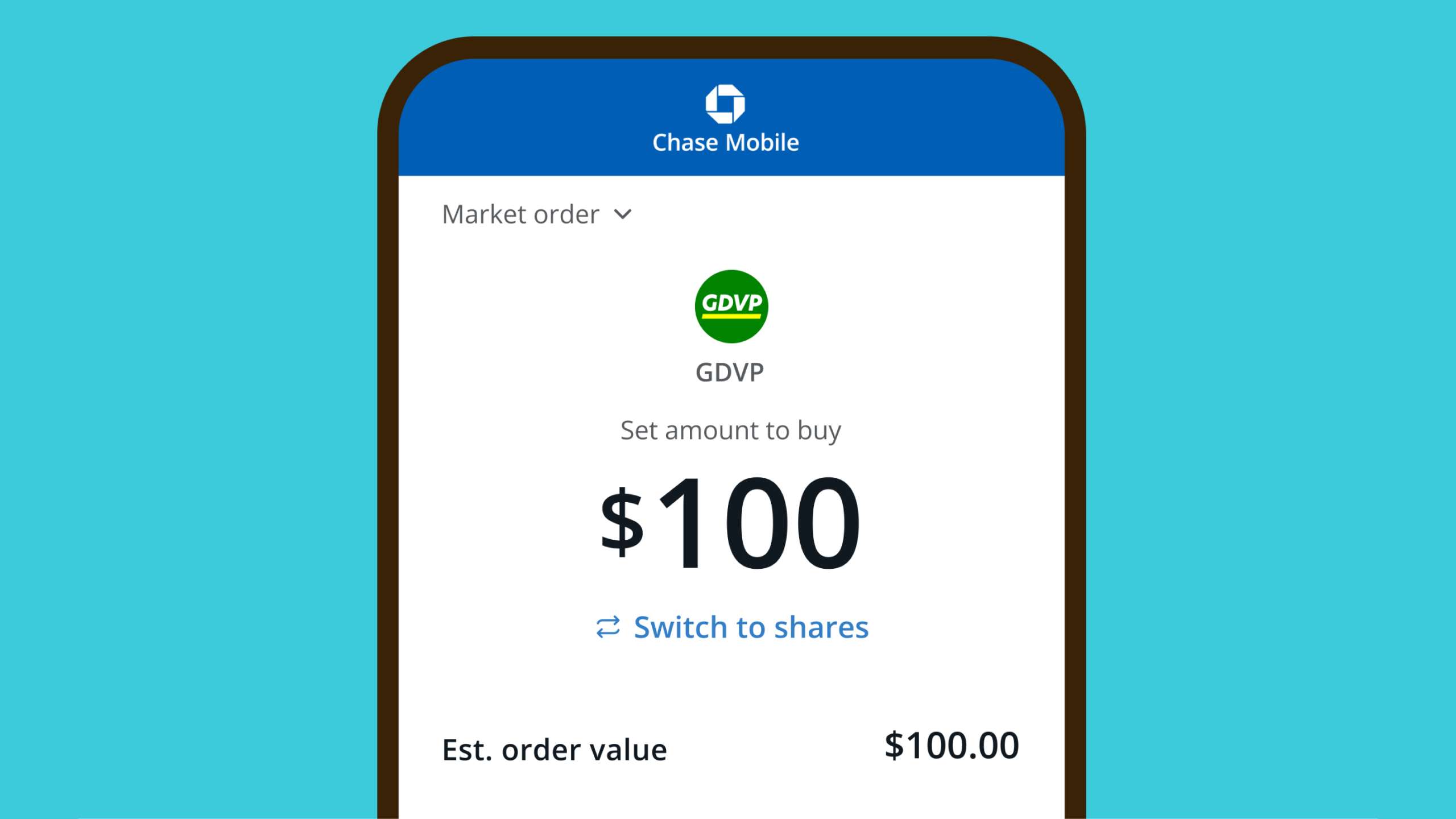

Fractional shares are available for market orders at chase.com and in the Chase Mobile® app.

Step 1: Toggle between shares and dollars

Use the toggle on the trade ticket to easily switch between investing in shares or dollars on the eligible stock or ETF.

Step 2: Set amount

Enter the amount you’d like to buy.

Step 3: Place your order

Review and confirm the details to place your order.

Unlimited commission-free online trades

Get up to $700 cash bonus when you open and fund a J.P. Morgan Self-Directed Investing account (retirement or general) with qualifying new money by 07/19/24. Options contract and other fees may apply.

Frequently asked questions

Sharpen your knowledge with the latest news and market commentary

Tap into the latest news and subscribe for market commentary and analysis from J.P. Morgan specialists to help you plan your investment strategy and learn about opportunities.