When you open and fund a J.P. Morgan Self-Directed Investing account.

Learn more about Self-Directed Investing

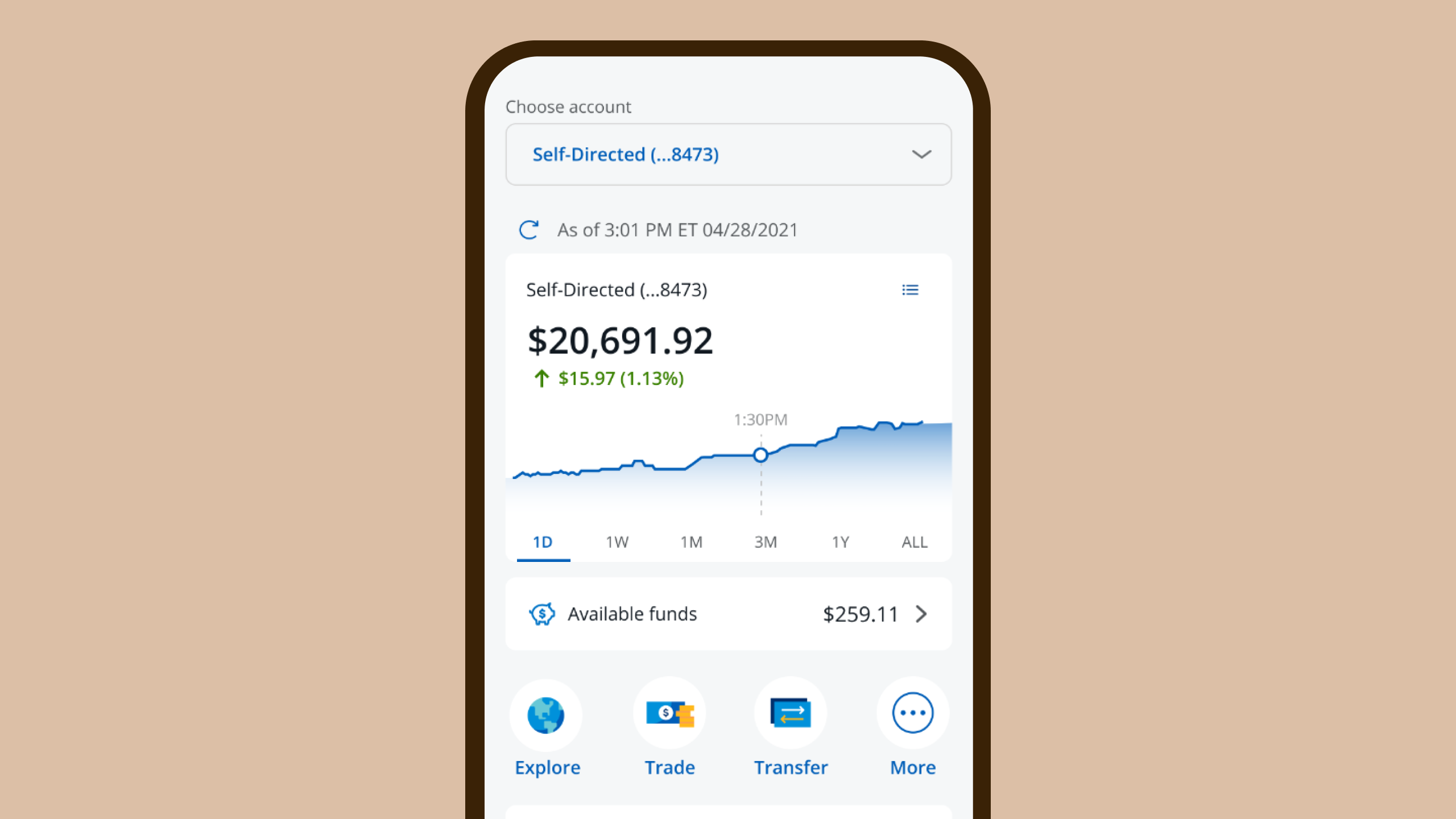

What are my account options?

General investment and retirement accounts (Traditional and Roth IRAs)

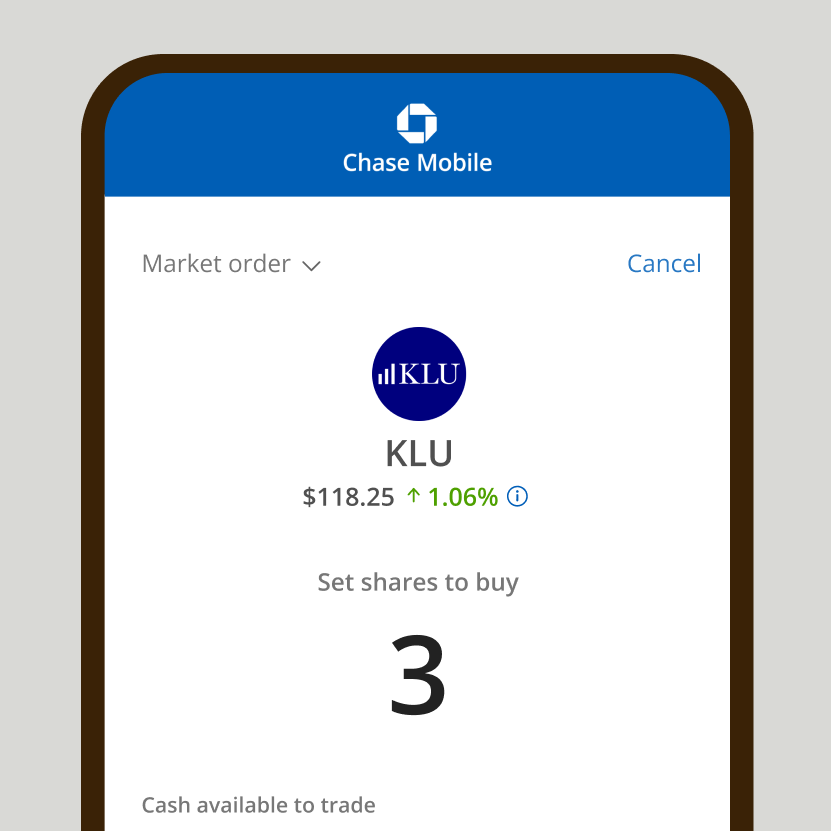

What investment products can I choose?

Stocks, ETFs, Options, Mutual Funds and Fixed Income

What is the pricing structure?

You can get started for free. We offer unlimited $0 commission online trades, including stocks, ETFs, mutual funds and options. Options contract and other fees may apply. For more information, see our pricing page.

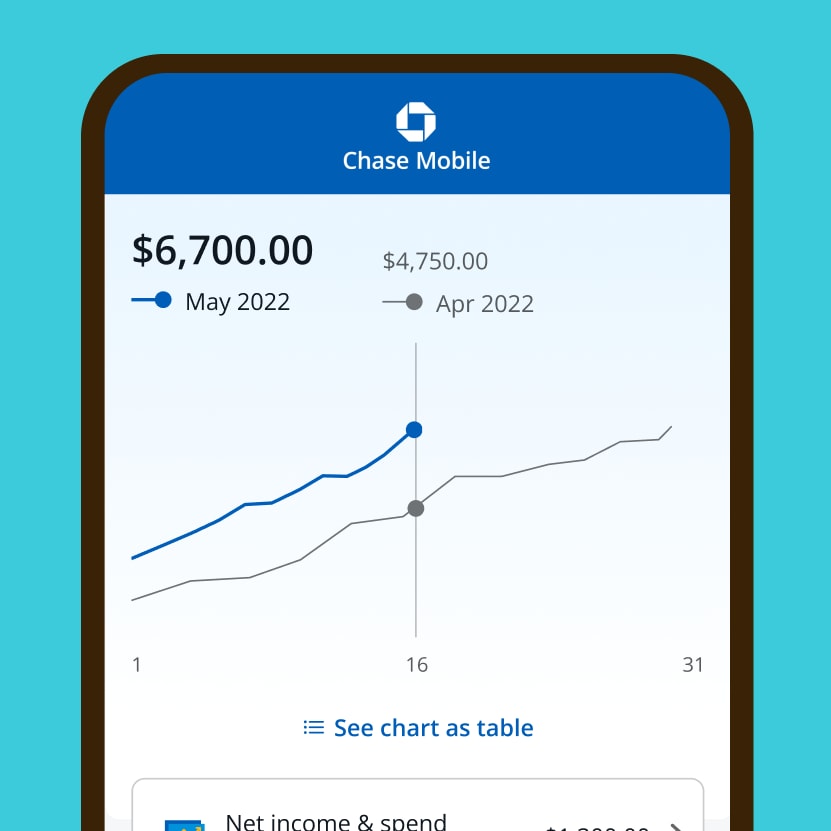

Online investing, made easy

Sharpen your knowledge with the latest news and market commentary

Tap into the latest news and subscribe for market commentary and analysis from J.P. Morgan specialists to help you plan your investment strategy and learn about opportunities.

Ready to start investing?

Get up to $700 when you open and fund a J.P. Morgan Self-Directed Investing account (retirement or general) with qualifying new money by 07/19/2024. Options contract and other fees may apply.